Bill-to Ship-to supplies are a common practice adopted by most businesses, especially in case of distance sales. In the Bill-to Ship-to model, the billing and shipping of goods are done to two different locations and entities.

Let us understand Bill-to Ship-to supplies with an example.

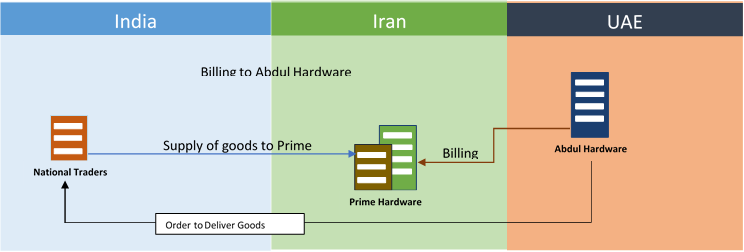

Abdul Hardware, a dealer in hardware goods, located in UAE, places an order to National Traders, located in India. The order is for the supply of 1,000 Nos. of aluminium ladders, with an instruction to ship the ladders to Prime Hardware, located in Iran. Prime Hardware is a customer of Abdul Hardware.

As illustrated above, there are two parts to this transaction:

- The first part of the transaction - between Abdul Hardware and National Traders: National Traders is the supplier of ladders and Abdul Hardware is the buyer. Accordingly, National Traders bills the transaction to Abdul Hardware, and as per the instruction, ships the goods to Prime Hardware in Iran.

- The second part of the transaction - between Abdul Hardware and Prime Hardware: Abdul Hardware is the supplier and Prime Hardware is the buyer. Abdul bills the transaction to Prime Hardware and provides necessary documents in favour of Prime Hardware which will enable him to take the delivery of the goods.

With the implementation of VAT in UAE from 1st January, 2018, what will be the VAT impact of Bill-Ship-to supplies in UAE?

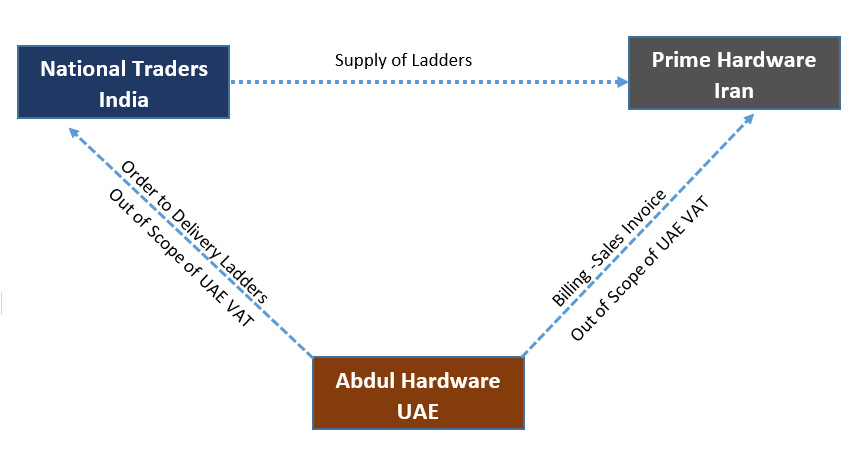

Broadly, the bill-to ship-to supplies are considered to be out of the scope of UAE VAT. This is because, place of supply is outside the UAE as the goods are outside the UAE when sold. Subsequently, the liability of the UAE Distributer’s supply is outside the scope of UAE VAT.

Let us consider the example of Abdul Hardware, discussed above, to understand the VAT implication on bill-to ship-to supplies.

In the above example, on the instruction from Abdul Hardware, National Traders ships the aluminum ladders to Prime Hardware located in Iran. For the second part of the transaction between Abdul Hardware and Prime Hardware, both the transactions will be considered to be outside the scope of UAE VAT. As a result, VAT at 5% will NOT be applicable to those transactions.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal

Place of Supply

Place of supply in case of export of goods, Place of supply of goods under VAT in UAE, Place of supply of real estate under UAE VAT, Place of Supply of Services, Place of supply of specific goods