For the purpose of VAT in UAE, Designated Zones will be treated as being outside the State and outside the Implementing States. Though it is considered to be outside the State, movement of Goods from a place in the State to the Designated Zone will not be considered as an export of Goods. This implies that supply of goods from the mainland to the Designated Zone will not be zero-rated and the standard rate of VAT will be applicable.

On the other hand, goods imported from a place outside the State to a Designated Zone will not be considered as imports. This means, that the import of goods from other countries will not be taxable and it will be considered as out of the scope of UAE VAT.

In this article, we will understand the VAT treatment of goods purchased into Designated Zone under the following scenarios:

- Goods purchased from Designated Zone in UAE

- Goods supplied from Mainland

- Goods supplied from outside the UAE State

To know more about Designated Zones, please read VAT on Designated Zone and VAT on Free Zones in UAE .

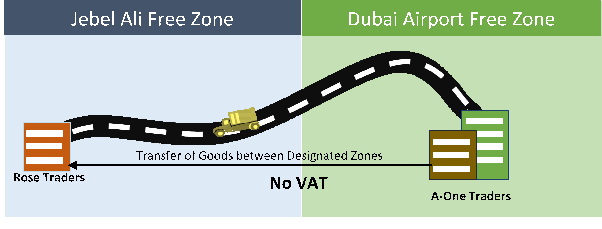

Goods purchased from Designated Zone in UAE

Supply of goods between Designated Zones will not attract VAT. For example, Rose Traders located in Jebel Ali Free Zone purchased goods from A-One Traders, Dubai Airport Free Zone.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free Zone are Designated Zones. The purchase of goods from A-One Traders will be VAT free since the supply is between Designated Zones.

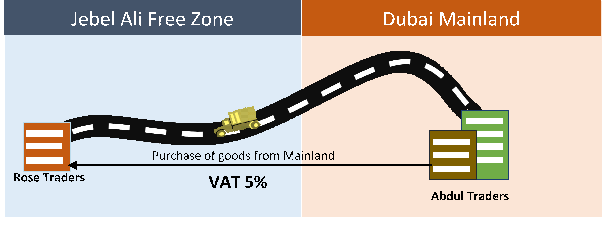

Goods supplied from Mainland to the Designated Zone

Movement of goods from a place inside the State to the Designated Zone will not be considered as export of goods. Thereby, the standard rate of VAT will be applicable on such purchases by the taxable person in Designated Zone. The Input VAT paid on such purchases can be recovered by adjusting with output VAT liabilities.

For example, Rose Traders located in Jebel Ali Free Zone purchased goods from Abdul Traders, located in Dubai mainland.

In the above illustration, goods are purchased from Dubai (mainland) to Jebel Ali Free Zone (Designated Zone). The supply of goods from Abdul Traders to Rose Traders will attract VAT at 5%. This because the supply of goods from the mainland to Designated Zone are not considered as exports.

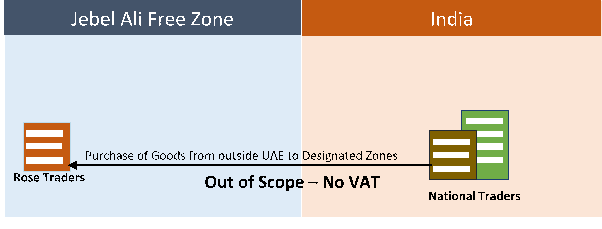

Goods supplied from outside the UAE State into Designated Zone

Goods purchased into Designated Zone from outside the UAE State will not be considered as imports and will be out of the scope of UAE VAT. As a result, there will be no VAT implications on such purchases.

For example, Rose Traders located in Jebel Ali Free Zone purchased goods from National Traders, located in India.

In the above illustration, goods are purchased into Jebel Ali Free Zone (Designated Zone) from India. The purchase of goods by Rose Traders from National Traders will be considered out of the scope of UAE VAT. Thereby, VAT is not applicable.

Conclusion

The businesses located in UAE should make a note of two important points discussed above. Firstly, the purchase of goods from the mainland (inside the state of UAE) are not considered as exports, meaning VAT 5% will be applicable on such purchases. Secondly, purchase of goods from outside the state is not considered as imports and will be out of the scope of UAE VAT.

Read more about VAT Zone

VAT on Designated Zone in UAE, VAT Computation in Case of Services Supplied from Designated Zone in UAE, VAT Computation on Goods Supplied from Designated Zone in UAE, New VAT Free Zones in UAE VAT, VAT Treatment on Services Received in Designated Zone UAE

UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Invoice

VAT Invoice in UAE, Simplified Tax Invoice under VAT in UAE, What Consumers Must Check in a Tax Invoice in UAE, Checklist for a Tax Invoice under VAT in UAE, Date of Supply, Value of Supply and Invoice for Deemed Supply in VAT, How to issue a Tax Invoice to unregistered customers, How to issue Tax Invoice to registered customers, Tax Invoice under VAT in UAE