With the concept of e-invoicing in Saudi, handwritten and manually generated invoices will no longer be valid. The e-invoicing system requires businesses to generate e-invoices using software or any electronic solution complying with the guidelines.

While it is evident that one must use software or any other electronic solution, businesses must understand the different types of supplies covered under the scope of e-invoicing in Saudi. Barring a few notified supplies like exempt, imports etc., to other kinds of supplies, one needs to issue an e-invoice.

Let’s take a look at different types of supplies covered under e-invoicing in Saudi

Supplies of goods and services subject to VAT at a standard rate

e-Invoice is mandatory for taxable supplies subject to the standard VAT rate and whose value is SAR 1,000 or more, whether made to a taxable or non-taxable legal person.

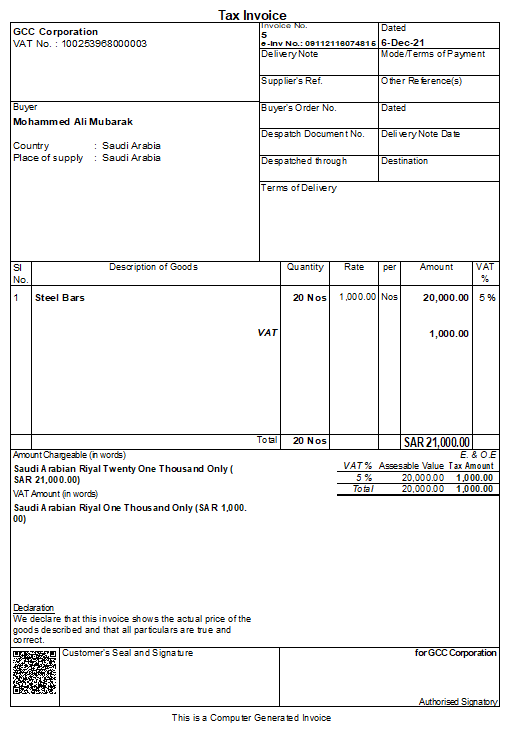

e-Invoice generated using TallyPrime

Example of e-invoice for standard-rated supplies

B22 Supplies – Supplies to VAT registered business

Ali Enterprises is a trader in electronic goods located in Riyad. They supplied electronic goods worth SAR 20,000 to Abdul Electronics, attracting a standard rate of VAT. Abdul Electronics is VAT registered electronics dealer in Riyad.

- Ali Enterprises generates an e-invoice using a compliant e-invoice software or any other electronic system and issue a tax invoice to Abdul Electronics.

- The invoice should include all the mandatory components of tax invoice such as buyers details, VAT registration number, details of supply etc. as prescribed in VAT law and regulations

- Ali Enterprises may optionally add a QR code on the invoice

- Also, they need to archive a copy of the e-invoice in their records on a system in XML/PDF format.

| How Phase-1 of e-Invoicing System Work? | Best e-Invoicing (FATOORA) Software in Saudi |

B2C supplies – Supplies to End-consumer

Ali Enterprises is a trader in electronic goods located in Riyad, sold a music system to Mr Rizwan, an end consumer.

- Ali Enterprises should generate a simplified e-invoice invoice with a QR code

- The QR code so generated and printed on the invoice should be scannable

- All other requirements of mentioned for B2B invoice would be applicable here as well

Export of goods from KSA

An e-Invoice is required for all exports of goods, regardless of supply value or importer status.

Example of E-invoice for exports

Al Hafoof Chemical company, a registered taxpayer, is a subcontractor for chemical products in Riyadh. Florida Steel Factory, a USA based company, contracts Al Hafoof for chemical products for one of their steel productions to be delivered in the USA. Al Hafoof supplied the products as per the order received from Florida Steel Factory.

- After making the supply, Al Hafoof issued an electronic invoice through their e-invoice solution

- The invoice will be zero-rated since it is an export invoice, and the VAT rate will be 0%

- The invoice should include all the mandatory components of the tax invoice as prescribed in VAT law and regulations

- The invoice totals will all be in USD except for VAT amount, which must be in SAR.

- Al Hafoof archives a copy of the e-invoice in their records on a system in XML/PDF format.

e-Invoice for intra-GCC supplies

For the supply of goods or services from a supplier residing in the Kingdom to a customer located in any member state of the Gulf Cooperation Council, an electronic invoice must be issued in all cases in relation to such transactions.

It is important to note that that supplies between the GCC countries will be considered inter-state supplies from the date in which the transitional provisions under Article 79 of the VAT Implementing Regulations expire, and until that date, the import and export provisions will apply to those transactions

Example of intra-GCC supplies

Ali law firm, a taxable person resident in KSA, provided legal services to A-1 Enterprises, an entity located in Bahrain for a dispute related to real estate located in Bahrain. The law firm should issue an e-invoice (Standard Invoice) to XYZ once relevant Articles of GCC VAT Framework Agreement are enforced.

e-Invoice for nominal supplies

A nominal supply is an actual supply of goods or services to another person for no consideration. This does not include the supply of free of charge samples and gifts which have a value of less than 200 SAR (provided under the normal course of business)

An e-Invoice must be generated for nominal supplies and retained with the business records for audit purposes. However, the taxable person receiving goods or services under a nominal supply arrangement will not to allowed to deduct input VAT. Therefore, the e-Invoice should not be provided to the Customer

Example of e-invoice for nominal supplies

Alaa store, a perfume store in Riyadh, provides a free bag to a customer as a token of thanks for being a loyal customer. The cost price of the bags is SAR 300. Alaa Store must account for VAT of SAR 45 (15% of the cost price) on the nominal supply of goods for no consideration.

Since the deemed supplies should be documented for VAT purposes, Alaa Store should generate an e-invoice and retain it as a business record, according to the provisions in VAT Law.

e-invoice for payments received before actual supply

An e-invoice must be issued on the date of receiving the payment before making the actual supply. In simple words, an e-invoice must be issued for receiving advances against the supply. In cases of part payment, an e-invoice must be issued to the extent of the consideration received.

e-Invoice for debit and credit notes

Businesses should issue electronic notes for those situations for which debit and credit notes are issued. It includes sales return, cancellation of supply, change in price etc.

How TallyPrime can be your preferred e-invoicing software?

TallyPrime now comes with an e-invoicing (FATOORA) solution that will help you generate and manage e-Invoicing with ease. Using TallyPrime, you can generate e-invoice with QR code, store and archive invoices in XML format, and get exclusive reports, including user event logs, giving you a complete view of all e-invoicing tasks.

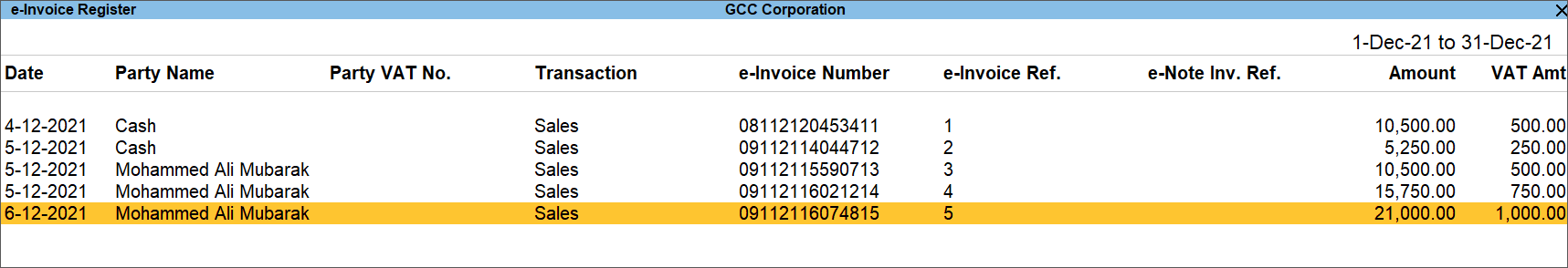

e-Invoice report in TallyPrime

Here is a list of e-invoicing requirements, you can manage using TallyPrime

- Generate e-invoices in a single click

- Print QR code on invoices effortlessly

- Generate e-invoice for tax invoices and simplified invoices

- Exclusive e-invoice report will give you a single view of all e-invoicing tasks

- Intuitive prevention, detection, and correction mechanisms will help you deal with exceptions with ease

- Supports e-invoice for debit note, credit note POS invoice, and receipts

- Export e-invoice in XML file as per ZATCA (GAZT) requirement

- Security control and User login management

- User session log register to view all the log details indicating the entire history of the masters & transactions