In this new era which is full of opportunities with the new Saudi vision, your business success, growth, and expansion in Saudi Arabia depends on taking the right decisions, working with the right partners, and choosing the right tools.

After the 4th of December 2021, e-invoicing became mandatory for businesses in Saudi Arabia. This big step to the digitalized business future offers both businesses and buyers a lot of benefits and advantages.

| Best e-Invoicing (Fatoora) Software in Saudi | How to Generate e-invoices Instantly with TallyPrime in Saudi Arabia |

In order to leverage the benefits that e-invoicing brings to your business, you need to choose the right e-invoicing software. Whether you can make your own search or referred by your business colleague, here are 5 important things you need in your e-invoicing software, and they are so essential to comply with the e-invoicing norms.

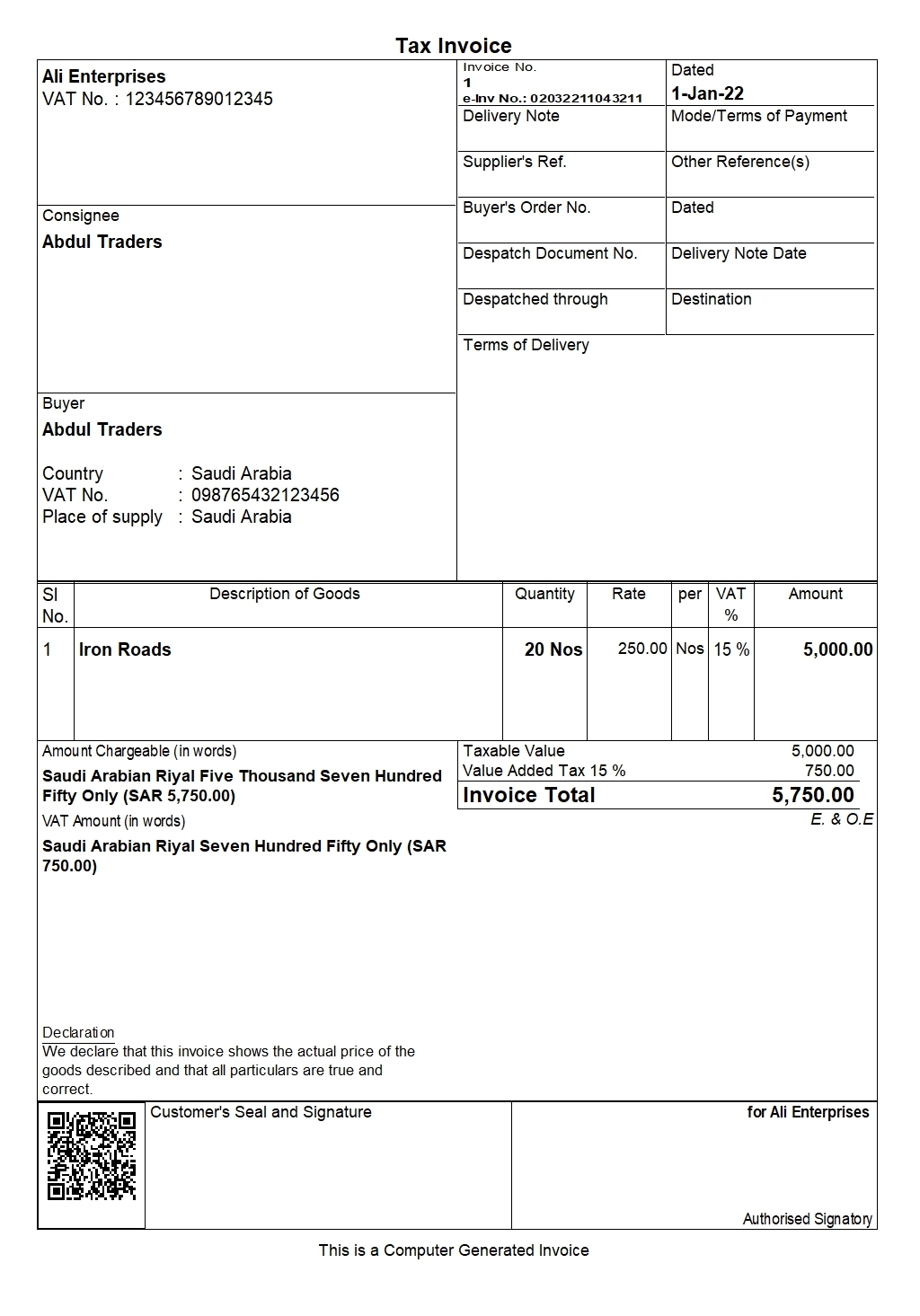

Printing of e-invoice that complies with the requirements

Although a printed traditional invoice which scanned or converted to PDF is NOT considered an electronic invoice, the need to print or export the electronic invoice may still exist.

e-Invoice generated from TallyPrime

The e-invoicing software that you choose should generate complaint e-invoices with a QR code and automatically archive those invoices as per the ZATCA guidelines. This way you can satisfy and give your customer the best experience while maintaining compliance with the regulations.

Supports e-invoices for different types of supplies (sales, credit note, debit note, POS, etc.)

Paper notes or documents created by handwritten, word processing, or graphic software are NOT allowed anymore. While you are thinking about choosing e-invoicing software for your business in Saudi Arabia, keep in mind that you need software that supports e-invoicing for, debit notes, credit notes, POS invoices, receipts, etc.

Your payment terms may vary from full payment to credit arrangements, goods returns via debit and credit notes etc., which requires an all-in-one solution to integrate the whole processes and transactions.

Inbuilt intelligence to validate and generate accurate invoices

Only smart systems can protect your business against commercial manipulation cases. You will need to check if your e-invoicing software has inbuilt intelligence to validate and generate accurate invoices that comply with e-invoicing guidelines. The e-invoice software with intuitive prevention, detection, and correction mechanisms will help you detect errors and correct those before issuing an invoice

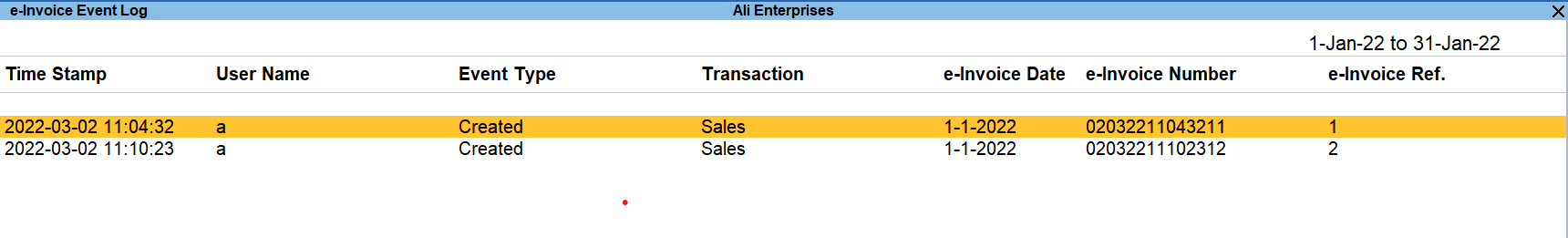

User access control, activity log, tamper-proof, etc.

A smart system will not work alone without users with good training and enough authority to use specific features; users here refers to your employees or team.

You need to check if your e-Invoicing software prevents anonymous access, ability to operate with a default password, absence of user session management, or allow for log modification and deletion.

To have full control over your financial system, you need e-invoicing software that comes with complete security control and user login management. The software should provide you with a user session log register to view all the log details indicating the entire history of the masters & transactions.

Integrated VAT and e-invoicing solution along with other business functions

As we have mentioned above, you are about to upgrade your financial system, not just buy an e-invoice system to operate it as a tool for generating e-invoices. This is a good opportunity to develop your team and organization's financial culture with the process.

So, keep in mind to check other features to make sure you have chosen the all-in-one integrated financial system, which integrates with other business functions such as accounting, inventory, VAT, payroll, banking etc.

It is your time to choose the right tool to gain more business opportunities, so choose it wisely! Take a look at how TallyPrime can help manage e-invoicing as well as your business requirements.

How TallyPrime can help?

TallyPrime, a complete business management software is enhanced with an e-invoicing solution that helps you generate and manage e-invoicing with ease. From generating e-invoices instantly to storing and keeping track of them through the e-invoicing report. Below are some of key e-invoicing features of TallyPrime.

- Generate e-invoices in a single click

- Print QR code on invoices effortlessly

- Generate e-invoice for tax invoices and simplified invoices

- Exclusive e-invoice report will give you a single view of all e-invoicing tasks

- Intuitive prevention, detection, and correction mechanisms will help you deal with exceptions with ease

- Supports e-invoice for debit note, credit note POS invoice, and receipts

- Export e-invoice in an XML file as per ZATCA (GAZT) requirement

- Security control and User login management

- User session log register to view all the log details indicating the entire history of the masters & transactions