- Accounting software in Oman for small business

- Why should business owners use accounting software in Oman?

- Features of reliable accounting software in Oman

- How do you find the right accounting software in Oman?

- Why TallyPrime is the best business accounting software

Accounting software in Oman for small business

Accounting software is increasingly being used by businesses all over the world because of the numerous benefits it provides. Contrary to popular belief, startups and small businesses in Oman should begin using a reliable accounting solution from the beginning so their transactions are precisely recorded and analysed. Accounting software isn’t only about recording your financial transactions but it is also about regularly analyzing your financial situation so you are aware of how well you are doing. Small businesses in Oman should always choose a scalable solution so they can continue using the same software even when they grow into a bigger company.

Why should business owners use accounting software in Oman?

Accounting software for small business in Oman is crucial to manage daily financial activity and to derive deep insights. Here are some reasons why going the accounting software route is better than traditional forms of accounting.

Highly accurate

You want your financial transactions to be stored without errors because they form the basis of analysis and insights. Using an accounting solution enables you to store your financial information safely and accurately by minimizing human errors. Its automation allows you to spot errors immediately so that those errors can be rectified. For example, some robust software solutions have an automatic bank reconciliation feature whereby any errors or missed entries are shown to you.

Best VAT Software in Oman |

Best Accounting Software in UAE for Small Business |

Shift focus to other important tasks

Accounting software greatly decreases the time it takes for you to manage your business. This allows you to focus on other important aspects of your business and thereby improve the business bottom line. With traditional accounting, accountants and bookkeepers had to spend hours managing their books and correct errors. With the advent of software solutions for accounting, this has become obsolete because the software is much faster and easier to go through. It can save hours.

Improved tax compliance

A small business should stay away from trouble with the tax authorities from the beginning. An accounting solution helps with proper tax compliance with its tax features. When you are generating invoices, you can easily and accurately include VAT information. Also, it enables you to file your VAT returns with ease when the time comes thereby allowing you to always stay ahead.

Software solutions such as TallyPrime make tax compliance easy

Better cash flow

Accounting software improves business cash flow because you can keep track of payments. With a software tool, you can send automated reminders to people who haven’t paid to ensure they make the full payment. Small business owners in Oman must be aware of their business cash flow because it provides insights into liquidity. With software solutions, small business owners can improve their cash flow considerably with the right information.

Automate accounting tasks

Accounting software increases efficiency because you can automate repetitive tasks that are most prone to mistakes. Automation can save you from putting a lot of effort into processes that don’t need human intervention. The software solution allows you to automatically save details. For example, it saves invoice details so you don’t have to re-enter those details every time you generate invoices. You can set reminders and automate tasks that would otherwise occupy your resources.

Boost business growth

Accounting tools improve small business growth in Oman because you get valuable insights in the form of reports. Report generation is a vital part of a good accounting solution. How can you make changes if you don’t know which area is doing poorly? With the help of a reporting feature, you know which parts of your business need improvement and so you can tweak your business strategy accordingly.

Features of reliable accounting software in Oman

Trustworthy accounting software in Oman should contain the following key features.

Bank reconciliation

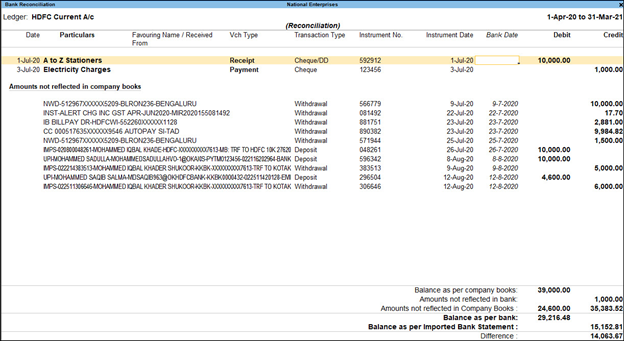

The accounting solution should have some banking features such as bank reconciliation. Bank reconciliation is an important feature because it ensures no theft is taking place in your business and that there are zero errors in your financial statements. It also ensures higher accuracy.

Bank reconciliation example in TallyPrime

Data security

The data you enter is sensitive. The accounting software should ensure your data is always safe and secure while ensuring data integrity. The software must have proper data security in place whether it relates to access of your financial data or accessing it from other devices.

Inventory management

A good accounting tool will have an inventory management feature so you can maintain the right amount of stock for your business. It should enable you to determine how much stock is available and how much you need for smooth business operations.

Access to data

You should have access to data when you need it. Accounting software should have the capability of allowing you to access vital reports and data of your business from wherever you wish while ensuring safety in the process. This allows you to make decisions even when you aren’t physically in your office.

Invoice feature

An accounting solution with an invoicing and billing feature is important for better accounting. Invoicing is an important aspect of a business. Generation of professional invoices is necessary and an accounting solution should enable you to add your business logo while creating invoices.

How do you find the right accounting software in Oman?

Here is how to find the right accounting software in Oman.

Brainstorm your business needs

You cannot go ahead and buy something without being clear about your needs. Similarly, before you purchase accounting software, you should know your business needs. This will enable you to eliminate the options that are not supportive of your business growth. What major features do you want the accounting software to contain? How easy to use do you want the software to be? What kind of post-purchase support are you looking for? Write your desired features in an accounting solution.

Read reviews and testimonials

Only relying on the accounting software’s website may not be enough. You should look into reviews and testimonials to get a better grasp of how the software has helped various businesses. Understanding other people’s experiences using the software ensures you get an in-depth overview of how the software solution works. This enables you to know whether the software tool will work for your business now and in the future.

Know the price details

Accounting software is generally expensive but you want the software price details before you purchase. Does the software require monthly payments or yearly payments? Are you comfortable with spending that amount on accounting software? It is vital to note that accounting software can save hours of time and a lot of money for your business in the long run. You should compare the prices of your top software choices before making a purchase.

Try the software before purchase

Reading is one thing but using it is a whole different thing. No matter how good you think the software is, you should always try it at least once before you buy it. Only by trying you will be able to understand how easy it is to use the various features and whether all the listed features are available in the software product or not. The software company should allow you to try the product for free and allow you to use all the features.

Why TallyPrime is the best business accounting software

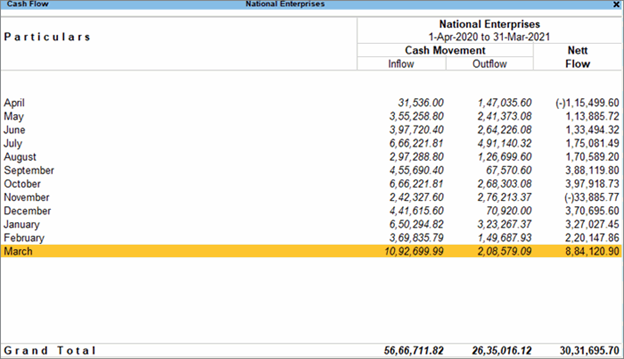

TallyPrime is a business accounting software in Oman that helps your business grow. Its myriad accounting features ensure you are aware of your business performance every step of the way. The high level of accuracy and reliable customer support ensure you are getting the most out of the software. TallyPrime has several unique features such as payroll management, inventory management, banking, taxation, invoicing, and billing. The software enables you to manage your business with ease as the software’s intuitive interface is simple to understand. The software tool provides cash flow and credit management giving you a realistic view of your current financial status.

An example of cash flow management in TallyPrime

TallyPrime’s reporting feature enables you to generate more than 400 distinct reports which allow you to get powerful business insights. These reports enable you to understand your business at a granular level. You can generate accurate financial reports such as balance sheets, ratio analysis, and profit & loss statements. You can get detailed information about your inventory by generating inventory reports. These include stock-item-wise profitability, stock ageing analysis, and re-order status reports. You can generate management control reports such as funds flow, cash flow projection, and budgeting. TallyPrime is an advanced accounting software package that is great for growing businesses in Oman.