VAT return filing periods in Bahrain are classified into transitional return filing period for 2019 and the regular return filing period for 2020 onwards. The reason for having two type of return filing period is due to phase-wise registration which mandates the business to register on different dates spreading across 2019.

In this article, let us understand the transitional return filing period.

Transitional VAT Return Filing Period for 2019

The transitional Vat return filing period is scheduled basis the registration phases which consist of different registration due date for different businesses. The larger businesses with annual turnover should register first before December,2018 and remaining businesses are mandated to register later during 2019.

To know registration due dates, please read our article VAT Registration Deadline in Bahrain.

Basis the registration due dates, the VAT return filing schedule and deadlines are designed by the National Bureau for Taxation (NBT). The following are the VAT return filing period.

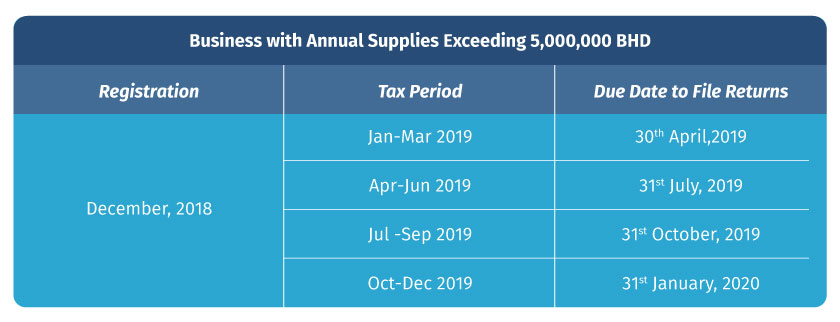

Vat Return Period for Businesses with Annual Supplies Exceeding 5,000,000 BHD

If you observe the above table, businesses who have already registered by December,2018 will file returns on a quarterly basis and the first tax period is from Jan-March with the due of 30th April,2019. Similarly, the taxpayer needs to file the returns for the rest of the quarter as mentioned in the above table.

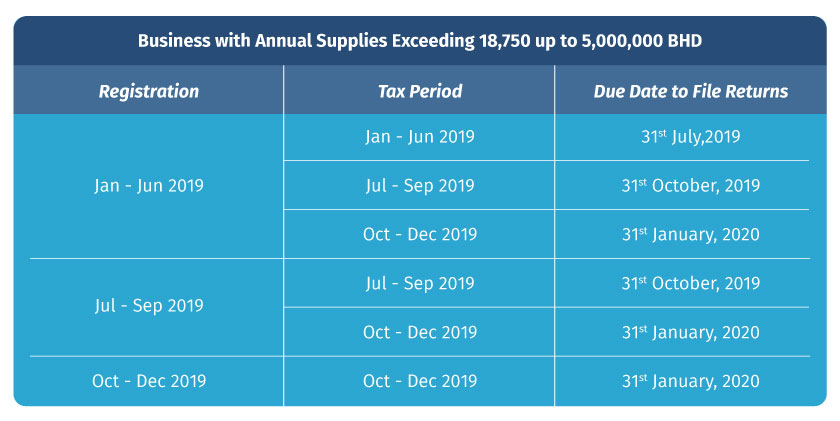

Vat Return Period for Businesses with Annual Supplies Exceeding 18,750 BHD up to 5,000,000 BHD

You can observe the following from the above VAT return filing schedule.

- For Taxable Persons whose registration takes effect from 1st January,2019 but before 1 July 2019, the first Tax Period will commence on the effective date of their registration and will end on 30th June 2019

- For Taxable Persons whose registration takes effect on or after 1 July 2019, but before 1 October 2019, the first Tax Period will commence on the effective date of their registration and will end on 30th September2019

- For Taxable Persons whose registration takes effect on or after 1 October 2019 but before 31 December 2019, the first Tax Period will commence on the date of their registration and will end on 31st December. 2019

The above is the transactional return filing period applicable only for 2019. Basis the date on which you register under VAT, your return filing period will be determined. From 2020 onwards, you will have regular VAT return filing period which is different from the above.

Read more on Bahrain VAT

VAT in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, VAT Return Filing Period

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain