As the name suggests, a simplified tax invoice is a simplified version of a tax Invoice. The format requires less information than a full tax invoice and it will be very useful for retail businesses like Supermarkets, whose customers are primarily unregistered.

The registered supplier can issue the simplified Tax invoice in the following cases:

- The recipient of the supply is not registered under Bahrain VAT.

- The total consideration of the supply does not exceed BHD 500

If you look at the above cases, the simplified tax invoice will be most commonly used in B2C segment such as Supermarkets, Restaurant etc. and yes, even in B2B segment it can be issued, if the total consideration of the supply does not exceed BHD 500.

Mandatory details to be captured in Simplified Invoice

The following are the mandatory details to be captured in the Simplified Invoice in accordance with the provision of Bahrain VAT Regulations:

- The name, address and registration number of the taxable person

- The date of issue of the simplified tax Invoice

- A description of the goods or services supplied

- The total value of the supply in Dinars, inclusive of Tax

- The rate and amount of tax applicable in Dinars

Simplified Tax Invoice Format

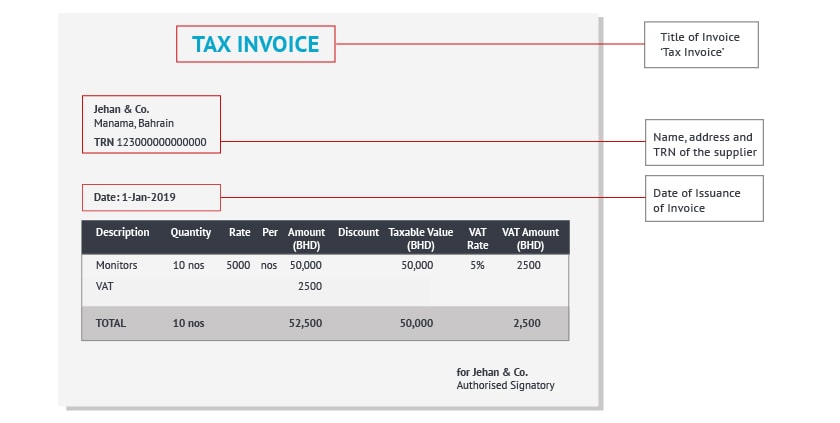

As per the mandatory details required in a Simplified Tax Invoice, a sample format of a simplified Tax Invoice is shown below:

If you observe the format, only the key details of Supplier, supply and VAT are mandated in the simplified invoice. In comparison on with Tax invoice, the simplified invoice requires very less information and can be easily prepared.

Key Points to be noted for issuing a Tax Invoice

The following are the key points for issuing a Simplified Tax Invoice in Bahrain

- Mentioning the details of the customer is not mandatory in the simplified tax invoice.

- Simplified Invoice can be issued only in 2 cases – Supply is to unregistered business or consideration of supply is less than BHD 500. All other cases, the tax invoice needs to be issued.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain