The concept of input VAT deduction is the core aspect of VAT in Bahrain. The mechanism of Input Vat deduction allows businesses to recover the Vat paid on the purchases or expenses and set off it against the VAT collected on the sales. Thus, at any given point, you will be required to pay only the excess VAT (5% on the value addition) to the government.

Let us understand with an example.

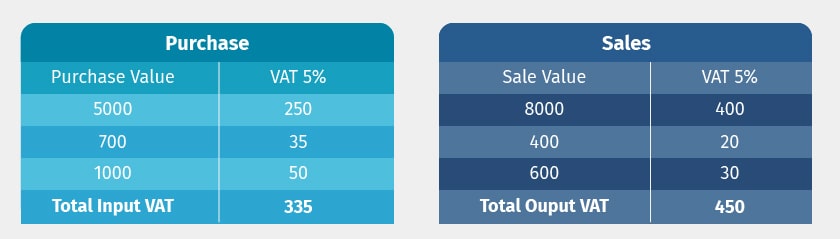

Crystal Enterprises LLP is a trader in electronic goods. The following are the purchase and sales recorded in the month of January.

From the above example, the total Vat paid by Crystal Enterprises on their purchase is 335 BHD which is known as Input VAT. The total VAT collected on sales is 450 BHD known as Output.

Crystal Enterprises LLP can claim input Vat deduction of 335 BHD and can set-off against output VAT of 450 BHD. The final Vat payable by Crystal Enterprises is 115 (450 BHD – 335 BHD).

To know more about VAT in Bahrain, please read our article ‘What is Vat and How does it work?

Input Vat Deduction Eligibility

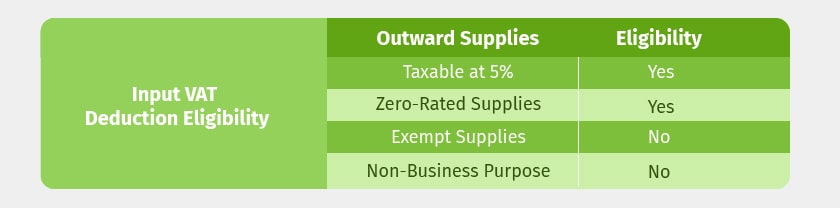

While Bahrain Vat law allows the registered businesses to claim input Vat deduction, you will not be allowed to claim on all purchases or expenses. The eligibility to claim input Vat deduction depends upon the nature of use.

Let us understand eligibility for input Vat recovery.

For businesses to recover input Vat, the purchases or expenses should be used in making taxable supplies. In other words, the purchase or expenses should be directly or indirectly used in supplying the goods or services which are taxable at 5 % or zero-rated.

In case, the purchase or expenses used in supplying goods or services are exempted from VAT or used for the non-business purpose (personal purpose), you will not be allowed to recover the input Vat.

Let us understand this with an example.

Example -1

Farhan Enterprises purchases 20 KG of Aluminium roads for 1,000 BHD and paid Vat 50 BHD. All 20 KG of aluminium roads is used to manufacture aluminium ladder, which is taxable. In this case, Farhan Enterprises will be allowed to claim input VAT reduction of 50 BHD since it is used to make taxable supplies.

Example -2

Electronic Word, a retailer in electronic goods purchased 10 Laptops for 3000 BHD + Vat of 150 BHD. Out of these 10 laptops, 9 were sold to customers by charging VAT at 5% and 1 was used for personal use.

In this case, Electronic Word will be allowed to recover the input VAT only on 9 laptops i.e. Input Vat of 135 BHD can be recovered. This is because, out of 10, only 9 laptops were supplied as taxable and the remaining 1 was used for a non-business purposes.

In our next article, we will discuss terms and conditions for claiming input VAT deduction.

Read more on Bahrain VAT

VAT in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, VAT Return Filing Period, Expenses on Which Input Tax Recovery is Blocked, VAT Payment in Bahrain,

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain