The businesses registered under Bahrain VAT are responsible to adhere to the provisions of VAT law right from applying for VAT registration to the filing of VAT return. Any slippage in meeting the requirements as prescribed in VAT Law and regulations will attract hefty administrative penalties.

In this article, let us understand and know the various administrative penalties applicable in Bahrain VAT.

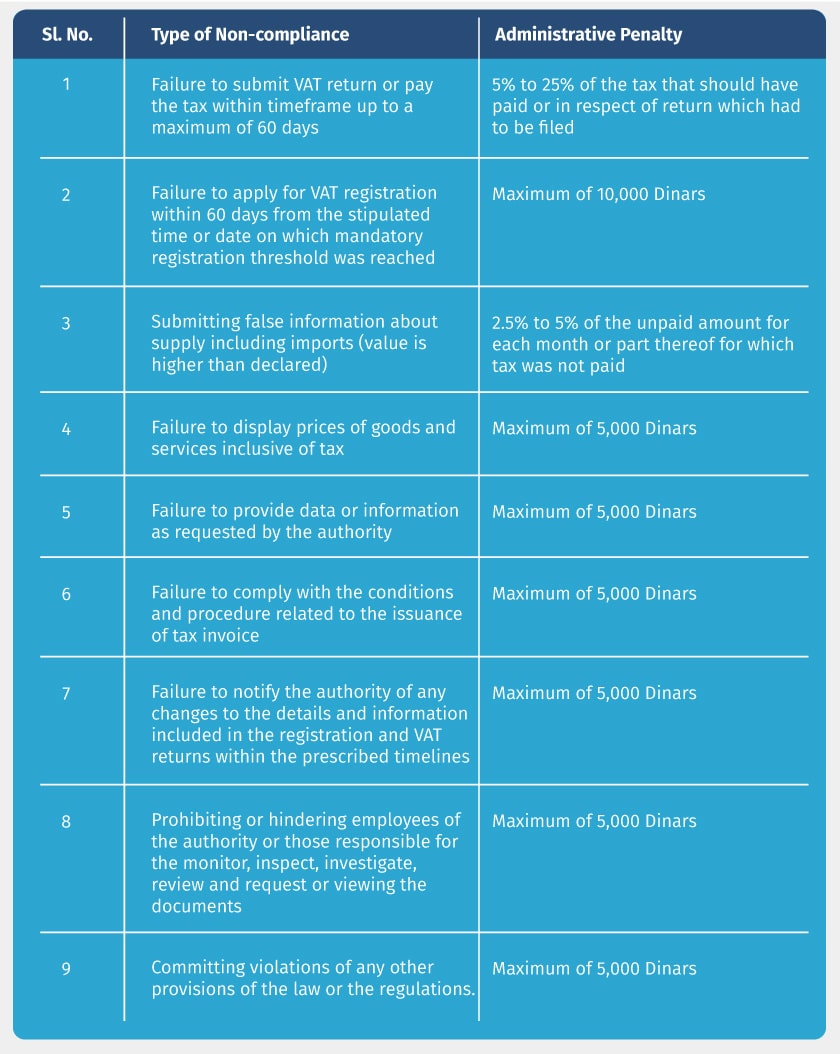

The Bahrain VAT law imposes different administrative penalties basis the type of non-compliance act committed by the taxpayers. The following are the different non-compliance acts along with the penalties.

Over and above the penalties discussed above, the Bahrain VAT law prescribes penalties for instance of tax evasion. The instance of tax evasion such as registration, return filing, knowingly recovery of wrongful tax etc. will attract heft penalties and in some cases imprisonment. The penalties range from a maximum 5 times the recovery tax value with up to 5 years of imprisonment based on the act of tax evasion.

The punishment is expected to be multiplied in case the same offence is repeated within 3 years from the date of issuance of final conviction.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain, VAT Payment in Bahrain

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain