Stock analysis is extremely crucial for any business as stock plays the role of a company’s heartbeat. From stock movement to reordering to stock ageing, various reports are involved in order to get the right information about your business’ inventory. It is only with these crucial reports can one identify the important aspects of stock items and thus take business decisions worry-free. One such report is Stock Summary.

What is Stock Summary?

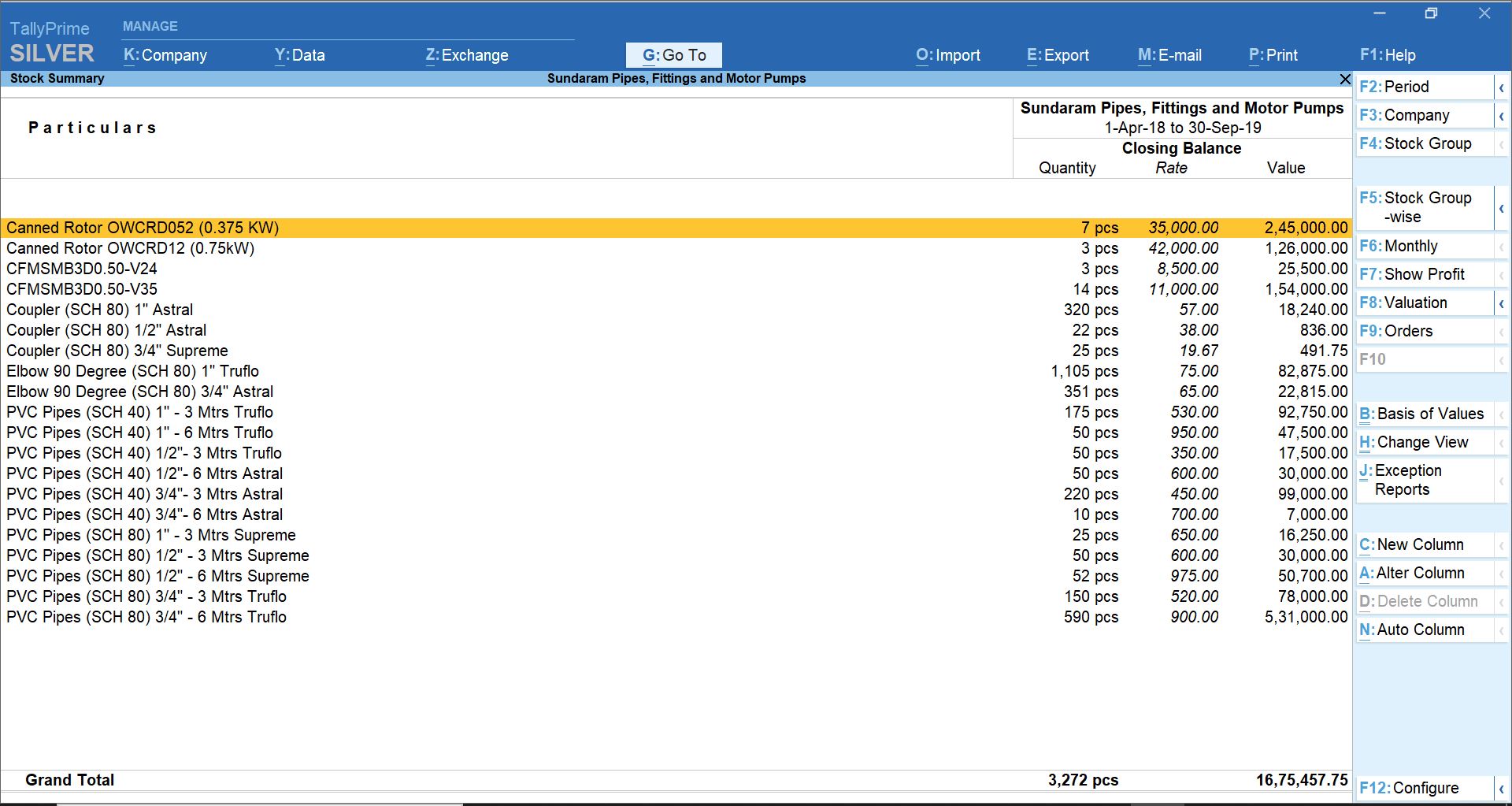

A Stock Summary is a statement of the stock-in-hand on a particular date. It is one of the primary inventory statements that updates the stock record in real-time as and when transactions are entered. Stock Summary provides information on stock groups and shows the quantity details, rate and closing value of the stock items under them.

Benefits of Stock Summary Report:

-

Know your stock details

Stock Summary provides information on stock items such as quantity, rate, and opening and closing value of the stock items. You can view the entire stock flow, including goods inward, goods outward, opening stock, and closing stock. Whether it is about stock reordering or stock ageing, you can get the right information about the inventory in your business using this report. You can understand the movement of a particular item day-on-day, month-wise or for any selected period.

-

Understand sales and purchases of stock

You can view details of the available stock at different locations and make a purchase or sales decision accordingly. A clear view of the purchase and sales order outstanding helps you further decide on the next steps to improve the cash flow in your business.

-

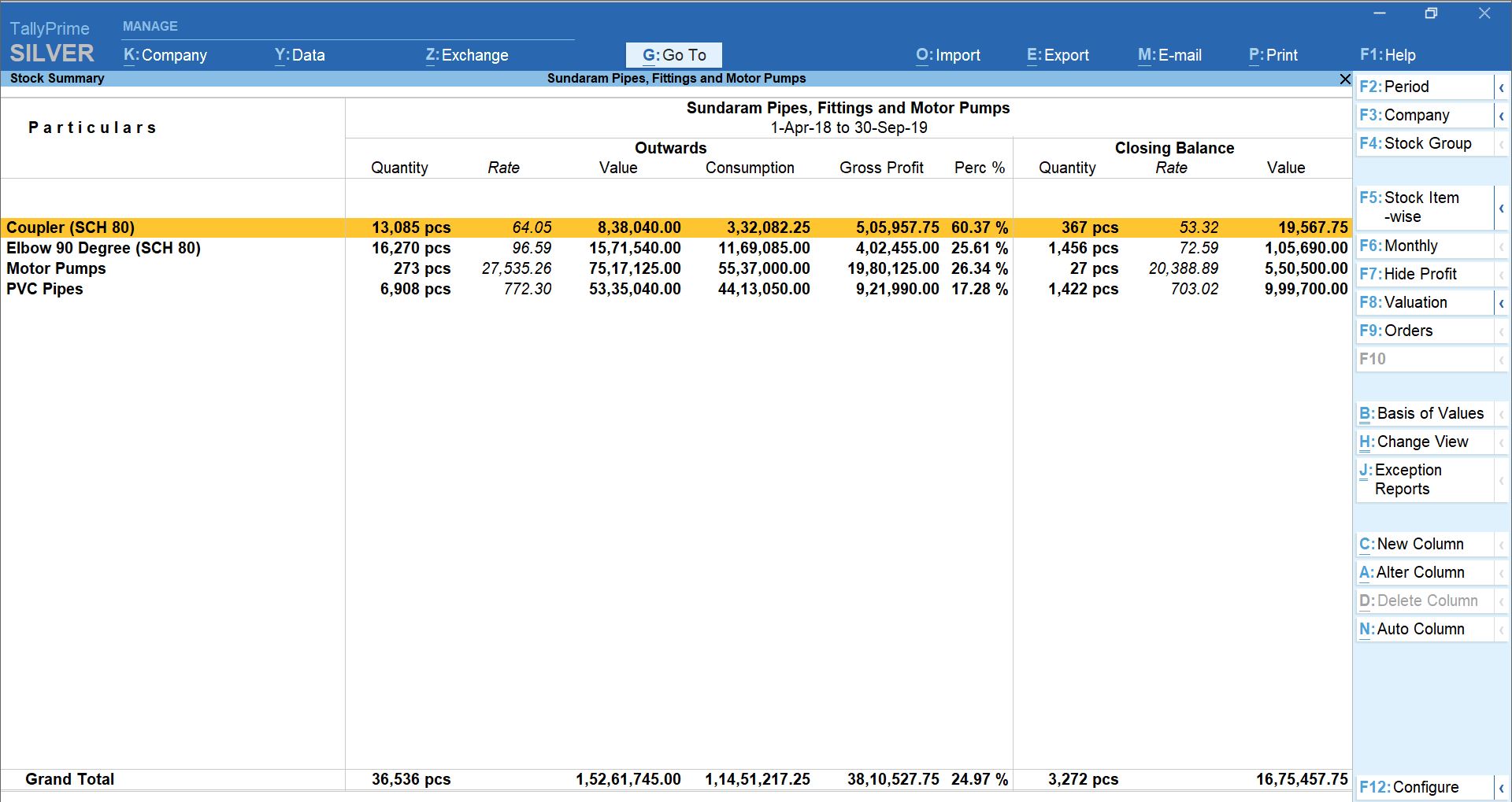

Know stock-wise profit

When you make business transactions with your vendors, you will need to keep a tab on your profit margins regularly. Understanding the profit value against the sales and purchase value of the items help in maintaining your future transactions. Using the Stock Summary report, you can view the profit made from sales of stock items, individually or per group.

How TallyPrime's stock summary report will benefit your business

Whether you maintain your stock individually or in groups, you will be able to know the opening and closing balance of your stock on any given day. In the Stock Summary report, you can view the stock balance and profits made from sales of your stock. The report also helps you to know the available stock quantity, the pending sales and purchase orders, and how much stock is available for supplying to your customers.

You can either view the closing balance of all the stock items individually or a stock group, based on your preference. Whether you have grouped your stock items or maintained them individually, it becomes tedious to track the profit manually. However, with TallyPrime you can see the profit earned from your outward stock, including the consumptions made. This statement is used to reconcile the closing balance because the closing value is derived by taking the consumption values instead of the outward goods at sales value.

The Stock Summary report with stock valuation methods can be used to view the effects of different methods on the value of stock. Each stock item can be set up to have a different stock valuation method. In some instances, a particular method of valuation may be required, for example, to assess the replacement value or saleable value of stock. TallyPrime displays stocks in any or all the valuation methods dynamically and simultaneously, without any complicated procedure.

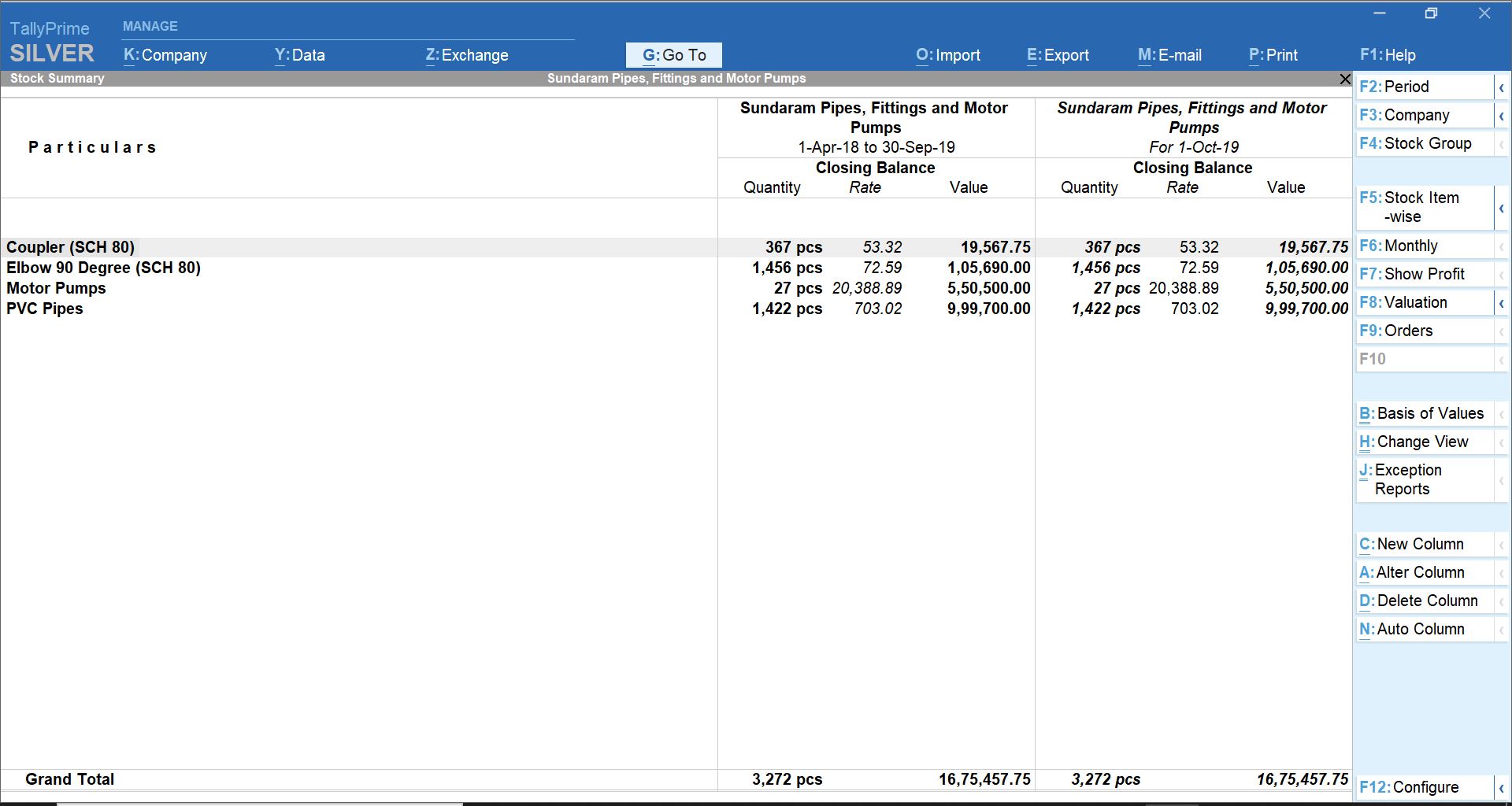

Tally’s stock summary report is so dynamic that apart from just showing you a list of inventories, you can do so much more. You can compare data for different companies, stock groups, periods, valuation methods, and so on, by adding columns in the reports and defining respective parameters as per your needs.

Quite interesting, isn’t it? Take a free-trial of TallyPrime today and manage your business more efficiently.