1. Introduction to GST on Property

Real Estate is one of the vital sectors of the Indian economy. It is one of the most globally recognized sectors and is often seen as one of the prime areas of investment. If sources are to be believed, the real estate sector in India is expected to reach a market size of US$ 1 trillion by 2030 from US$ 120 billion in 2017 and contribute 13 percent of the country’s GDP by 2025. This being the prime sector, treatment of GST on the property is crucial for it to reach the expected market size.

Right from the day of GST implementation, GST on the property was in the spotlight and is a widely discussed subject in GST council meetings. GST on the property has undergone server changes right from GST rate on a property to the treatment of a few property-related transactions.

In this article, we will discuss the latest rate of GST on property.

2. Type of GST Property Transactions

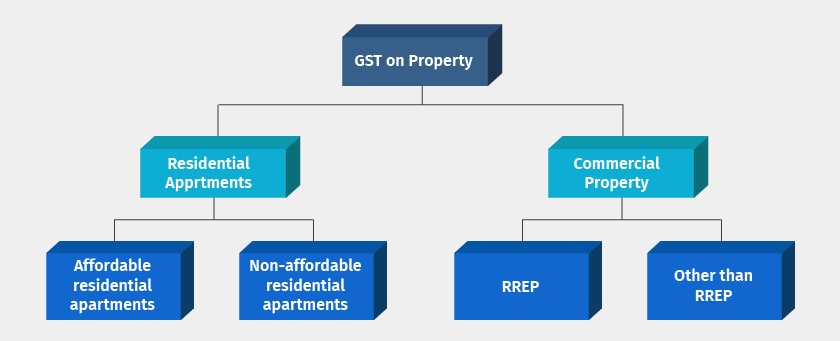

In order to understand the latest rate of GST on property, the real estate transactions can be classified into the following:

The latest rate of GST on property is primarily classified into residential apartments and commercial property. These are again sub-classified to arrive at the different rates of GST on property. In the below section, we will discuss the rate of GST on property along with the meaning of each of the property type listed above.

3. Latest GST Rates on Property from 1-4-2019

1. Residential Apartments

From 1st April,2019, the GST rates on residential apartments are fixed considering the affordability of the apartment. Further, for the projects which are on-going, an option has been given to opt the newer or older property GST rates with certain conditions.

With effect from 1st April 2019, the effective rate of GST on property type which deals with the construction of residential apartments by promoters in a real estate project are as under:

- Construction of affordable residential apartments

GST Rate of 1% without ITC on total consideration after deducting the land value

- Construction of residential apartments other than affordable residential apartments

GST Rate 5% without ITC on total consideration after deducting the land value

- On Going-Projects

The above GST rates are applicable for the on-going project as well. However, in case of on-going projects, the promoter has an option to pay GST at the old rates, i.e. at the effective rate of 8% on affordable residential apartments and effective rate of 12% on other than affordable residential apartments and consequently, can avail permissible credit of inputs taxes. In such cases, the promoter is also expected to pass the benefit of the credit availed by him to the buyers.

For us to have a deeper understanding of GST rate for above type of property, we need to understand the following:

- What is an affordable residential apartment?

Affordable residential apartment is a residential apartment in a project which commences on or after 1st April 2019, or is an ongoing project in respect of which the promoter has opted for a new rate of 1%, having a carpet area up to 60 sq. meters in metropolitan cities and 90 sq. meters in cities or towns other than metropolitan cities, and the gross amount charged for which, is not more than INR 45 lakhs.

In an ongoing project in respect of which the promoter has opted for new rates, the term also includes apartments being constructed under the specified housing schemes of Central or State Governments. It is to be noted that cities or towns in the notification shall include all areas other than metropolitan cities as defined, such as villages. Metropolitan cities are Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (the whole of MMR) with their geographical limits prescribed by Government.

- What is an on-going project?

An on-going project is one which meets the following conditions shall be considered as an ongoing project:

- Commencement certificate for the project, where required, has been issued by the competent authority on or before 31st March 2019, and it is certified by a registered architect, chartered engineer or a licensed surveyor that construction of the project has started (i.e. earthwork for site preparation for the project has been completed and excavation for foundation has started) on or before 31st March 2019

- Where commencement certificate in respect of the project, is not required to be issued by the competent authority, it is to be certified by any of the authorities specified above, that construction of the project has started on or before the 31st March 2019

- Completion certificate has not been issued or the first occupation of the project has not taken place on or before the 31st March 2019

- Apartments of the project have been, partly or wholly, booked on or before 31st March 2019.

2. Commercial Property

The GST on commercial property includes the construction of shops, godowns, offices etc. With effect from 1st April 2019, effective rate of GST, after deduction of the value of land or undivided share of land, on the construction of commercial apartments (shops, godowns, offices etc.) by the promoter in real estate project are as under:

- 5% without ITC on the total consideration

Construction of commercial apartments in a Residential Real Estate Project (RREP), which commences on or after 1st April 2019 or in an ongoing project in respect of which the promoter has opted for new rates effective from 1st April 2019 – 5% without ITC on the total consideration

- 12% with ITC on the total consideration

Construction of commercial apartments in a Real Estate Project (REP) other than Residential Real Estate Project (RREP) or in an ongoing project in respect of which the promoter has opted for old rates – 12% with ITC on the total consideration

Here, a residential real estate project means a project in which the carpet area of the commercial apartments is not more than 15 per cent. of the total carpet area of all the apartments in the project.