In June 2019, Kerala Government notified an additional cess known as ‘Kerala Flood Cess (KFC)’ of 1%. This was done to overcome the crisis caused due to the flood in 2018. The additional 1% levy was effective from 1st August,2019, and it is charged on the value of goods and services supplied, in addition to the GST.

Not only a levy of flood cess, but the taxable persons were liable to file Kerala Flood Cess Return in ‘Form KFC-A’ and pay Kerala Flood Cess. The flood of cess of 1% was applicable on goods and services attracting more than 5% GST. Also, a cess of 0.25% was levied on gold and silver, attracting 3% GST. Furthermore, this additional cess was levied by regular dealers only on intrastate B2C sales. In other words, it was not applicable to composition dealers, inter-states sales and intra-state B2B supplies.

Recently, the Kerala Government has announced that the flood cess would be applicable till 31st July 2021. In other words, no Kerala Flood Cess of 1% would be applied from the 1st of August,2021.

This implies that businesses who were charging 1% cess along with GST, would need to ensure that cess is not calculated on the new invoices issued from 1st August,2021. On this note, a press release is issued by the Government directing businesses to make necessary changes in their billing software.

How to configure TallyPrime to stop Kerala Flood Cess(KFC) from 1st August,2021

If you are using TallyPrime, configuring this change is quite easy. A simple change in tax rate setup would ensure:

- All invoices recorded till 31st July 2021 will continue to be with Kerala Flood Cess(KFC)

- For new invoices that you record from 1st August,2021, Kerala Flood Cess will stop being calculated

Here are the steps that you can follow to stop KFC from 1st August,2021. To know the detailed steps, read 'Stop Calculation of Kerala Flood Cess (KFC) in TallyPrime'

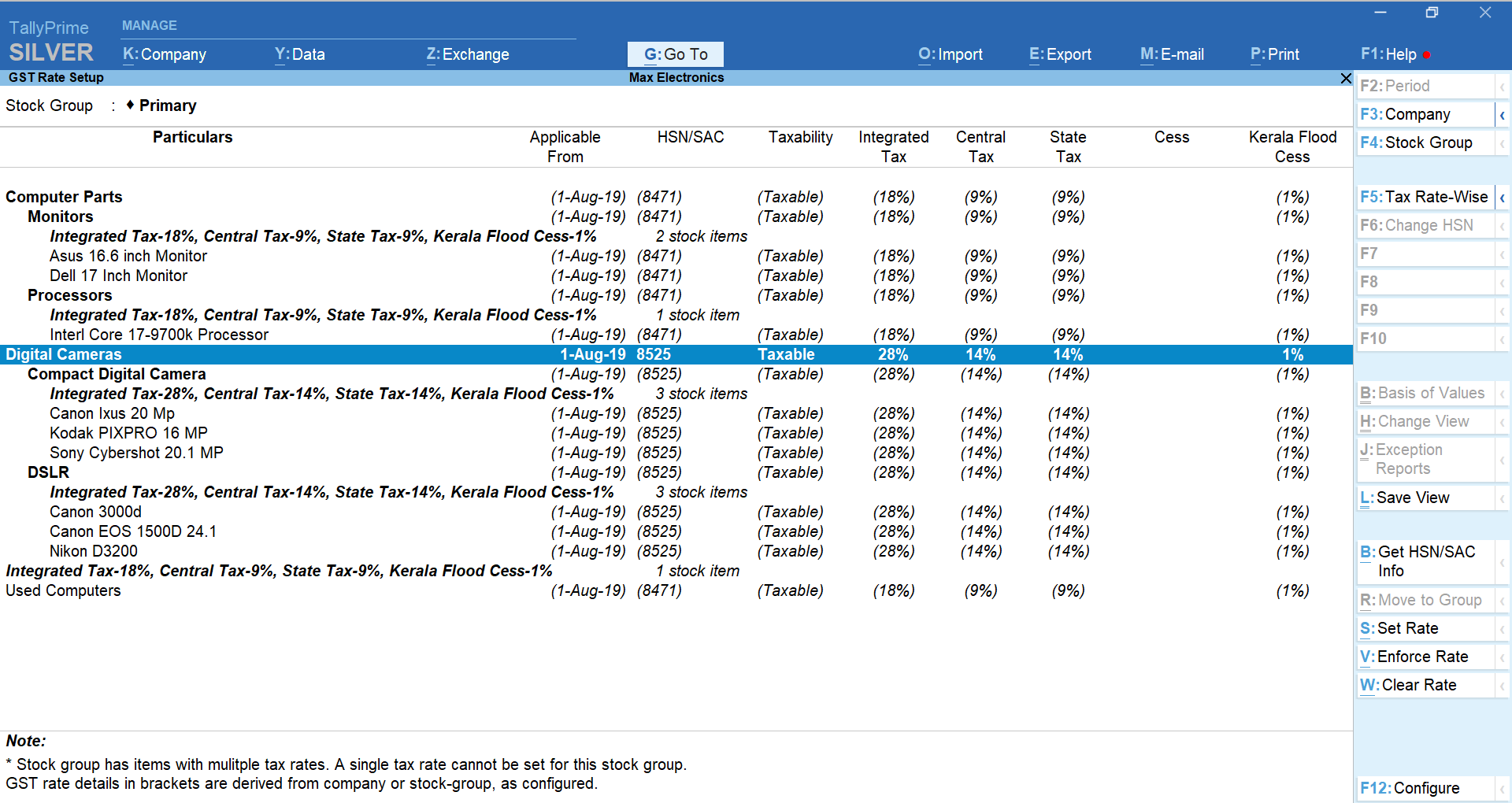

- Press Alt + G for ‘Go To’

- Type 'GST' and select ‘GST Rate Set-up‘

- Select stock groups or stock items on which cess is currently applicable. Ideally, you need to select stock groups or items on which GST of 12%, 18% and 28% is applicable.

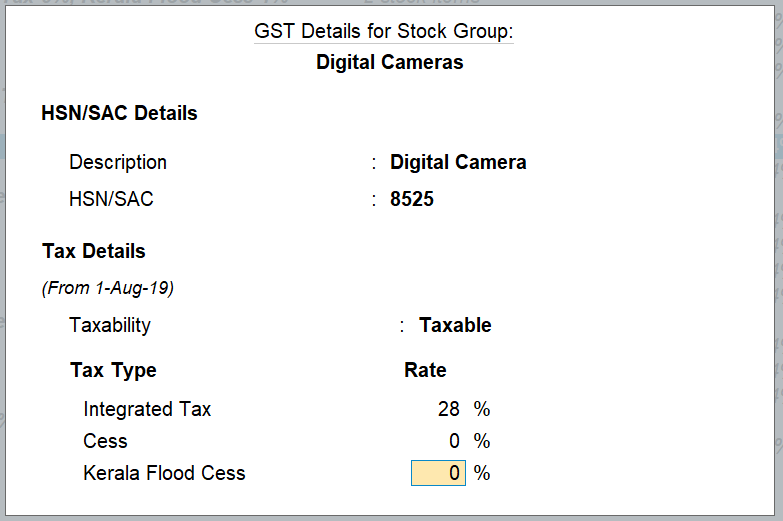

- Press Alt + S for ‘Set Rate’

- Mention Kerala Flood Cess as ‘0’

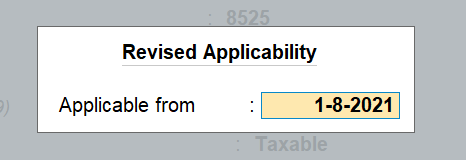

- Mention applicability date as 1st August,2021

- Enter and accept to save the changes

In case, if you have configured KFC details at ledger groups and accounts such as purchases, sales etc, you need to alter and make similar changes discussed above. You can make the changes today itself and it will be effective from 1st August 2021. To know detailed steps, read ' Stop Calculation of Kerala Flood Cess (KFC) in TallyPrime