In our previous blog Understanding Input Service Distributor (ISD) in GST, we discussed the role of an ISD in GST. In this blog, we will discuss the various conditions applicable for the distribution of credit and method of distribution of credit to different units (branches).

Conditions for distribution of input tax credit by an ISD

The following are the conditions applicable for distribution of input credit by an ISD:

- An ISD invoice clearly indicating ‘issued only for distribution of input tax credit’, should be issued by the distributor to the recipient of credit. The unit to which the input tax credit is distributed is referred as the ‘Recipient of credit’. The tax invoice should contain the following details;

- Name, address, and GSTIN of the Input Service Distributor

- A consecutive serial number containing only alphabets and/or numerals, unique for a financial year

- Date of its issue

- Name, address, and GSTIN of the supplier of services, the credit in respect of which is being distributed, and the serial number and date of invoice issued by such supplier

- Name, address, and GSTIN of the recipient to whom the credit is being distributed

- The amount of credit distributed, and

- Signature or digital signature of the supplier or his authorized representative

- The amount of credit distributed shall not exceed the amount of credit available for distribution.

- The input tax credit available for distribution in a month shall be distributed in the same month, and the details of the same shall be furnished in Form GSTR -6.

- The input tax credit should be distributed only to that branch which has consumed the input services. Let us understand this with an example:

For example, Top-In-Town Home Appliances Ltd, is located in Bangalore, Karnataka. They also have branches located in Mysore (Karnataka), Chennai (Tamil Nadu), and Mumbai (Maharashtra). The unit in Bangalore is the Head office and they procure common services in bulk which are used by the other branches too.

Top-In-Town Home Appliances Ltd (HO) receives an invoice of Rs.1,00,000 + GST of Rs.18,000 towards advertisement services provided exclusively to the Mysore branch.

The total credit of Rs.18,000 will be distributed only to the Mysore branch.

- The credit of tax paid on input services, availed by more than one recipient of credit or all, should be distributed only amongst such recipients or all recipients.

Method of input tax distribution

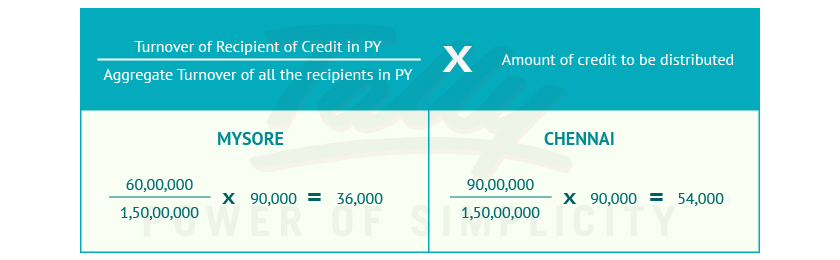

The distribution shall be on pro rata basis based on the turnover for the previous year of such recipients. In the absence of turnover in previous financial year, the turnover of the last quarter of the month in which ITC is distributed, will be considered.

Let us consider the above example and understand in detail.

| Amount of credit to be distributed | Rs.90,000 |

| Number of recipients of credit | Mysore and Chennai |

| Aggregate turnover of Mysore unit in previous financial year (PY) | Rs.60 Lakhs |

| Aggregate turnover of Chennai unit in previous financial year (PY) | Rs.90 Lakhs |

| Aggregate turnover of all recipients of credit | Rs.150 Lakhs |

The credit of Rs.90,000 will be distributed in the following manner:

- Any additional amount of input tax credit on account of issuance of a ‘debit note’ by a supplier to the ISD shall be apportioned to each recipient in the same ratio in which the input tax credit contained in the original invoice was distributed. The distribution should be on the basis of method illustrated in Point No. 5

- In case the input tax credit already distributed gets reduced for any reason, an ISD credit note should be issued for the reduction of credit. The following details have to be captured in the ISD credit note :

- Name, address, and GSTIN of the ISD

- A consecutive SL.No containing alphabets or numerals or special characters such as hyphen or dash or slash, symbolized as, “-“ “/” respectively, and any combination thereof, unique for a financial year

- Date of its issue

- Name, address, and GSTIN of the recipient to whom the credit is distributed

- The amount of credit distributed, and

- The signature or digital signature of the ISD or his authorized representative

- Any input tax credit required to be reduced on account of issuance of a ‘credit note’ by a supplier to ISD should be apportioned to each recipient in the same ratio in which the input tax credit contained in the original invoice was distributed. The distribution should be on the basis of method illustrated in Point No. 5

- The reduction amount so apportioned should be:

- Reduced from the amount to be distributed in the month in which the credit note is included in the return in FORM GSTR – 6 and

- Added to the output tax liability of the recipient, in case the amount so apportioned is negative.