With the introduction of the Invoice Management System (IMS), the way you interact with GSTR-2B and GSTR-3B is changing — for the better.

Quick overview of the IMS:

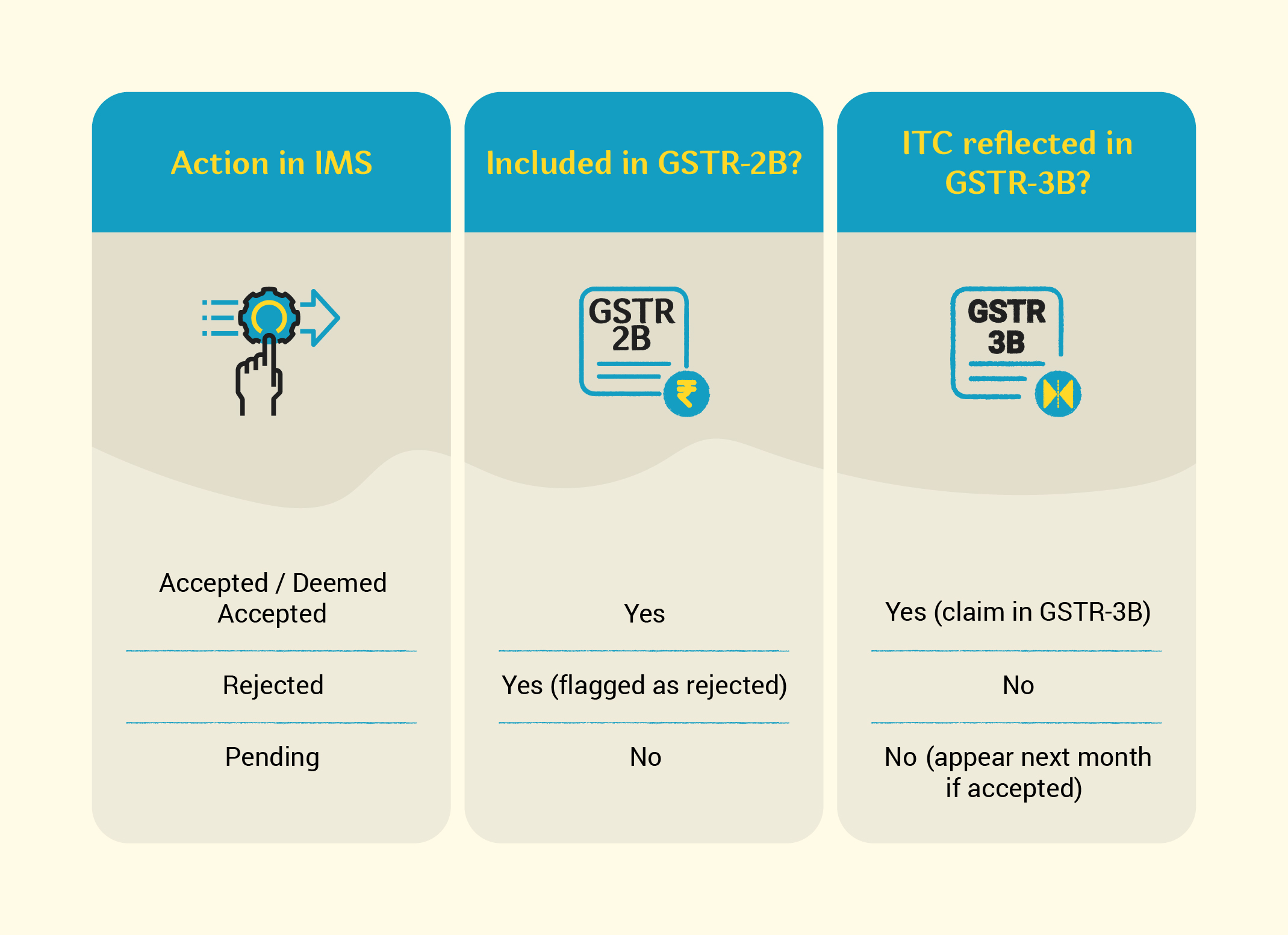

It allows you to view invoices uploaded by your suppliers in near real-time and take timely actions before filing returns. You can accept invoices that match your records, reject those that don’t belong to you, or mark them as pending if there are issues. These simple actions play a big role in how your GSTR-2B and GSTR-3B are generated — making it easier to claim eligible ITC and avoid filing mismatches. Here is quick snapshot of how different actions on IMS would impact the GSTR-2B and GSTR-3B:

Let’s explore more on how IMS is transforming the GSTR-2B and 3B experience — and what you need to do to stay ahead.

Impact of IMS on GSTR-2B – What is changing

GSTR-2B is your auto-generated ITC summary for the month. With IMS, your actions on supplier invoices (accept, reject, or mark as pending) now directly impact the data in your GSTR-2B, ensuring more accurate and up-to-date ITC reporting. Here are the key impacts of IMS on your GSTR-2B and how it streamlines your ITC reporting process:

1. More transparency with rejected ITC

Your GSTR-2B summary will now clearly show rejected invoices, giving you better visibility into which ITC claims were disallowed.

Note: These rejected entries in 2B do not affect GSTR-3B directly but help buyers track what they cannot claim.

|

IMS portal hands-on experience Try this interactive demo to explore invoice management on the IMS dashboard—without impacting your real data. |

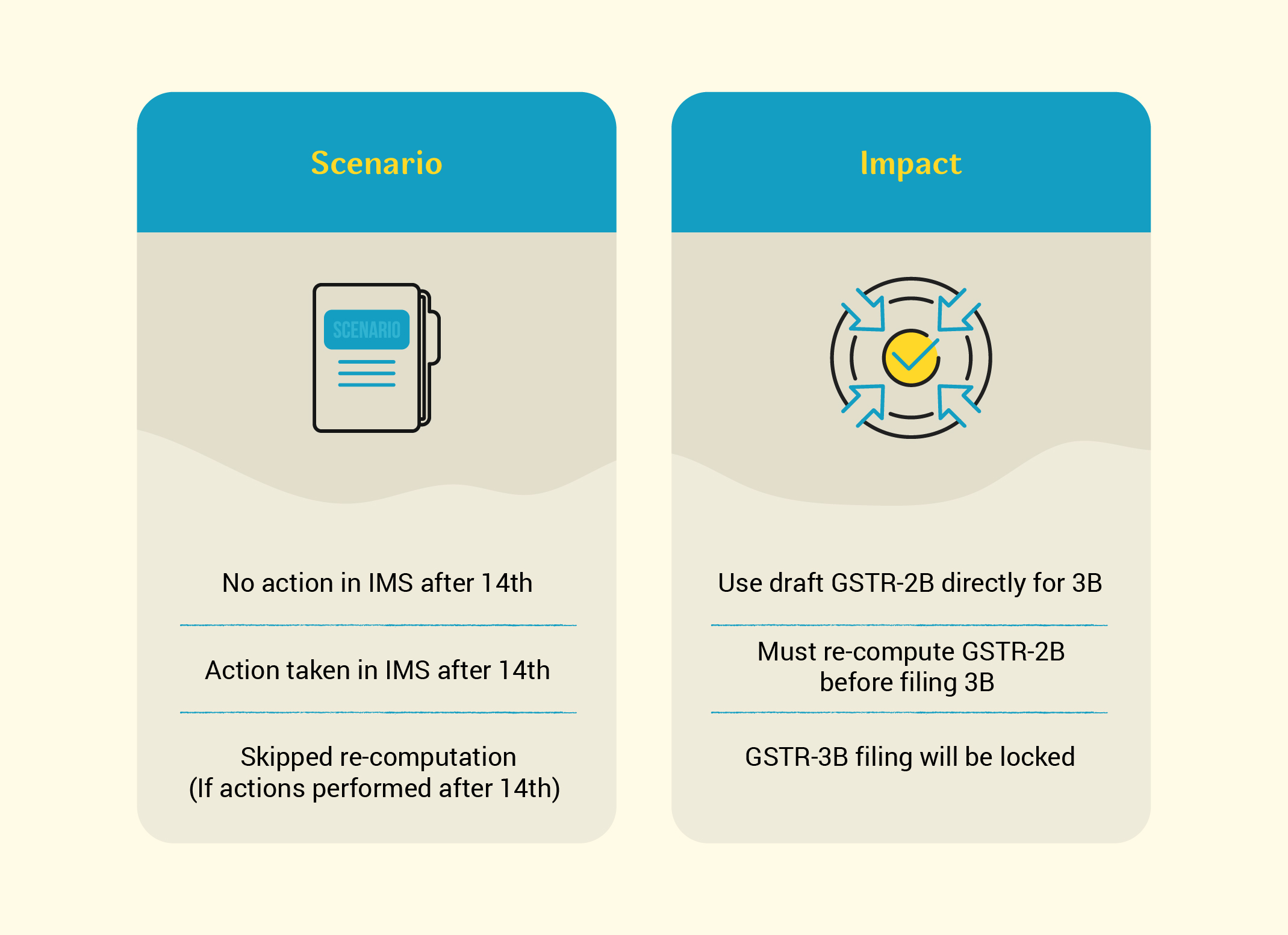

2. GSTR-2B is now a ‘draft’ until actions are final

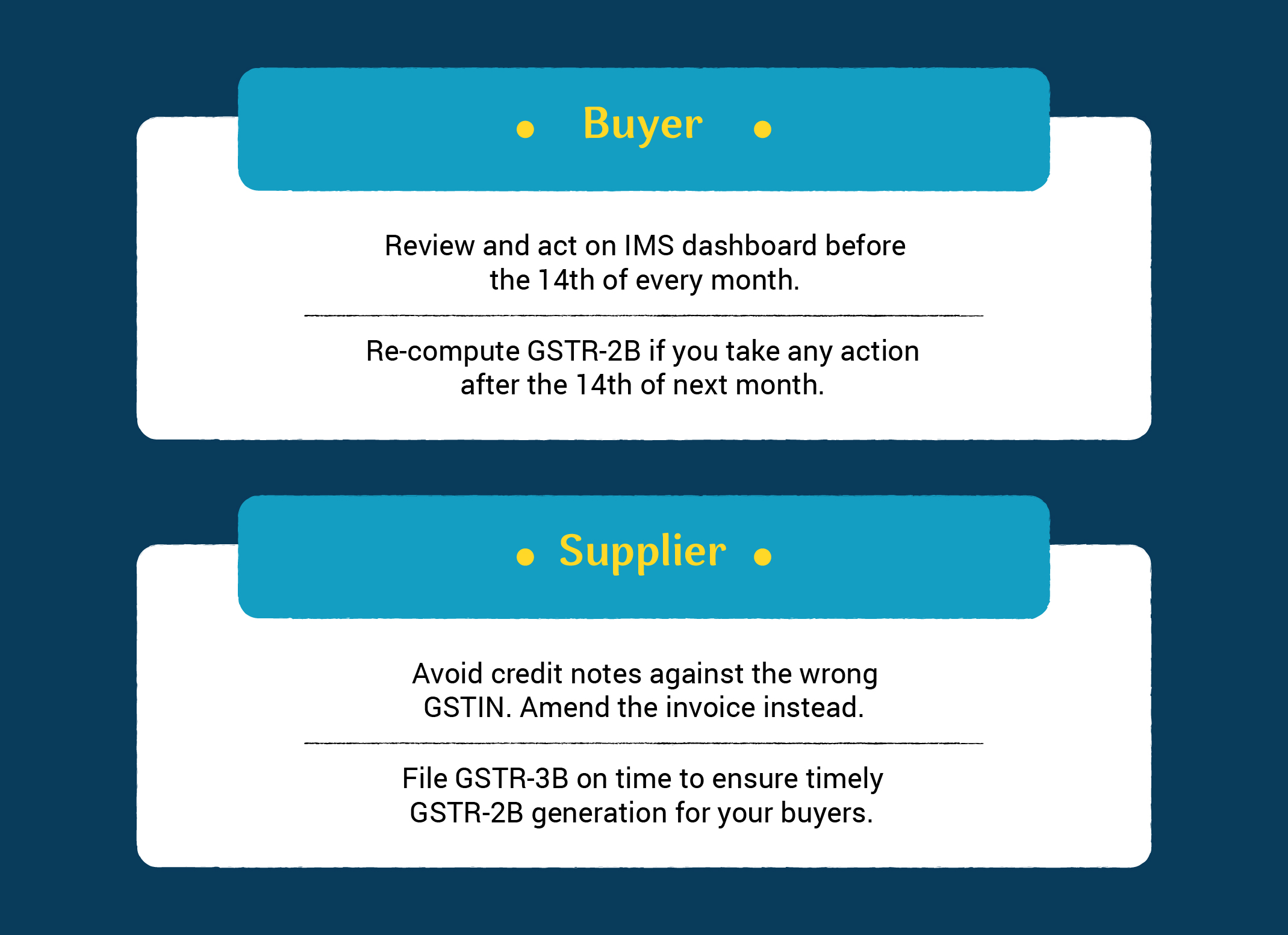

From now on, the GSTR-2B generated on the 14th of every month is considered a ‘Draft’. If you make any actions in IMS after the 14th, you must re-compute GSTR-2B to file GSTR-3B.

Note: GSTR-3B can’t be filed unless re-computation is completed only if the actions are performed after 14th.

(Tip: It’s best to act on invoices before the 14th to avoid last-minute recalculations.)

3. Early actions reflect in draft GSTR-2B

If you reject or mark invoices pending before the 14th, they are excluded from draft GSTR-2B. This gives you more control over your ITC and ensures only relevant invoices are reflected.

Example: You spot an invoice uploaded against your GSTIN that doesn’t belong to you. If you reject it before the 14th, it won’t show in your draft GSTR-2B — and you won’t accidentally claim ineligible ITC.

4. Rejected and pending invoices won’t appear in GSTR-2B

If you mark any invoice as ‘rejected’ or ‘pending’ before the 14th of the month, it will be excluded from that month’s GSTR-2B. In case of pending invoices, they are kept on hold and won’t be considered for ITC in the current return cycle.

However, once the discrepancies are resolved or clarifications are received, you can take appropriate action and claim them in future returns. This process helps ensure only eligible and accurate invoices are reflected in your GSTR-2B.

5. QRMP taxpayer alert

If you're under the QRMP (Quarterly Return, Monthly Payment) scheme, GSTR-2B will be generated only once per quarter. That means you won’t receive GSTR-2B for Month 1 and 2—only for the third month of the quarter. However, you can continue to view the invoices and take actions on IMS dashboard anytime and all such actions will be include when GSTR-2B is generated.

(Tip: Plan ITC claims accordingly — you’ll only get visibility in the 3rd month.)

Impact of IMS on GSTR-3B

GSTR-3B is where you declare outward/inward supplies, pay taxes, and claim ITC.

1. GSTR-2B is now dependent on GSTR-3B

Earlier, GSTR-2B was generated independently every month.

Now, GSTR-2B for a month will only be generated after filing the GSTR-3B for the previous month. For example, May’s GSTR-2B will be generated only after you file April’s GSTR-3B. This synchronization ensures cleaner reporting and prevents ITC mismatches.

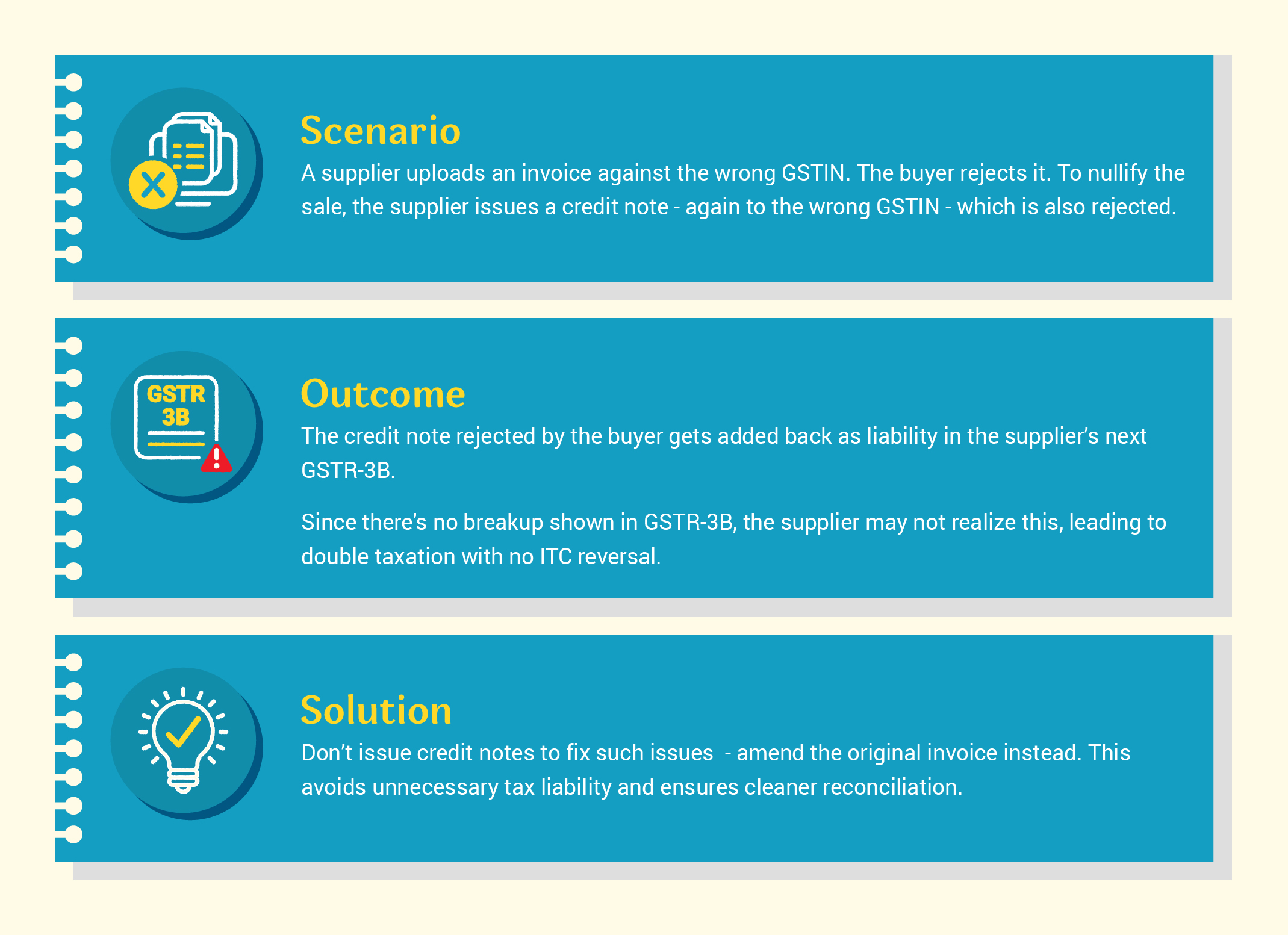

2. Rejection of credit notes adds to supplier’s liability

If a buyer rejects a credit note, it is added to the supplier’s liability in the next month’s GSTR-3B (Section 3.1a). However, since there is no clear breakup in GSTR-3B to show this liability addition, suppliers might miss it and not understand why they are paying extra. Here’s an example for your reference:

3. Avoid bulk credit notes

Issuing a credit note against multiple invoices might seem convenient, but it can create complications if the credit note is rejected. Since it’s not linked to a single invoice, tracing the issue becomes difficult — leading to mismatches and unresolved liabilities in your returns.

(Tip: To avoid confusion and ensure easier reconciliation, issue credit notes against individual invoices whenever possible.)

RCM invoices and IMS: No action possible

RCM (reverse charge mechanism) invoices are not displayed in IMS. This means buyers:

- Cannot accept, reject, or mark them as pending.

- May mistakenly end up paying liability again if a forward charge invoice is wrongly uploaded as RCM.

This is particularly common in industries like transportation, where operators may not fully understand GST categories. For example, a transporter uploads a forward charge invoice as RCM. Buyer pays tax under RCM and claims ITC. Later, seller amends the invoice as forward charge—but buyer loses actual ITC since rejection wasn’t possible initially.

Best practices: What you need to do

Key takeaways from this article

- Actions taken in IMS (accept, reject, pending) directly impact GSTR-2B and indirectly affect GSTR-3B.

- GSTR-2B is now treated as a draft — re-computation is required if actions are taken after the 14th of the month.

- Rejected and pending invoices are excluded from GSTR-2B, helping prevent ineligible ITC claims.

- GSTR-2B for a month is generated only after filing the previous month's GSTR-3B.

- Credit note rejections add to supplier liability — especially risky with bulk credit notes.

- QRMP taxpayers get GSTR-2B only once per quarter — plan ITC accordingly.

- IMS does not support RCM invoices — double-check for incorrect invoice categorization.

- Acting early in IMS = fewer errors, cleaner returns, and maximized ITC.