For businesses dealing with GST compliance, managing input tax credit (ITC) can be tricky. From mismatched invoices, missed credits, to back-and-forth reconciling with suppliers creates unnecessary stress. Incorrect ITC claims can also lead to legal trouble and cash flow hiccups. That’s exactly why Invoice Management System (IMS) was introduced - to help businesses accept, reject, or keep invoices pending, while simplifying the ITC claiming process.

Let’s break down the entire IMS cycle - how it works and why it matters for your business.

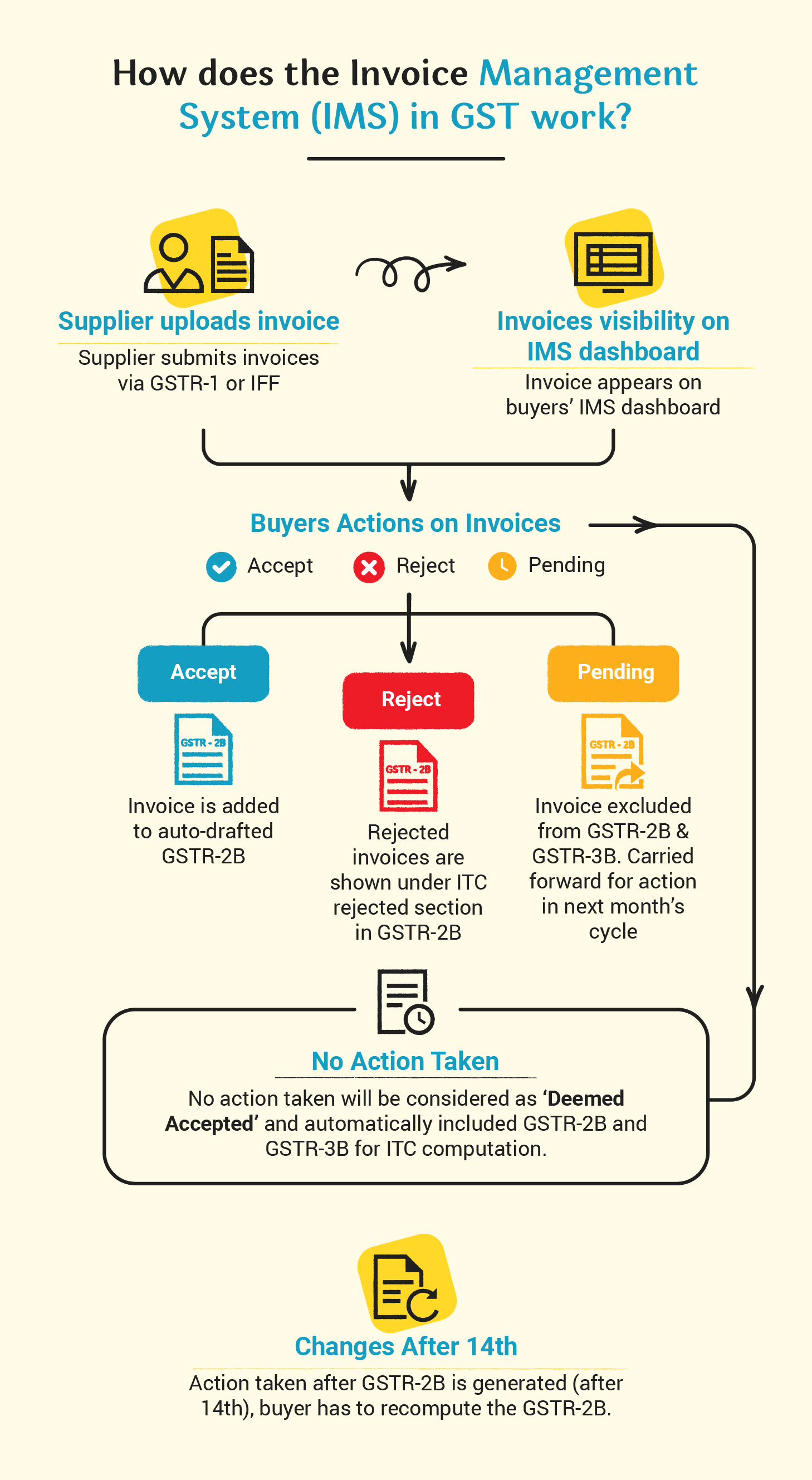

How does Invoice Management System (IMS) work?

The Invoice Management System (IMS) lets buyers accept, reject, or keep supplier invoices on hold. Why does this matter? With IMS, you get a chance to review and match supplier invoices (from IFF, GSTR-1 etc.) with your records before claiming ITC. This means fewer errors and smoother returns. The IMS facilitates a structured interaction between suppliers and buyers for invoice reconciliation.

1. Supplier submits invoices via GSTR-1 or IFF

Suppliers upload their outward supply invoices through GSTR-1 (by the 11th of every month) or the Invoice Furnishing Facility (IFF).

2. Invoices visibility on IMS dashboard

Once the supplier uploads the invoices, buyers can view all invoices reported by their suppliers on IMS dashboard. Some of the key details that visible in the dashboard are Supplier GSTIN, trade name, invoice number, invoice type.

3. Buyers actions on invoices

For each invoice, buyers can choose to take action – Accept, Reject and Pending before GSTR-2B is generated i.e. by 14th of month following the return period.

|

IMS Guide This all-in-one guide covers everything you need to know about IMS. Download now to get started. |

TallyPrime IMS hands-on experience Try this interactive demo to see how TallyPrime IMS helps you monitor vendor sales in real time and simplify ITC and GST compliance. |

-

Accept

- When invoice details are correct

- Invoice is added to auto-drafted GSTR-2B (generated on 14th)

- ITC from these invoices becomes part of GSTR-3B

-

Reject

- When incorrect or invalid invoice

- Rejected invoices are shown under ITC rejected section in GSTR-2B

- These invoices will not be included for ITC computation in GSTR-3B

-

Pending

- When goods or services are yet to be received or unclear on ITC eligibility

- Invoice is excluded from GSTR-2B and GSTR-3B

- Carried forward for action in next month’s cycle

4. No Action Taken?

All invoices which are not acted or no action taken by the buyer, will be considered as ‘Deemed Accepted’ and automatically included GSTR-2B and GSTR-3B for ITC computation.

5. Changes After 14th

If any action (Accept/Reject/Pending) is taken after GSTR-2B is generated (14th) but before GSTR-3B filing, in such case, the buyer has to recompute the GSTR-2B. Only after the recomputation, GSTR-3B return filing will be allowed.

Quick Snapshot of IMS actions on GSTR-2B and GSTR-3B

|

Buyer action |

Impact on GSTR-2B |

Impact on GSTR-3B (ITC) |

Supplier visibility |

|

Accepted invoices |

Reflected in GSTR-2B generated on 14th |

Included in ITC computation |

Notified as accepted |

|

No action taken (Deemed accepted) |

Automatically added to GSTR-2B |

Included in ITC computation |

Notified as accepted |

|

Rejected invoices |

Shown under ITC Rejected section |

Excluded from ITC computation |

Visible on supplier’s IMS dashboard |

|

Pending invoices |

Not included in current month’s GSTR-2B |

Not included until final action |

Notified once action is taken |

Why is IMS important for businesses?

The IMS offers tangible benefits for both buyers and suppliers:

|

For Buyers |

For Suppliers |

|

Control over ITC claims |

Visibility of invoice acceptance/rejection |

|

Avoid wrongful ITC claims |

Early detection of discrepancies |

|

Simplified reconciliation |

Faster resolution of mismatches |

|

Better audit readiness |

Smoother cash flow through accurate filings |

Common scenarios where ‘Pending’ is useful

Marking an invoice as Pending is a smart way to avoid incorrect ITC claims in these situations:

- Goods are yet to be received, though invoiced

- Discrepancies needing supplier clarification

- Supporting documentation pending verification

Pending invoices will continue to appear month-on-month until acted upon. However, the buyer must ensure ITC is claimed within the stipulated time — by December 31st of the following financial year — as per Section 16(4) of the CGST Act.

The Invoice Management System (IMS) is not just another compliance step — it’s a proactive step to help businesses stay in control of their ITC. By allowing buyers to accept, reject, or keep invoices pending, IMS ensures cleaner reconciliations and reduces the risk of errors or disputes later. Whether it’s managing supplier mismatches, avoiding wrongful ITC claims, or staying audit-ready, IMS brings much-needed clarity to the process.