The Invoice Management System (IMS) is set to bring a major shift in how businesses claim Input Tax Credit (ITC). For QRMP (Quarterly Return Monthly Payment) taxpayers, this means a departure from the current reliance on auto-populated GSTR-2B to verify purchase invoices of businesses uploaded by suppliers.

With real-time invoice validation and tighter control over claimable ITC, IMS will significantly impact how QRMP businesses manage their compliance and working capital. In this article, we break down what’s changing, how it affects you, and what steps you can take to stay ahead.

How QRMP Taxpayers Will Use IMS to Manage ITC?

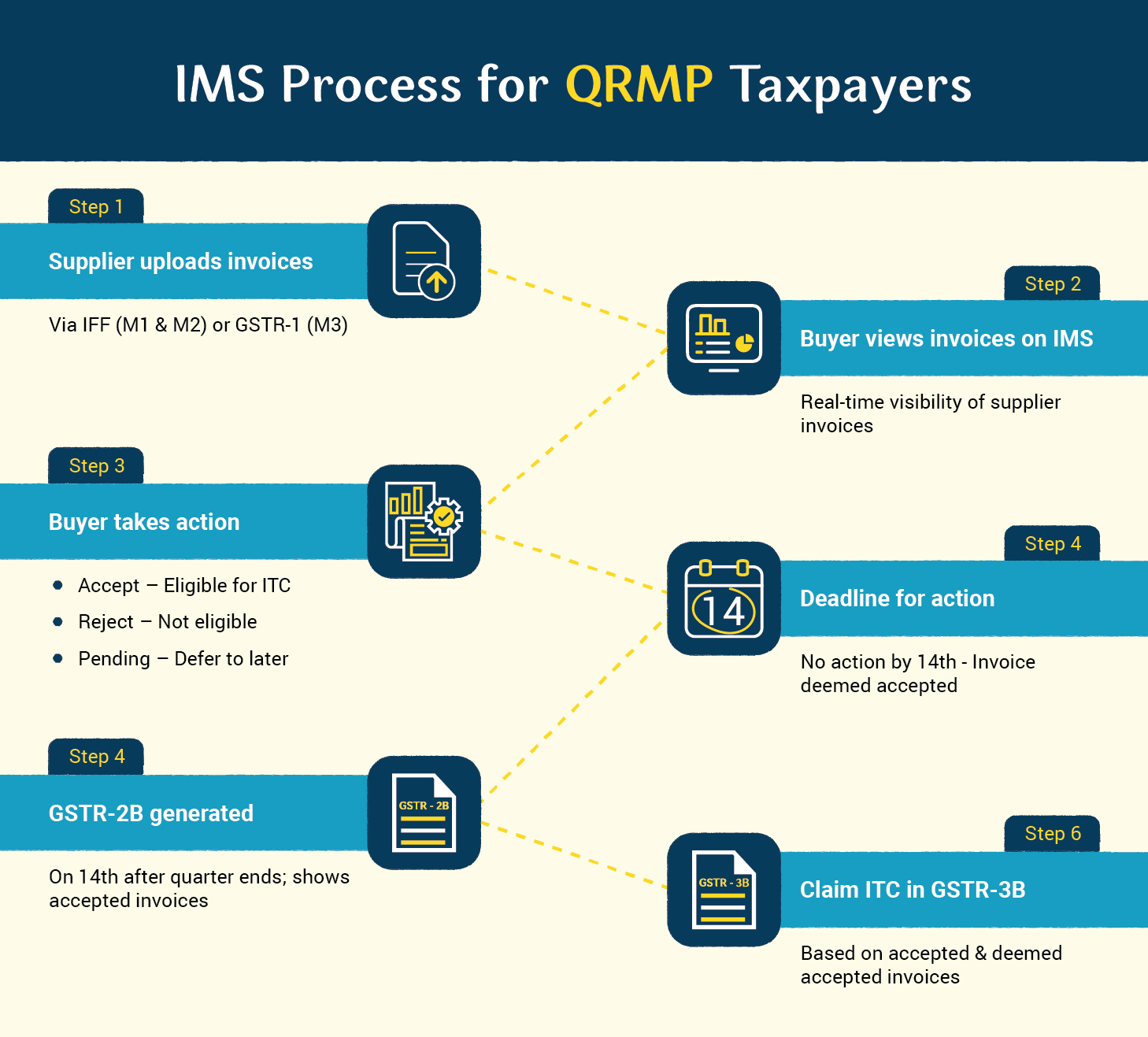

Given below are the steps that the QRMP taxpayers will follow under IMS to claim their ITC:

Step 1: Supplier uploads invoices via IFF or GSTR-1

Your purchase invoices will start reflecting on IMS only when your supplier uploads his/her sales invoices using IFF or GSTR – 1. The upload through GSTR-1 happens by the 11th of each month.

Step 2: Buyer views invoices on the IMS dashboard

Once suppliers upload the invoices, they become instantly visible on the IMS portal. You can access and review them at any time thereafter.

Step 3: Verify invoices and choose an action

Scan the invoices showcased on the IMS portal and verify that those invoices are present in your books as well. You can take one of the following three actions for each invoice:

- Accept – The invoice is correct and eligible for ITC

- Reject – The invoice has some errors or doesn’t belong to you and is not eligible for ITC

- Pending – You need clarification or are awaiting goods/services. If no action is taken on invoices marked as pending, they are carried forward to the next quarter.

Using the Pending status on an invoice provides a buffer period for reviewing it, preventing you from accidentally claiming ineligible ITC. If no action is taken by the 14th of the month following the quarter, the invoice is deemed as accepted

|

IMS Guide This all-in-one guide covers everything you need to know about IMS. Download now to get started. |

TallyPrime IMS hands-on experience Try this interactive demo to see how TallyPrime IMS helps you monitor vendor sales in real time and simplify ITC and GST compliance. |

Step 5: Generation of GSTR-2B and auto computation of ITC

On the 14th of the month after the quarter ends, GSTR-2B is generated, showing all accepted and deemed accepted invoices along with auto-calculated ITC. If you make any changes in the IMS portal after the 14th of the month following the end of the quarter, you must recompute GSTR-2B to update and recalculate your ITC.

Step 6: Claiming ITC

You can claim ITC in the quarterly GSTR-3B return according to the ITC available in your GSTR-2B.

Impact of IMS on GSTR-2A and GSTR-2B for QRMP filers

The table below explains how the new system will impact QRMP taxpayers, especially in terms of invoice visibility, action timelines, and ITC computation.

|

Month |

Supplier uploads invoices via |

Appears in IMS dashboard |

GSTR-2B generation |

Action required by |

ITC Computation in GSTR-3B |

|

M1 (1st Month) |

IFF or GSTR-1 |

Immediately after upload |

NA |

Anytime |

NA |

|

M2 (2nd Month) |

IFF or GSTR-1 |

Immediately after upload |

NA |

Anytime |

NA |

|

M3 (3rd Month) |

IFF or GSTR-1 |

Immediately after upload |

By the 14th of the month following M3 |

14th of the month after the end of the quarter |

Yes |

Key changes for QRMP taxpayers

These are the key changes QRMP taxpayers will encounter when shifting their GSTR-2B reconciliation process to IMS for ITC claims:

- GSTR-2B will be generated only once per quarter. For example, for the April–June quarter, it will be available on 14th July. Currently, GSTR-2B is generated monthly even for QRMP taxpayers.

- IMS dashboard offers real-time invoice visibility. Even though GSTR-2B is quarterly, QRMP taxpayers can view invoices uploaded by their suppliers in real time through the IMS dashboard.

- Buyers can take action anytime during the return period. Invoices can be marked as Accept, Reject, or Pending at any time until GSTR-2B is generated. These actions determine ITC eligibility.

- Post-GSTR-2B actions are still allowed. Buyers can continue to take or modify actions after GSTR-2B is generated, up until GSTR-3B is filed. In such cases, GSTR-3B needs to be recomputed to reflect the updated ITC eligibility.

IMS is not just a compliance tool. It is a shift in how QRMP taxpayers engage with their purchase data. With the new system in place, businesses need to no longer manually match the purchase invoices in their books with the auto-generated GSTR-2B to claim ITC. The new system will also eliminate the need to pass reversal entries in the future.