Persons whose turnover does not exceed Rs. 75 Lakhs (in special category) and Rs. 1.5 crores (in rest of India) have the option to register as composition dealers. Composition dealers cannot charge tax on their outward supplies and hence, persons purchasing from composition dealers cannot claim input tax credit on such inward supplies.

In the GST portal, facility has been given to search whether a supplier is composition tax payer. Let us understand the process for this:

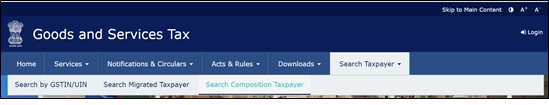

- In the GST Portal, click Search Taxpayer> Search Composition taxpayer

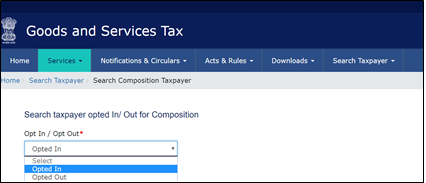

- Select whether you want to check for a person who has opted in or opted out of the composition scheme.

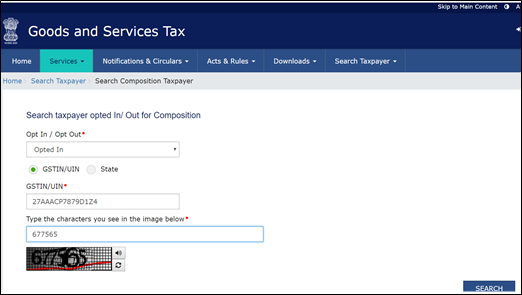

- The search can be done by the person’s GSTIN or State.

If you know the person’s GSTIN, select GSTIN/UIN and enter the person’s GSTIN. Also enter the characters shown in the CAPTCHA code and click on Search.

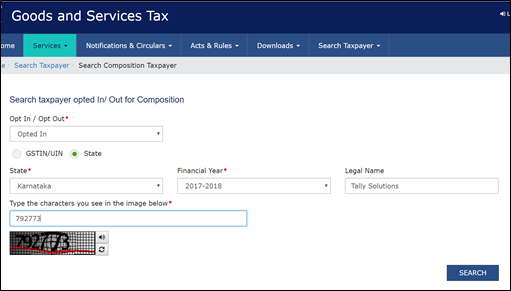

If you do not have the person’s GSTIN, you can also search by State and Legal name of the person.

For this, select the State and the financial year. Mention the Legal name of the person. Specify the characters shown in the CAPTCHA code. Click on Search.

Similarly, you can search for persons who have opted out of the composition scheme.

This is a good facility for any person to verify whether a person is a composition tax payer. This is especially useful for businesses to verify and ensure that their suppliers are not composition tax payers, as they cannot claim input tax credit on purchases from composition tax payers.