The Sahaj return is a quarterly GST return to be filed by 20th of the subsequent quarter. The businesses whose turnover in the previous financial year is up to 5 Crores and engaged in making outward supplies only to B2C i.e. end consumers or unregistered businesses can opt to file GST Sahaj return. The form to be filed by businesses opting Sahaj is Form RET-2

Though the Sahaj return in form RET-2 filing is on a quarterly basis, the payment of GST needs to be made on a monthly basis using the payment declaration form known as Form GST PMT-08. The businesses need to determine the tax liability and input tax credit on the self-assessed basis and accordingly remit it through Form GST PMT-08

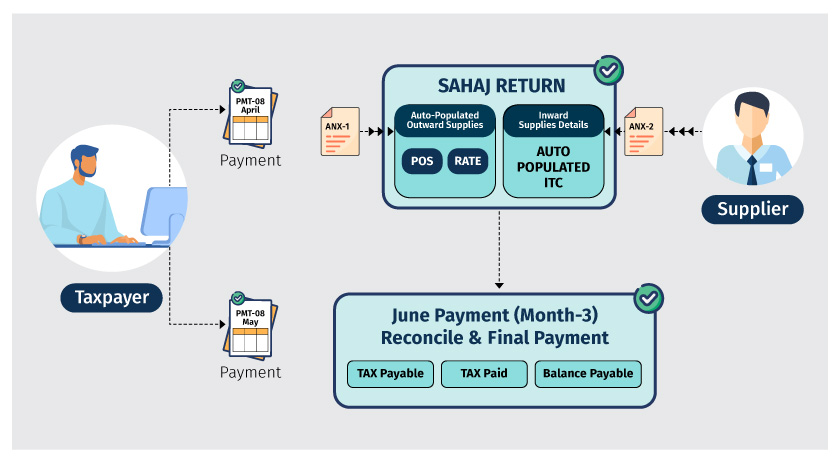

Let’s understand the complete Sahaj return filing Cycle.

How to file Sahaj return in form RET-2

The details of outward supplies in GST Sahaj form are required only at a summary level. This is because GST Sahaj is applicable only if you are making B2C supplies and your customer (the buyer) will not be in a position to claim ITC on the supplies made by you.

The GST Sahaj return filing cycle through Form RET-02 is explained with an illustration.

We have considered the April-June, 2019 to explain the GST Sahaj return filing cycle. In the above illustration:

- The taxpayer makes the self-assessed payment for the month of April 2019 and May 2019 using Payment Declaration Form GST PMT-08

- On completion of the quarter April to June 2019, GST Sahaj return needs to be filed by 20th of July 2019 with the payment of Tax

- The taxpayer needs to furnish the consolidated outward supplies details at rate-wise (5%, 12% etc.) and place of supply-wise in Form GST ANX-1. This, in turn, gets auto-populated into the Sahaj return Form GST RET-2

- Input Tax credit details will be auto populated in Sahaj return form RET-2

- As illustrated, as and when the invoices are uploaded by the supplier, details of ITC will be auto-captured in inward supplies annexure ‘ANX-02’ and which in turn gets auto-populated in GST Sahaj return form.

- Remember, Sahaj returns forms will not have a concept of claiming and reporting ITC on missing invoices which supplier has not uploaded. You can claim the ITC only to the extent of invoice uploaded by the supplier

- Once the required details are furnished in GST Sahaj return, the next step is to make payment

- The tax payment here includes:

- Tax payable for supplies made during 3rd month of the quarter

- Adjustment due to the difference in tax paid on the self-assessed basis in the first and second month versus the outward supplies’ details declared in the Sahaj return.

- Adjustment due to ITC claimed on self-assessed basis versus the auto-populated ITC available in inward supplies annexure.

- Once the tax payment is done, you can submit and file the GST Sahaj returns.

Conclusion

For businesses, the Sahaj return filing cycle is very simple. All you have to do is the self-assessed monthly payment and mention the consolidated details of outward supplies in annexure -1. The rest of the details are auto-populated in Sahaj return. The businesses can leverage on simplification only when they carefully assess their businesses profile and choose the one which is suitable.