Knowing about GST and implementing it for your business to be compliant are two different stories. If not understood properly, GST compliance becomes difficult. However, with GSTR-3B, businesses get an opportunity to file a summarised return while detailing their regular sales, ITC claims, tax liabilities, etc. This provision makes businesses file a much simplified return, by declaring the summary of their inward and outward supplies for July and August. However, the invoice-wise details in Form GSTR-1, are required to be filed either quarterly or monthly.

In this blog, let us understand how to fill Form GSTR-3B.

If you are using TallyPrime, you can skip the rest of this blog post. Our new release to supporting Form GSTR-3B is available now - Download.

Form GSTR-3B consists of 6 Tables. You need to capture the consolidated details of outward supplies, inward supplies, eligible ITC, and the details of tax payment. Let us discuss this in detail:

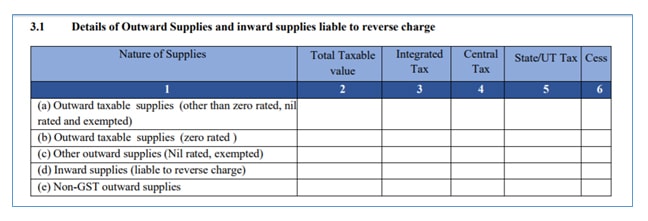

Details of outward supplies and inward supplies liable to reverse charge

In the above table (3.1), you need to capture the total taxable value (both intrastate and interstate) of the following Nature of Supplies along with the total tax (IGST, CGST, SGST/UTGST) as applicable:

- Outward Taxable Supplies other Zero Rate, Nil Rate and Exempted

- Outward Taxable Supplies (Zero Rated)

- Outward Supplies towards Nil Rated and Exempted

- Inward Supplies liable to be paid on reverse charge basis

- Non-GST Outward Supplies

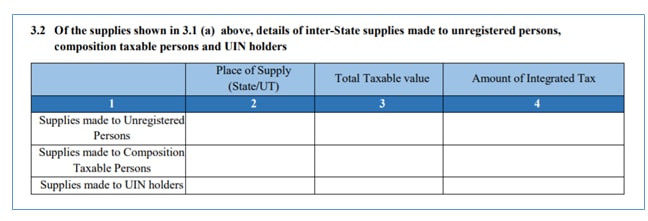

Details of inter-State supplies made to unregistered persons, composition dealer and UIN holders

From the outward supplies details declared in table 3.1, discussed in point No. 1, you need give a break-up of the interstate outward supplies made to Unregistered Persons, Composition Dealers and UIN Holders. These details needs to be captured State-wise/ Union-Territory-wise total with taxable value and total IGST levied on these supplies.

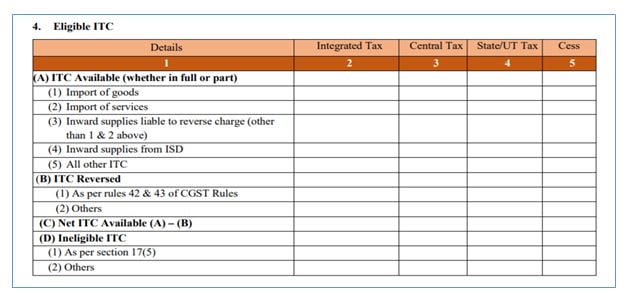

Details of eligible Input Tax Credit

In the above table, you need to capture the details of ITC availability, ITC to be reversed, and arrive at the Net ITC available. The following are the details you need to capture:

- ITC Available (Whether in Full or Part)

You need to give the break-up of inward supplies on which the ITC was availed. The following are the details you need to capture:- Import of Goods: Tax credit of IGST paid on import of goods.

- Import of Service: Tax credit of IGST paid on import of services.

- Inward supplies liable to reverse charge: You need to capture the ITC of GST paid on inward supplies liable for reverse charge such as, sponsorship services, purchase from URD, and so on, other than import of goods or services. To know more, read inward supplies liable to reverse charge

- Inward Supplies from ISD: Input tax credit received from Input Service Distributor (ISD). Read our blog post on ISD for more details.

- All other ITC: Apart from above, ITC of other inward supplies has to be captured here.

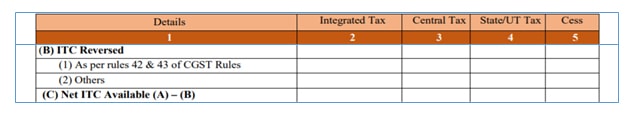

- Details of Input Tax credit to be reversed: Under this table, you need to capture the ITC reversible on usage of inputs/input services/capital goods used for non-business purpose, or partly used for exempt supplies. Also, if the depreciation is claimed on tax component of capital goods, and plant & machinery, then the ITC will not be allowed. Such reversal needs to be captured in this table. To know more, read ITC on inputs/input services used for non-business purpose or exempt supplies

The ITC available as reported in Table 4(a) needs to be reduced by the amount of ITC to be revered as reported in above table. The balance will be your eligible ITC.

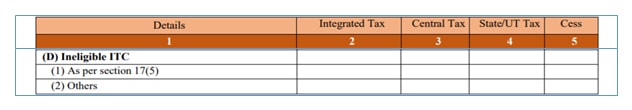

- Details of Ineligible ITC: GST paid on inward supplies listed in negative list will not be eligible as input tax credit. The details of GST paid on such supplies needs to be recorded in this table. To know more, see the list of supplies ineligible for ITC.

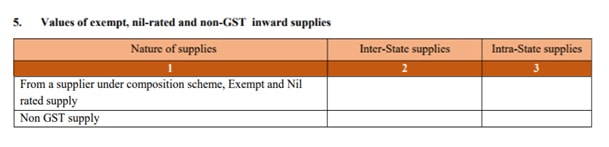

Details of exempt, nil-rated and non-GST inward supplies

You need to capture the details of inward supplies made from the composition dealer, inward supplies at nil rate and exempt. Also, you need to separately mention Non-GST inward supplies. The value of above discussed supplies need to be captured separately for interstate and intrastate supplies.

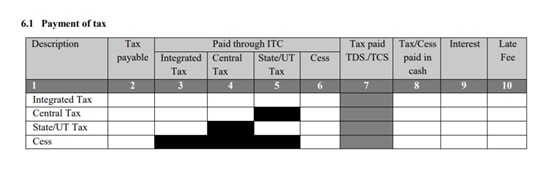

Payment of tax

In the above table (6.1), you need to declare the self-ascertained tax payable. This is based on the details of outward supplies and inwards supplies liable to be paid on reverse charge captured in Table No. 3.1. The tax-wise break-up of payment tax by way of utilization of ITC and cash deposit needs to be provided.

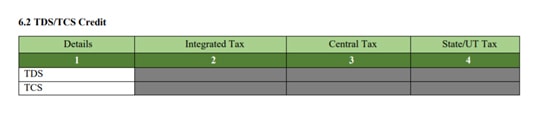

TDS/TCS Credit

In the above table, you need to capture the details of TDS (Tax withheld by the Government establishment) and TCS (Tax withheld by E-commerce operator). However, these provisions are deferred from initial rollout of GST. Accordingly, TDS and TCS is not applicable till it is notified further.

Note: The Value of Taxable Supplies refers to Net Taxable value and formula to calculate is given below:

Taxable value = Value of invoices + value of Debit Notes – value of credit notes + value of advances received for which invoices have not been issued in the same month – value of advances adjusted against invoices.

Step-by-step filing process

The filing of GSTR-3B involves a series of steps to be followed. Let us have a look at them below:

Step 1 – Login to the GST Portal. On the homepage, the last five tax periods can be found..

Step 2 – Click on ‘Services’ > ‘Returns’ > ‘Returns Dashboard’.

Step 3 – The ‘File Returns’ page opens.

Select from the drop-down list ‘Financial Year’, ‘Quarter’ & ‘Return Filing Period -Month or Quarter.’ Click the ‘SEARCH’ button.

Step 4 – On the ‘Monthly Return GSTR-3B’ tile, click ‘PREPARE ONLINE.’

The due date for filing the returns is displayed.

Step 5 - A list of questions needs to be answered as ‘Yes/No’ and click ‘NEXT’.

If filing a ‘Nil’ return, it is a ‘yes’ against the first question. Then go directly to Step 10.

Step 6 – The values, as applicable, are entered in each tile displayed. Enter the totals under each head. Also, if applicable, fill in interest and late fees.

- Summary details of outward supplies and inward supplies

- Details of supplies interstate to unregistered persons, UIN holders and taxes, and composition of taxable persons.

- Summarised details of input tax credits claimed and reversed and ineligible input tax credits.

- Summarised details of inward supplies - Nil, exempt, and non-GST, intra-state or inter-state supply.

- Details of late fees and interest under each tax head.

Step 7 – Click ‘SAVE GSTR-3B’ on the page.

A message at the top of the page confirms the successful saving of data.

No changes can be made in any fields after this.

Step 8 – View the draft GSTR-3B return. Click ‘PREVIEW DRAFT GSTR-3B’.

Step 9 – The ‘Payment of Tax’ is enabled after the return is successfully submitted.

To pay the taxes, follow these steps:

- Click ‘Proceed to payment’.

- Declared tax liabilities in the return and the credits are updated in the ledgers. These are reflected in the ‘Tax payable’ column in the payment section.

- The ‘CHECK BALANCE’ helps view the balance of credit and cash.

- Enter the credit amount available from the credit to pay off the liabilities.

- Click ‘OFFSET LIABILITY’. Click the ‘OK’ button once the confirmation message is received.

Step 10: Check the boxes for the declaration. Then, select the authorised signatory from the ‘Authorised Signatory’ drop-down list.

Click the ‘FILE GSTR-3B WITH DSC’ or ‘FILE GSTR-3B WITH EVC’ button.

Step 11 – Click ‘PROCEED’.

After the filing is successful, a message is displayed. Click ‘OK’.

Due dates and penalties

GSTR-3B filing comes with certain due dates that businesses must stick to. Failing to follow these dates can lead to huge penalties. Let us have a look at the curated list of due dates followed by penalty details.

GSTR-3B due dates

|

Turnover |

Filing Frequency |

State Category |

Due Date |

|

Above ₹5 crore (Annual) |

Monthly |

All States/UTs |

20th of next month |

|

Up to ₹5 crore (QRMP Scheme) |

Quarterly |

Category A* States |

22nd of month after quarter |

|

Up to ₹5 crore (QRMP Scheme) |

Quarterly |

Category B* States |

24th of month after quarter |

*Category A states include Chhattisgarh, MP, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, and others.

*Category B: Remaining states and union territories.

Recent updates or changes

The latest updates in GSTR-3B announced in 2025 are listed below:

11th April 2025

- The advisory stated reporting values in Table 3.2 of GSTR-3B.

- As per the advisory, from April 2025, Table 3.2 values applicable for inter-state supplies cannot be edited for supplies to UIN holders, unregistered persons, and composition taxpayers.

- To change the incorrect values, taxpayers will need to use Form GSTR-1A or Form GSTR-1/IFF. The amendments must be made on these forms and filed in the upcoming tax periods.

10th January 2025

- As per the CGST notifications 01/2025 and 02.2025, the due dates for filing GSTR-3B and GSTR-1 for December 2024 were extended by two days.

Conclusion

Timely filing of GSTR-3B is of utmost importance. You also need to ensure data accuracy. This is the best way to avoid penalties and ensure smooth business operations. Common filing errors attract legal issues and affect vendor relationships and ITC claims.

Tally Solutions makes compliance easy with automated tax calculations and drives accuracy with real-time validations and seamless data management for GSTR-1, GSTR-3B, and GSTR-7. Integrate Tally with your financial systems for a hassle-free and efficient GST filing experience so that you can grow your business with confidence.

FAQ

How can I file GSTR-3B on the GST portal?

First, log in to gst.gov.in. Then navigate to Returns and open GSTR-3B. Fill in the required details, pay the tax if applicable, and submit using DSC/EVC.

What is the due date for GSTR-3B filing?

If you file the return monthly, the due date for GTSR-3B is the 20th of the following month. QRMP scheme filers should submit the return quarterly by the 22nd or 24th, depending on their state.

Are there any penalties for late filing of GSTR-3B?

Yes, a late fee of ₹50 per day is applicable for taxable returns and ₹20 for nil returns. Additionally, you need to pay 18% annual interest on unpaid tax.

What details are required to fill out the GSTR-3B form?

The GSTR-3 B Form requires summary details of items like outward supplies, inward supplies, input tax credit (ITC) claimed, tax payable, and tax paid during the period.

Can I revise my GSTR-3B after submission?

No, once filed, GSTR-3B cannot be revised. Errors, though, can be corrected in the subsequent month's return.

What are the recent updates to GSTR-3B filing rules?

Recent updates include - tighter ITC claim rules, auto-drafted ITC data from GSTR-2B, and system validations to match GSTR-1 and 3B figures.