In this blog, we will discuss about supply of goods or services between related and distinct persons without consideration.

Related person

The definition of “Related Person” is similar to the current Customs Valuation Rules. The supply is considered as between related persons only if the supply of goods or services is made between:

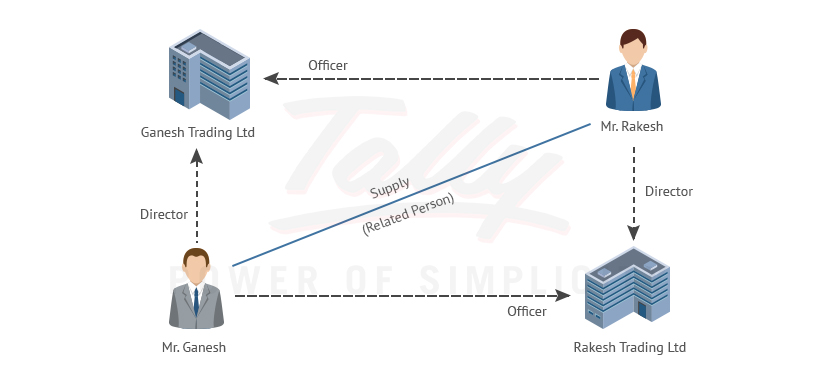

- Officers or directors of one another's businesses: In a supply, the supplier and the recipient are actually officers or directors of the other business.

As illustrated above, Mr. Ganesh is a Director in Ganesh Trading Ltd, and an officer in Rakesh Trading Ltd. Mr. Rakesh, is a Director in Rakesh Trading Ltd. Also, Rakesh is an officer in Ganesh Trading Ltd. Therefore, any supply between them, will be treated as supply between related persons.

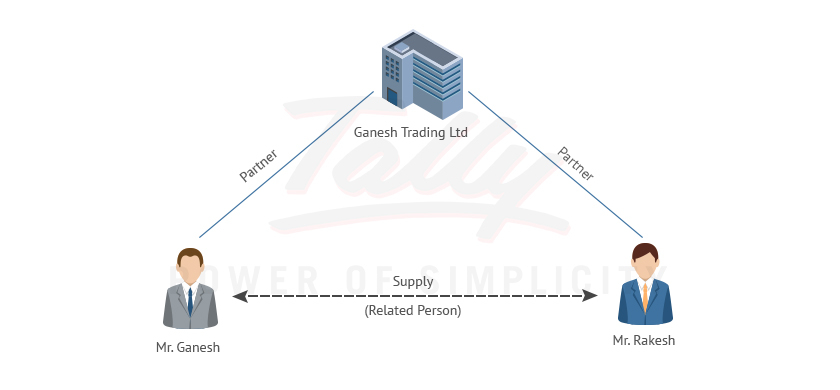

- Legally recognized partners in business: The supplier and the recipient are partners in the same business or associated business.

As illustrated above, Mr. Ganesh and Mr. Rakesh are partners in Ganesh Trading Ltd. Any supply between Mr. Ganesh and Mr. Rakesh will be treated as supply between related persons.

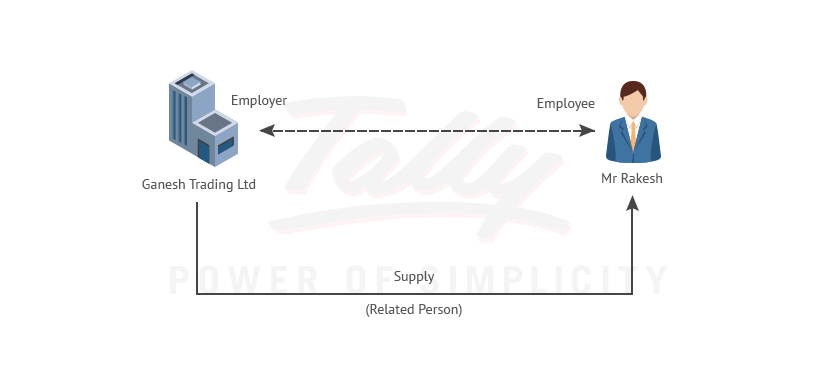

- Employer and employee: Any supply of goods and services between employer and employee.

Mr. Rakesh is an employee of Ganesh Trading Ltd. Any supply from Ganesh Trading Ltd to Mr. Rakesh is considered as supply between related persons.

- The supplier or recipient directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares.

For example, the recipient hold 25% of equity in the supplier’s business.

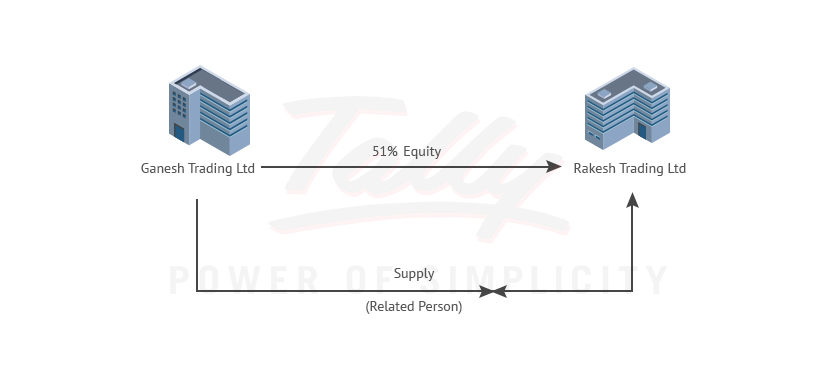

- One of them directly or indirectly controls the other: If in any supply, the supplier or the recipient directly or indirectly controls the other, then it is considered as supply between related persons.

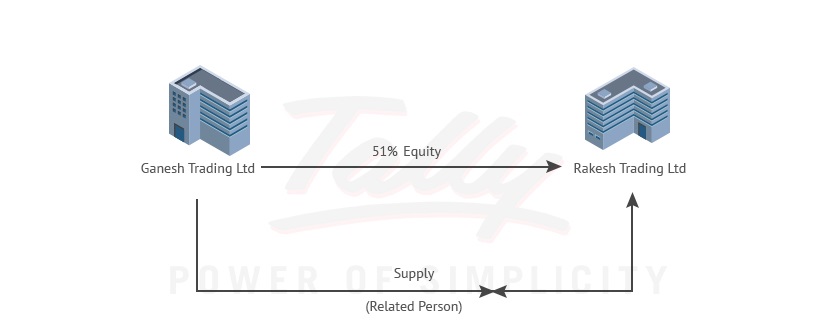

Direct Control

As illustrated above, Ganesh Trading Ltd holds equity in Rakesh Trading Ltd. The supply between Ganesh Trading and Rakesh Trading are related since Ganesh Trading Ltd directly controls Rakesh Trading Ltd.’s business.

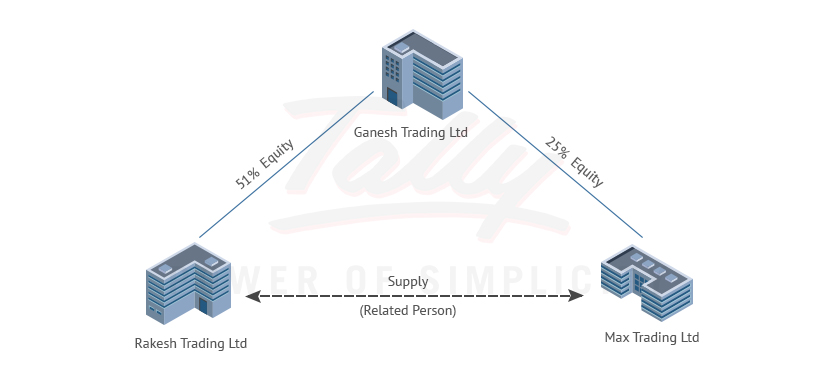

Indirect Control

As illustrated above, Ganesh Trading Ltd holds equity in Rakesh Trading Ltd . Rakesh Trading Ltd. holds equity in Max Trading Ltd. Any supply between Ganesh Trading Ltd and Max Trading Ltd. are related. This is because Ganesh Trading Ltd. indirectly controls Max Trading’s Ltd business by way of ‘Rakesh Trading’s’ business interest in Max Trading Ltd.

- Both of them are directly or indirectly controlled by a third person: If in any supply, the supplier and the recipient are directly or indirectly controlled by a third person.

In the illustration above, Ganesh Trading Ltd holds equity in Rakesh Trading ltd and Max Trading. The supply between Rakesh Trading Ltd and Max Trading ltd are related since both of them are directly controlled by Ganesh Trading Ltd.

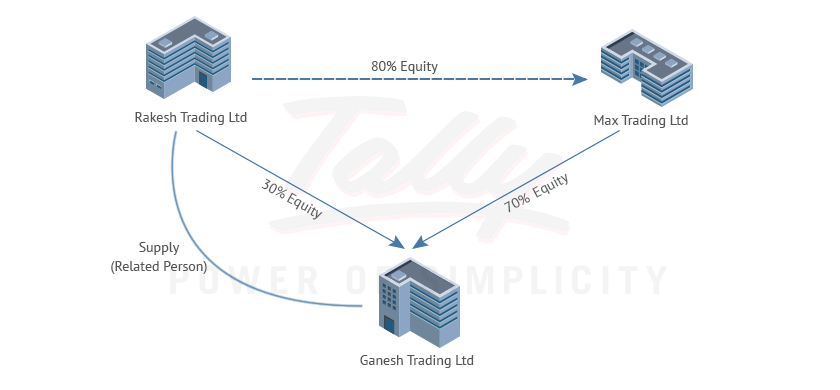

- Together they directly or indirectly control a third person: If in any supply, the supplier and the recipient, together, directly or indirectly control a third person.

As illustrated above, Rakesh Trading Ltd holds 80% equity in Max Trading Ltd and 30% in Ganesh Trading Ltd.

Max Trading Ltd’ hold 70 %equity in Ganesh Trading Ltd . Now, together, Rakesh Trading Ltd has control over Ganesh Trading Ltd and the supply between them will be considered as supply between related persons.

- They are members of the same family: A supply made between the members of the same family is considered as supply between related persons.

Distinct Person

A Distinct Person can be defined as a taxable person who has obtained or is required to obtain more than one registration in the same state or a different state. Or an establishment of a person who has obtained or is required to obtain a registration, and also has the establishment in another state.

Each of his/her registration and establishment will be treated as a Distinct Person, and any supply between them will be taxable.

Therefore, any stock transfer or branch transfers are taxable in the following two cases:

- Intrastate stock transfer: Only when an entity has more than one registration in one state.

Example: Super Cars Ltd is a car manufacturing unit located in Karnataka. They also own a service unit in Karnataka. Super Cars Ltd have obtained separate registrations for both the manufacturing and service units.

The manufacturing unit and the service unit of Super Cars Ltd will be treated as distinct persons, and any supply between them will be taxable, even without consideration.

- Inter-State Stock transfer: Transfer between two entities located in different states is taxable.

Example: Super Cars Ltd is a car manufacturing unit located in Karnataka. They also own a service unit in Delhi.

The manufacturing unit and the service unit of Super Cars Ltd located in Delhi will be treated as distinct persons, and any supply between them will be taxable, even without consideration.