- Introduction

- About GST Complaint Portal

- Advantages of GST Complaint Portal

- Address to GST Complaint Portal/Greivance Redressal Portal and Basic Design

- Quick Guide to Lodge a Complaint / Issue on GST Complaint Portal / Greivance Redressal Portal

- GST Complaint Mail Id and GST Complaint Number

Introduction

GST being a new architectural structure there are possibilities that tax payers tend to have complaints with the new habitat of changed taxation environment. And the council considered this aspect and introduced a GST complaint/ grievance redressal portal wherein taxpayers or complainee shall have answers to his questions under GST.

About GST Complaint Portal

The design of the portal is for lodging complaints by taxpayers and other stakeholders. Both taxpayers and stakeholders can lodge Complaint here indicating issues or problems faced by them while working on GST portal instead of sending emails to the Helpdesk.

It has been designed in a manner that the user can explain issues faced and upload screenshots of pages where they faced the problem, for quick redressal of grievances.

Advantages of GST Complaint Portal

- Enable the user to lodge his complaint and raise tickets himself.

- To provide all required information and reducing to and fro communication between helpdesk and the tax payers, helping to reach a faster resolution.

- Enable the tax payer to check the progress of resolution of his complaint by using the ticket number (acknowledgement number generated after a complaint is lodged).

- Check the resolution comments in case the complaint/ticket is closed.

- Based on selection of category/ subject and sub category, portal provides relevant FAQ/ pages of User manual to help the user resolve the problem faced by him.

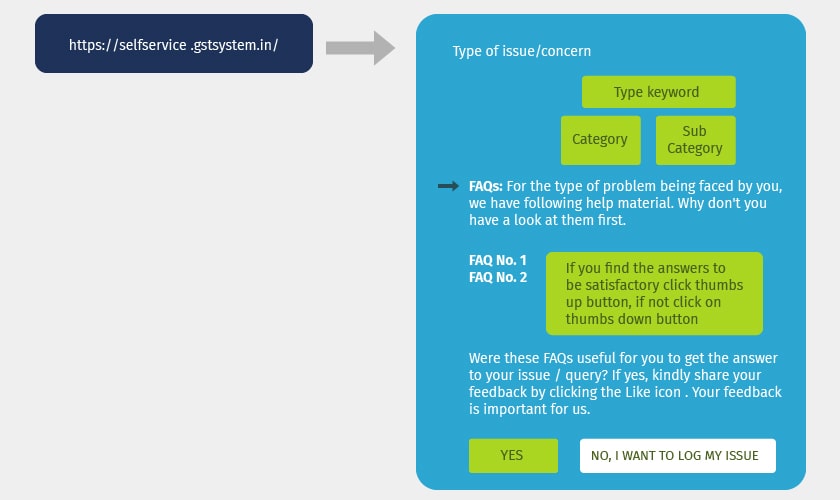

Address to GST Complaint Portal/Greivance Redressal Portal and Basic Design

Quick Guide to Lodge a Complaint / Issue on GST Complaint Portal / Greivance Redressal Portal

|

Step 1 : |

Enter the keyword related to issue / complain being faced by you in the "Type of Issue/Concern" box. The system will search and show the list of all the issue with the entered keyword from which you can select the exact issue, after which the system will show the FAQ.s and relevant sections of User Manual related to that issue / complain. |

|

Step 2 : |

Go through the FAQ shown which may solve the problem faced by you. |

|

Step 3 : |

This step is cared when no match is found with the keyword entered by you. Then in all such cases, you can select the most relevant Category and Sub category from the dropdown boxes next to the box, "Type of Issue". |

|

Step 4 : |

This is when we move to lodging of complaint in GST when we don’t find answers to our solutions in these three steps : When FAQ.s do not help resolve the issue, then please select the button "No, I want to lodge my complaint" which will show the page to fill in the details to lodge the complaint. |

|

Step 5 : |

Obtain the ticket reference number of the complaint made by you which will be generated by the system after you lodge your complaint. This ticket reference number will be helpful in future date to track down the application status of the complaint lodged. |

GST Complaint Mail Id and GST Complaint Number

- The GST complaint email id of helpdesk@gst.gov.in has been discontinued after the introduction of selfservice.gstsystem.in

- The GST complaint number for raising queries is 1800 1200 232 (Note : It is a toll free number)