Does your current process of matching purchase records with GSTR-2B feel like an uphill task? For many businesses, it takes days of reconciling entries manually and chasing vendors for clarifications, only to end up with mismatches and delays. It’s a time-consuming, error-prone grind that eats into productivity. If there are mismatches

But that long-winding road gets a smart shortcut when an Invoice Management System (IMS) steps in. This isn’t just an upgrade, it’s a smarter, faster, and more accurate way to manage your GST compliance workflows from start to finish.

How does IMS make GSTR-2B reconciliation different?

IMS makes the process of Input tax credit (ITC) a cakewalk by giving you the entire list of invoices uploaded by your suppliers in a single place, the IMS portal. The best part is that IMS comes with a range of options that helps you review and act in a timely manner to safeguard your ITC. The IMS provides three action options on the portal: Accept, Reject, and Pending. Using these options, you can either accept or reject invoices. The invoices that you need further clarity on can be marked pending so you can come back to it later to accept or reject them.

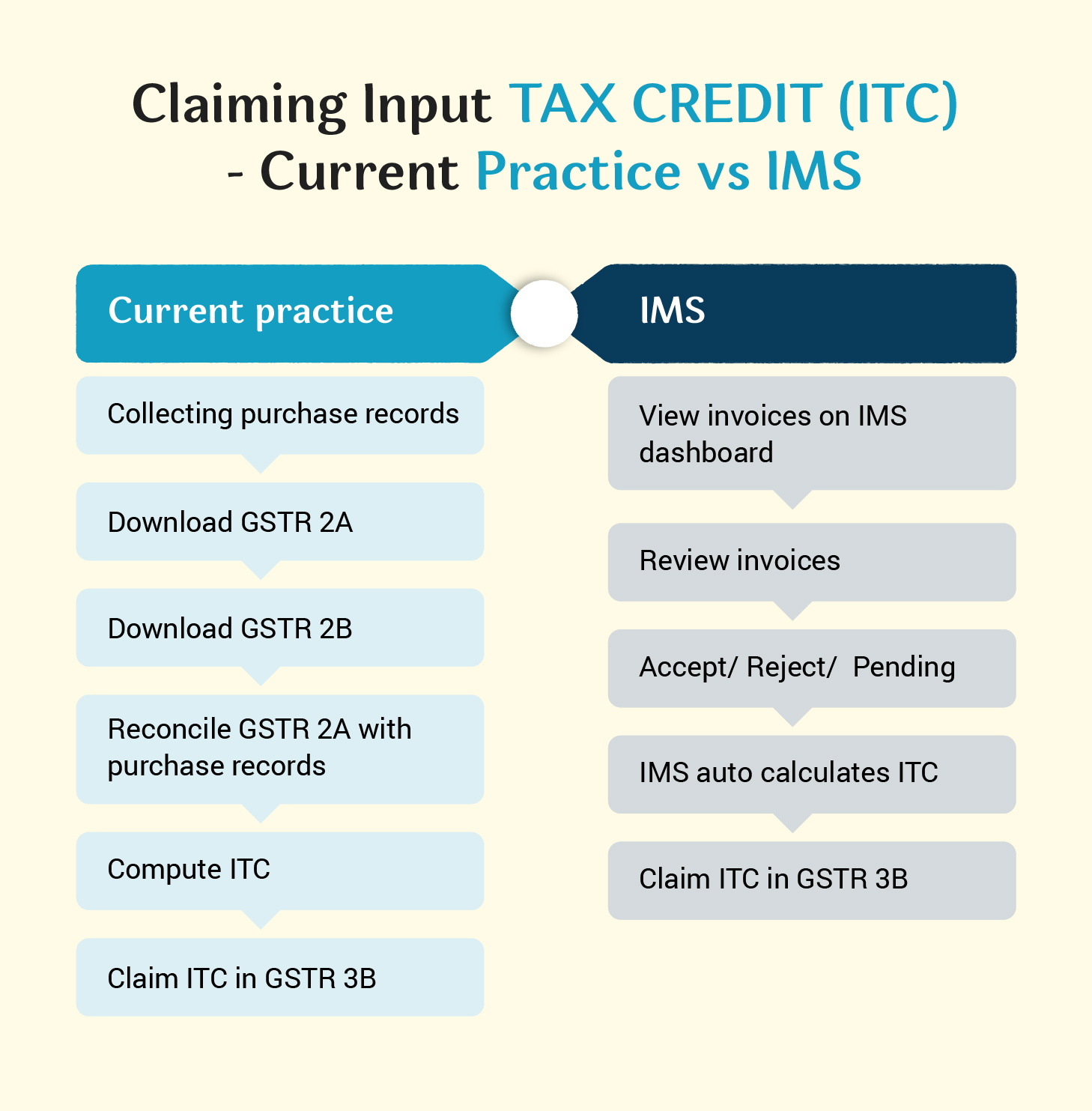

While IMS is designed to simplify the invoice management process of ITC and return filing, to help understand this in deeper, we will walk you through the current practice of availing ITC, process to be followed in IMS and then the change.

Current Practice vs IMS for ITC

Current practice

Let’s start with the current practice. The current practice strongly depends on the GSTR 2B for ITC calculation. Let us have a look at the current process that IMS seeks to replace:

Step 1: Download GSTR-2A/2B

Once suppliers file GSTR-1 or upload invoices using IFF (Invoice Furnishing Facility), invoices start reflecting in the taxpayer’s GSTR-2A. On the 14th of every month, the system generates GSTR-2B — a static summary of available ITC.

|

IMS Guide This all-in-one guide covers everything you need to know about IMS. Download now to get started. |

TallyPrime IMS hands-on experience Try this interactive demo to see how TallyPrime IMS helps you monitor vendor sales in real time and simplify ITC and GST compliance. |

Step 2: Reconcile GSTR-2A with purchase register

The buyer compares every invoice between the purchase register and GSTR-2B to ensure nothing is missing. In the case of invoices that are wrongly uploaded or need to be kept pending for ITC claim, the buyer should record a reversal entry to claim the right ITC.

Step 3: Claim ITC in GSTR-3B

Based on the matching invoices and reversal entries, buyers will claim eligible ITC in line with the guidelines.

IMS Process of Claiming ITC

IMS seeks to ease the above process through the following process:

ITC handling: Before and after using IMS

Here are few scenarios to help to understand new practice with IMS in GST.

|

Scenario |

Current Practice (without IMS) |

New practice (with IMS) |

|

Supplier uploads sales but ITC is ineligible |

Such ITC gets auto-populated from GSTR-2B to GSTR-3B and needs to be reversed. Since in book these are entered as expenses, this is additional adjustment entry for reversal, only for return filing/ portal purpose |

Reject such invoice in IMS and such invoices will not get auto-populated in GSTR-2B/GSTR-3B. Therefore, no requirement to pass a reversal entry for return filing purpose. |

|

Receive a purchase in GSTR-2B that does not belong to me (wrongly updated by supplier against my GSTIN) |

Such ITC gets auto-populated from GSTR-2B to GSTR-3B. You need to record an adjustment entry to reverse such auto-populated ITC. |

Reject such invoice in IMS, therefore these will not get auto-populated in GSTR-2B/GSTR-3B. Thus, elimination the need of recording reversal entry in books. |

|

Receive a purchase in GSTR-2B but it is mismatching with books Ex: Books has Rs 1000 ITC but supplier uploaded as Rs 500 tax |

Inform supplier (offline) to correct and re-upload invoice in subsequent period as amendment. Reverse the auto-populated ITC of Rs 500 and claim it subsequently when supplier amends it to 1000. |

Mark such invoice as ‘Pending’ in IMS. Such invoices will not auto-populate in 2B/3B and no requirement to reverse. ‘Accept’ subsequently when supplier corrects it. |

|

Supplier issues a wrong credit note (Sales return) and reduces his liability. |

This is auto populated in 2B and 3B (as purchase return), thus reducing my ITC with no recourse. |

Mark such Credit notes as ‘Rejected’ in IMS, no risk to ITC. |

|

Supplier uploaded sales, but purchase not entered in books (Ex: Goods not yet received) |

Such ITC gets auto-populated from GSTR-2B to GSTR-3B. Record reversal entry to reverse such auto-populated ITC. Subsequently when such purchases are entered in books, claim such ITC which was reversed earlier. |

Mark such invoice as ‘Pending’ in IMS. Such invoices will not auto-populate in 2B/3B and no requirement to reverse. ‘Accept’ subsequently when supplier corrects it. |

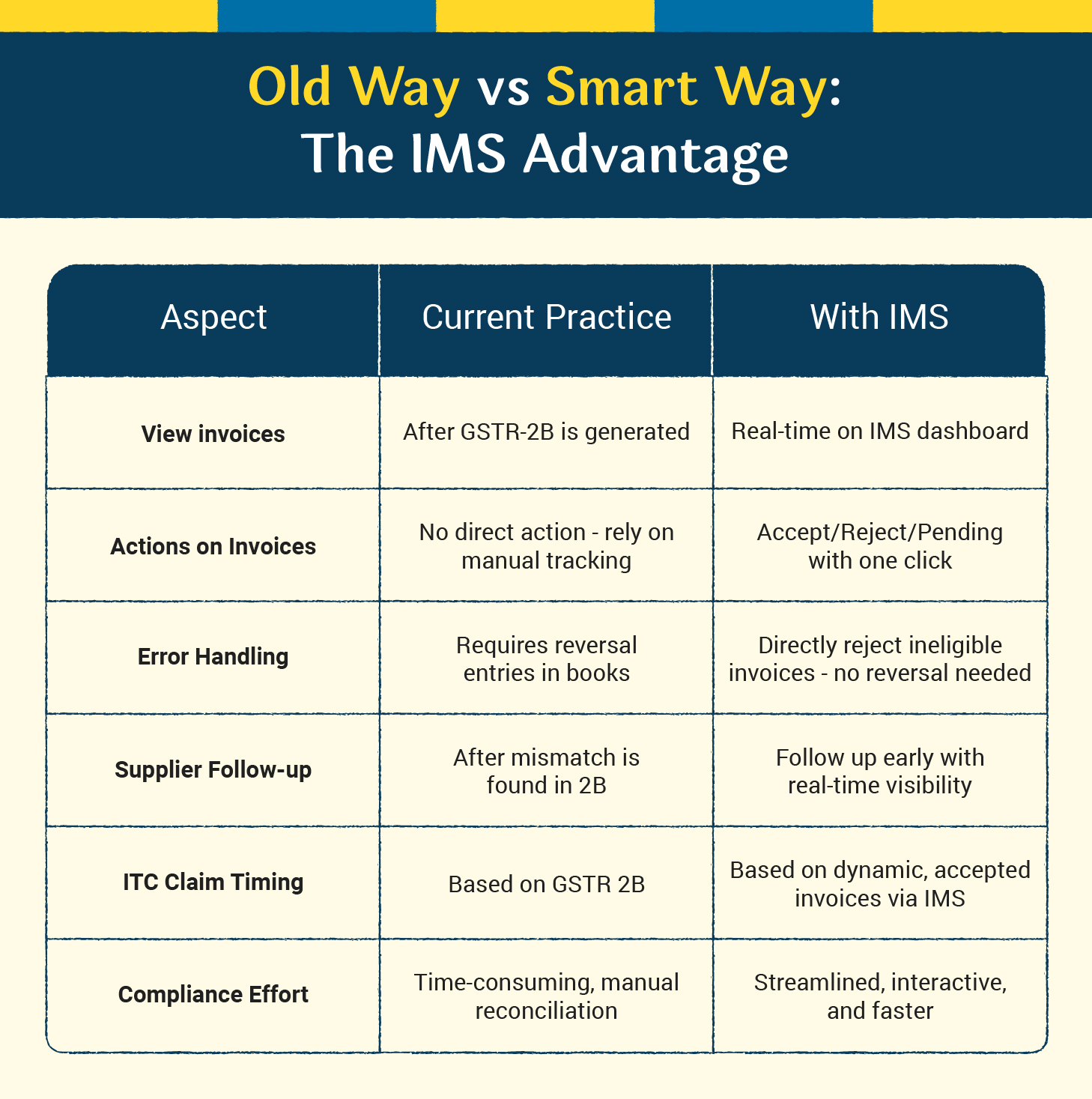

What will change with IMS?

The actions available for buyers in IMS portal will largely benefit the practice of accounting reversals. Today, all purchases are shown both in 2B and 3B and the buyer is expected to reverse credits for which he is not eligible. For example, staff welfare expenses, non-business expenses, wrong invoices etc, are not eligible for ITC.

In IMS, buyers have flexibility to ‘Reject’ invoices which are wrongly assigned or are not eligible for ITC, thereby eliminating the additional step of ITC reversal in GSTR-3B. Additionally, since IMS provide real-time visibility, it helps buyers to determine discrepancies early and the potential ITC at Risk. This enables the buyer’s follow-up with suppliers in a timely manner.