- Configuring Party Ledger

- A highlight of Exceptions and Errors

In this episode, we will be a discussion on the important aspect of configuring Party Masters in Tally and key fields to be filled properly to ensure the reports are automatically auto-populated in the respective table of GSTR – 1 and GSTR – 3B.

Configuring Sundry Debtors and Sundry Creditors Ledgers with relevant fields filled in will save lot of time in compiling data for GST Return table-wise information, based on the relevant configuration the values will be automatically taken to respective tables.

Configuring Party Ledger

Note: The party ledger will be applicable for both Sundry Debtors and Sundry Creditors ledgers.

Steps to configure in Tally

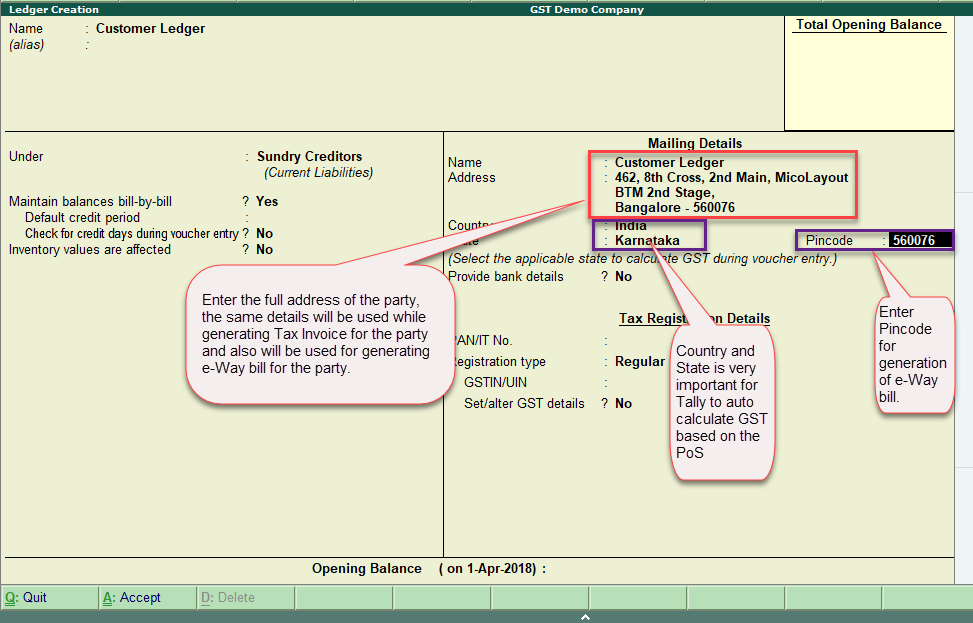

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name of the customer or supplier ledger

- Mailing Details -> enter the address of the party, the same information will be auto populated during the generation of Tax Invoice and e-way bill generation.

- Country -> Select -> India (In case if the country selected other than India, Tally will automatically not calculate GST

- State -> the list of all States of India will be listed for India. Here, for example, if you are selecting ‘Karnataka’ and your location of the company is ‘Karnataka’. Then Tally will automatically determine the ‘Place of Supply’ as ‘Intra-State’ and will only compute tax of CGST and SGST.

- Pincode -> by entering the pincode here, an e-way bill can be generated without any error, as pincode is mandatory for a valid JSON file, for generating an e-way bill.

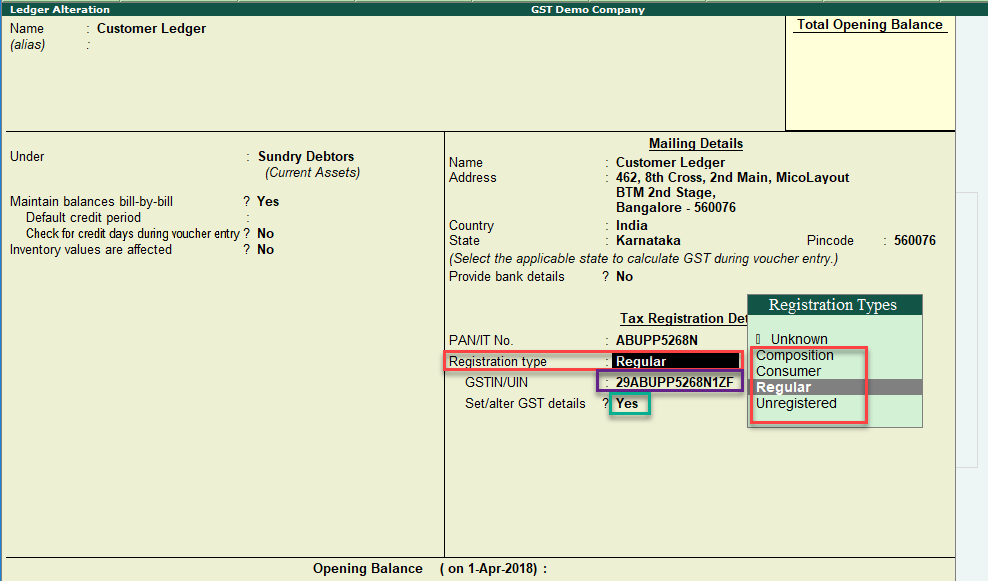

- Tax Registration Details: Under the registration Type any of the following entity can be selected. The impact in the return table is as follows based on the ‘Registration Types selected for a party:

- Regular: The party who is a GST registered dealer(regular), based on the place of supply the values of transactions of ledgers with ‘Regular’ registration type will be reported in Table - 4A,4B,4C,6B,6C of GSTR – 1.

- Composition: The party who is a GST registered dealer(composition), based on the place of supply the values of transactions of ledgers with ‘Composition’ registration type will be reported in Table - 4A,4B,4C,6B,6C of GSTR – 1.

- Consumer / Unregistered: Ledgers marked as either ‘Consumer’ or ‘Unregistered’ the values of transactions of ledgers will be reported in Table - 5A,5B for invoice value less than Rs.2.50 Lakhs and in Table – 7 for the transaction of invoice value exceeding Rs.2.50 Lakhs

- GSTIN/UIN -> Enter the GSTIN of registered party ledger Regular or Composition. Tally validates the 15 digits of GSTIN based on the State selected for the party. For example, if the State selected is ‘Karnataka’ – then the first 2 digits of the State code will be validated for ‘29’, if it is not ‘29’, Tally will prompt a warning as the wrong state code. Tally also validates the GSTIN with checksum for genuine GSTIN.

- Set/alter GST details -> Enable this option for further advance configuration of party ledger

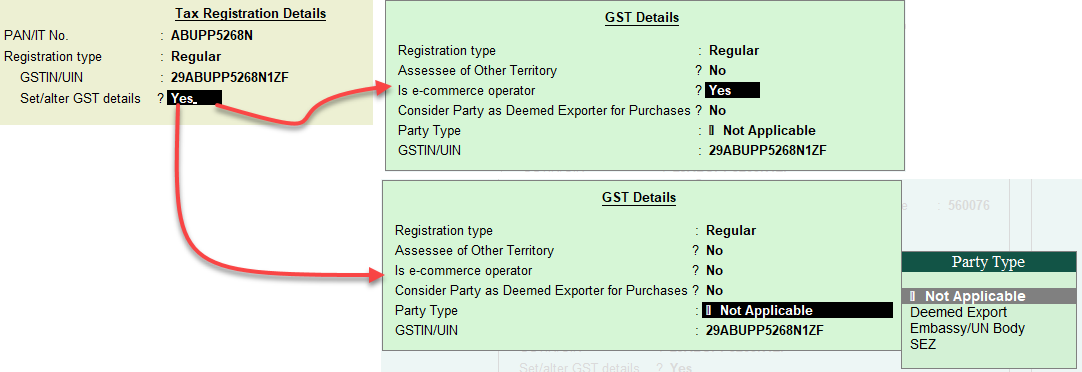

- Is e-commerce operator: If the option is set to ‘Yes’ – firstly, it identifies the party as an e-commerce operator and the values of the transactions of these ledgers will be reported in 4C& 5B of GSTR-1.

- In the sub screen of Party Type -> selecting the appropriate party type will report in the respective tables of GSTR1:

- Deemed Exports - 6C

- Embassy/UN Body – 4A

- SEZ – 6B

Highlight of Exceptions and Errors

- Country set as None: If the country is set as none, while passing the transaction (sales or purchase) voucher for the party and when GST ledger is selected, Tally will not auto compute tax and the tax amount will be blank. The reason being, Tally is not able to determine the place of supply and hence tax is not computed. (Note: In any transaction, if Tally is not calculating tax, it means there is an error in the master set-up of GST information as required)

- GSTIN of Party is blank or Wrong: In the party master if the GSTIN entered is wrong or blank, Tally will compute the tax and the voucher can be saved without any problem, but the transaction will be listed in the Return summary of the relevant form under “Incomplete/Mismatch in information (to be resolved)” and the value of this party will not be listed in the respective table unless the requisite information is provided.

- Party Ledger location is the same as the location of the supplier but marked as ‘SEZ’ in ‘Party Type’: Even though the recipient of the supply is in the same State of the supplier, the recipient is marked as ‘SEZ’ customer. Tally will calculate tax only if ‘IGST’ ledger is selected. If you select ‘CGST’ or ‘SGST’ ledger Tally will not auto compute the tax.

Configuring the party ledgers with the right information in the relevant field, Tally will take care of proper compliance of the law like determining ‘Place of Supply’, apply right GST type and also auto populate the values of the relevant party ledgers in the respective table in Form GSTR – 1 and GSRT – 3B.

In the next series, we will understand the creation and managing of GST ledgers and how you can avoid the creation of multiple tax ledgers. Also, we will understand how to avoid exception and errors in GST ledgers configuration.