- Use case Scenario-1

- Configuring GST for Expenses Ledger

- Use case Scenario- 2

- Enabling GST configuration for Voucher

- Master creation with GST configuration

- Transaction with Modification to Tax rate

In the last two series, we understood the process to configure GST at the company level and at Stock Group, Accounting Group, Stock Items and Accounting Ledgers, where the HSN/SAC is different from the configuration set at the company level.

In this episode, we shall learn how to configure GST details for Expenses ledgers, such that claim of ITC on indirect expenses can be auto-populated in the relevant form for the claim of Input tax credit.

We are aware that GST law allows businesses to claim ITC on all expenses subject to the condition, such expenses are “used or intended to be used in the course or furtherance of business.” (except for negative list).

Configuring GST details for expenses ledgers are simple in Tally and once they are configured properly, the GST paid on such inward supply will automatically reported as ITC claim in the relevant tables of the GST Returns.

Before we learn how to configure, we need to understand the fundamental functionality built in Tally for GST compliance. Following are the key points to consider:

- When GST is enabled for a Tally company, by default all the Revenue ledgers which will be created will be enabled for GST.

- Depending on the nature of ledger and based on the eligibility to claim ITC, the GST applicable option can be set to “Applicable” or “Not Applicable”.

Once, we understand the above fundamental, is easy to configure ledgers for GST accordingly.

Use case Scenario-1

Scenario:

Ganeshji Enterprises is a trading firm dealing in electronic goods, there are various inwards supply of goods or services, which are expenses (either direct or indirect) towards various operational and maintenance activities in the normal course of business.

In this case, there are certain inward supply expenses, where GST is levied but the taxable person does not possess ‘Tax Invoice’ or is not eligible to take credit of GST under certain circumstances, they while creating such expenses ledgers, the user should ensure that under Statutory Information – the option ‘is GST Applicable’ need to be set as ‘Not Applicable’.

Inward supplies on which ITC is claimable, while creating the ledger master ensure – the option ‘is GST Applicable’ is set to ‘Applicable’ and specify the GST details by enabling the option – ‘Set/alter GST Details’ to ‘Yes’ and provide details.

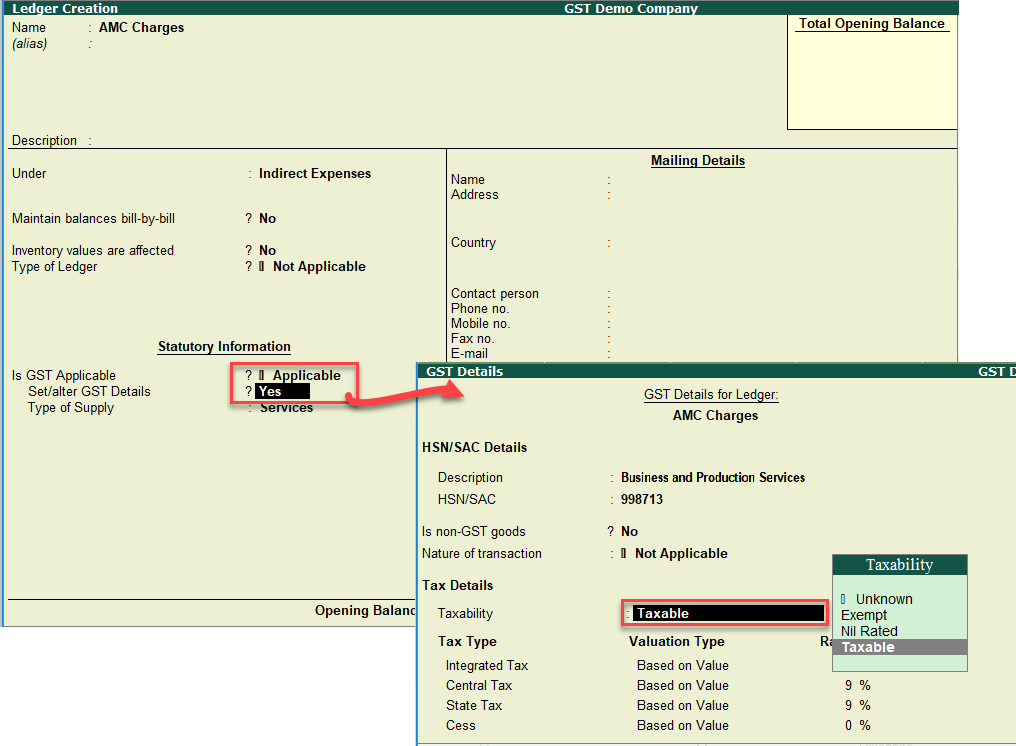

Configuring GST for expenses ledger

Steps to configure in Tally:

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name of the expense ledger

- Under -> Select the requisite Group (Direct or Indirect Expenses)

- Under Statutory Information -> Is GST Applicable – set to ‘Applicable’

- Set/alter GST Details – set to ‘Yes’

- Under the GST Details for Ledger Sub screen -> Specify the Description of Goods/Services

- HSN/SAC -> Specify the SAC

- Nature of Transactions – Set to ‘Not Applicable’ (By setting this as not applicable – you can use this ledger for both inter and intra state supplies)

- Set/alter GST Details -> set to ‘YES’ (GST details for Stock Group sub screen will open)

- Specify the description and HSN code of the products

- Under Tax Details -> Taxability -> set to ‘Taxable’

- Under Tax Details -> Taxability -> select Taxable

- Specify the rate of GST applicable

- Save the screen by pressing enter or Ctrl+A

Similarly, any ledger which has GST implication and where the taxable person can avail input credit on the supply, can be created with the above configuration.

Use case scenario - 2

Scenario: Expenses ledgers with multiple rate of GST and inward supply from within the State and Inter-State supply.

Now, let us take an example of ‘Repair & Maintenance’ expenses ledger. The company may have inward supplies pertaining to repair & maintenance, where the rate of GST could of different rate for different items procured and the inwards supply can be Inter or Intra – State supplies.

The question arises in your mind, would be, do I have to create multiple ledgers for repair & maintenance inward supply, rate wise and place of supply wise?

The hard way to do is creating individual ledgers, but to avoid multiple ledgers, just for GST compliance, in Tally you can have one single ledger and can take care of the differential rate during the voucher entry.

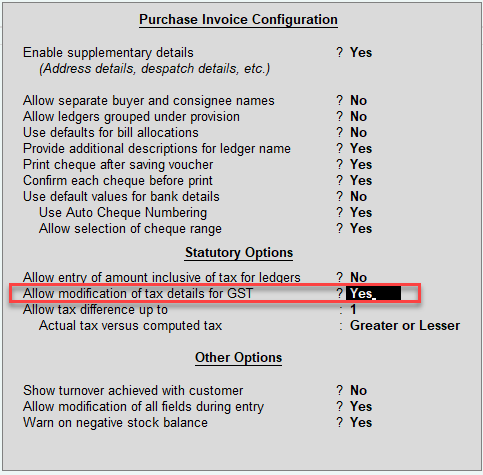

In the earlier series, we have understood the hierarchy of GST setting and its inheritance. There is one more GST feature in Tally, where we can ‘override’ the settings and modify the default master set-up during the voucher entry and the changes overridden will only impact that particular transaction. This option by default will be set to ‘No’. You need to enable this in F12 – configuration.

Enabling GST configuration for voucher

Steps to configure in Tally

- Gateway of Tally -> Accounting Voucher

- By default, the Voucher type will be ‘Payment’

- Select Purchase -> F9-Purchases or Sales -> F8-Sales

- Press -> F12 Configuration from the right-hand side button bar

- Set the option -> ‘Allow modification of tax details for GST’ – to ‘Yes’

- Save the screen by pressing enter or Ctrl+A

Once this option is set to ‘Yes’ during voucher entry – when a particular revenue ledger(s) is selected (expenses, income, purchase & sales) – the ‘Tax Classification Details’ sub screen will open, where you can provide relevant information related to GST, which will consider only for that particular voucher.

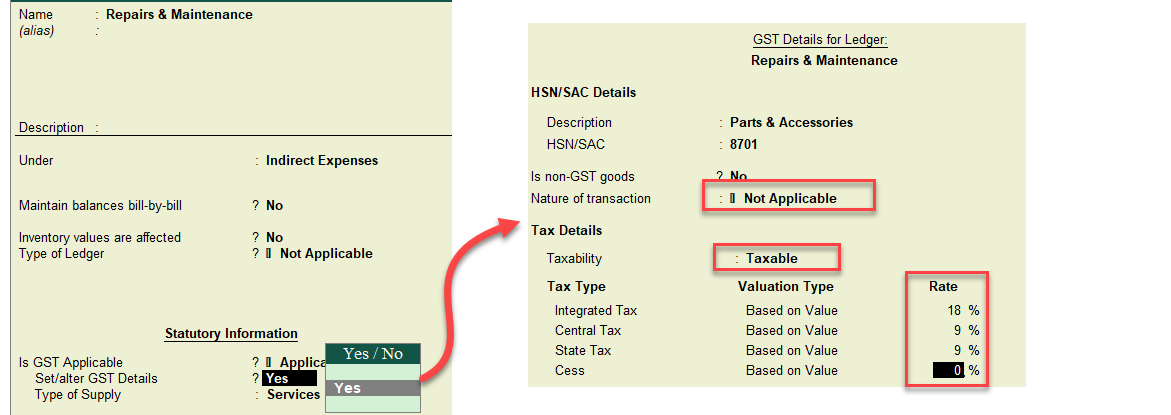

Master creation with GST configuration

Ganeshji Engineering Pvt ltd is a manufacturing company in Bangalore, they procure components & spares towards maintenance of their machinery from with the State and procure from outside the State. The rate of GST of their inward supply varies from 5% to 18% and sometimes they also procure some components from unregistered dealers.

The best way to handle this scenario in Tally is to create a single ‘Repair & Maintenance’ ledger and configure that ledger for a particular GST rate of tax which is say, 18%. Then while passing an inward supply transaction for repair & maintenance, during the voucher entry if there is any change in rate of GST can be modified in the transaction also modify details in a transaction as no GST impact.

Ledger Master Creation Screen:

(Note: By setting the option ‘Nature of Transaction’ – to ‘Not Applicable’ – Tally will automatically consider the GST type of taxes as Intra (CGST & SGST) and Inter (IGST) based on the State of the Supplier.

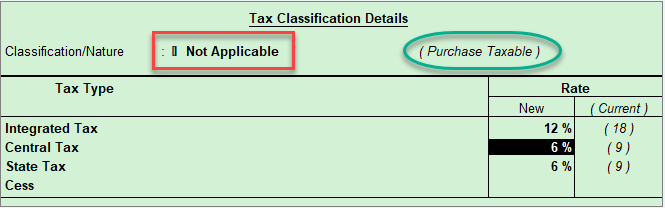

Transaction with modification to tax rate

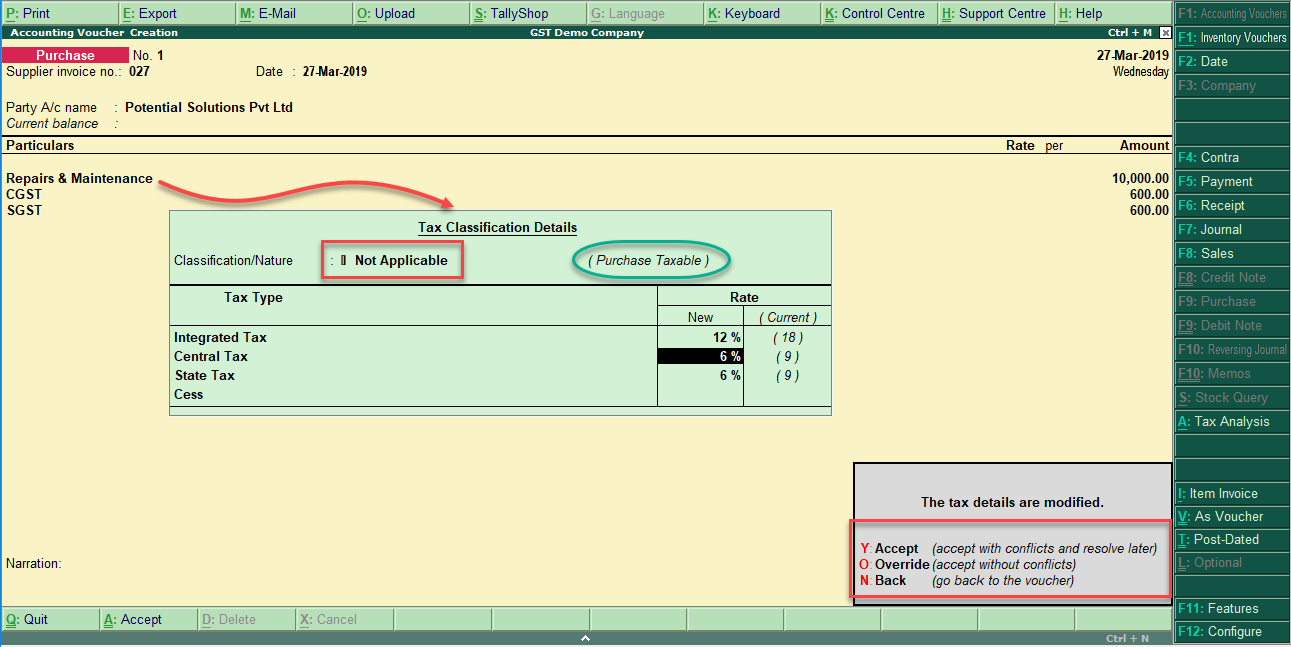

Let us now pass a transaction with for repairs & maintenance, where the GST rate in this inward supply is at 12% (Remember, we had configured the ledger with GST rate @ 18%, see the above screen)

Purchase Entry

Steps to pass Purchase Entry in Tally

- Gateway of Tally -> Accounting Voucher

- By default, the Voucher type will be ‘Payment’

- Select Purchase -> F9-Purchase (Note we have already set the option ‘Allow modifications of tax details for GST to yes)

- Reference No -> Enter the Tax invoice number of the supplier

- Date -> Enter the date of Tax invoice

- Party A/c Name -> Select the supplier

- In the particulars -> Select the ledger ‘Repairs & Maintenance’

- Amount -> Enter the transaction value (without GST)

- Tax Classification Details screen will appear

[Note: - Under the Classification/Nature – You can just press enter, where ‘Not Applicable’ will be selected. By default, Tally will determine the nature of purchase based on the master configuration of ‘Party Master’ (supplier/ customer)]

- In the New Tax rate column -> Integrated Tax -> Type 12 (Tally will automatically fill in Central Tax rate and State Tax rate)

- Press enter and come to the main voucher entry screen

- Select -> CGST Ledger – The amount will be auto calculated (if the amount is not auto populated, it means, there are some error in the master configuration)

- Select -> SGST Ledger

- Accept the Voucher

(Note: Before you save the voucher. Tally will pop- out a message ‘The tax details are modified’, it means that, as per master configuration the rate of GST was set as 18%, but whereas, in this transaction, the rate has been modified to 12%. Hence, Tally provides 3 option before the voucher is saved - The three options are Y-Accept, O-Override, N-Back.

When you press ‘Y’ or enter – the transaction will be reported in the GSTR form summary as an exception, which needs to be accepted to remove from exception.

When you press ‘O’ – Tally will consider this transaction as valid and will not report in the exception report.

Press ‘N’ – you can go back to the voucher and if needed, make necessary correction.)

Similarly, you can account the expenses using ‘Journal Voucher’ also. Once you saved the voucher, it is advisable to turn off the option ‘Allow modifications of tax details for GST to ‘No’ in F12- configuration to avoid unnecessary popping out of ‘Tax classification sub-screen’

In the next series, we will understand, the key fields required to be configured in the Accounting Masters for accurate and error free GST compliance in Tally.

In conclusion, it is simple and easy to configure GST for expenses ledgers and handle your compliance and financial reporting in the same way, you have been following all this while. Leverage the feature of modification of tax details for GST for easy, simple and reliable GST compliance in Tally.