Configuring GST at the Company Level

In Tally, the GST configuration can be set at different level of hierarchy masters of the company. The way the compliance engine is designed in Tally is that, based on the hierarchy level the configuration is set, Tally will automatically infer and inherit the configuration till the lowest level. Understanding this ‘Hierarchy and Inheritance’ is the key to easily set-up GST master and avoid majority of mismatch, ensuring quicker and easier filing of return from Tally.

Firstly, let us understand the areas where GST can be configured at different level of hierarchy.

These are the level of hierarchy from topmost to least level:

- Company Level configuration

- Inventory Group

- Inventory Stock Items

- Accounting Group

- Accounting Ledgers

Above are the linear order of GST set-up. The computation of GST compliance takes place in the reverse order, which we will cover in the upcoming series in detail.

Now, let us take different Use case scenario where and how, the user can leverage these hierarchy facilities in Tally.

Use case Scenario – 1

Manufacturer & Traders

A registered taxable person is trading in products which falls under a single HSN and the rate of GST is 18%. The registered person might be dealing with items in 100’s of the this HSN and said rate.

The question arises, do we need to configure every hundred items with HSN / Description and GST rate?

The answer is ‘No’, this is where you will leverage the Power of ‘Hierarchy and Inheritance’ of Tally.

How do we set up GST configuration? Here are simple steps to configure in Tally:

Step-1:

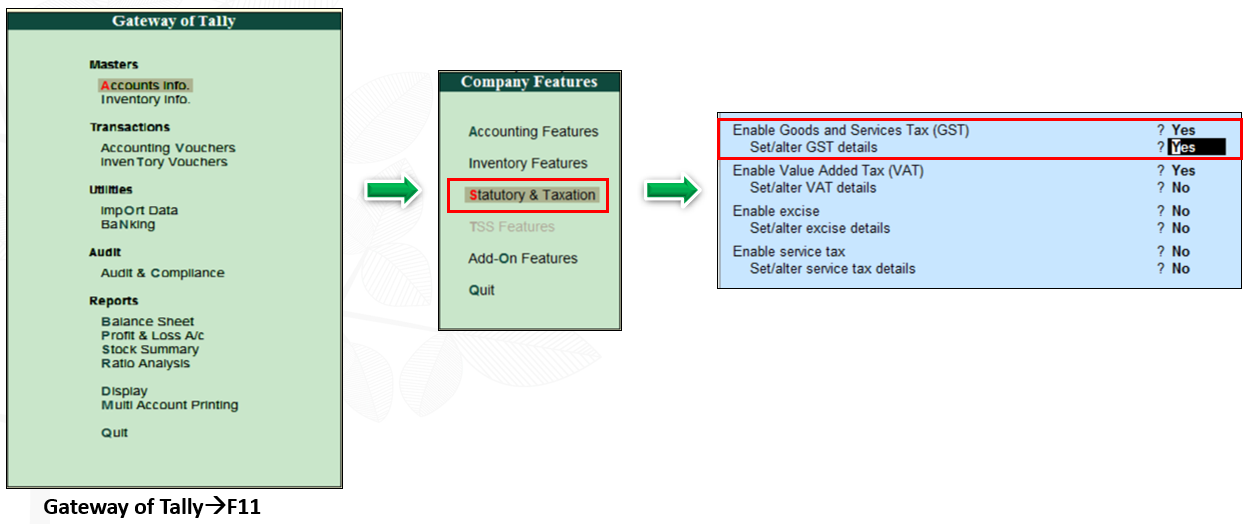

- Enable GST under ‘Statutory & Taxation’ option of F11: Features:

- Set to ‘Yes’ the option ‘Set/alter GST details’

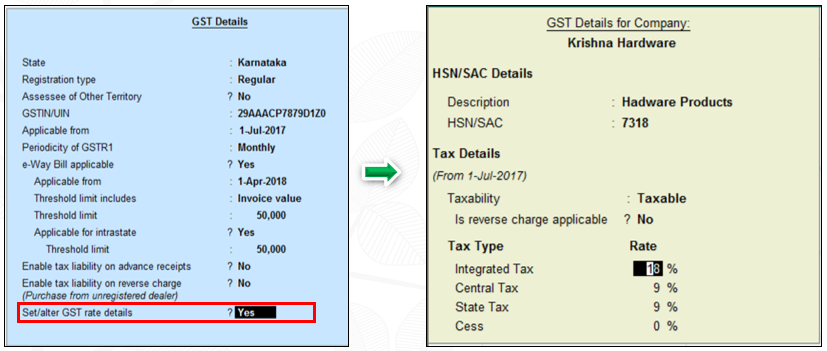

- From the Company GST Details -> set the option ‘Set/alter GST rate details’ to – ‘Yes’

- In the ‘GST Details for Company’ screen – specify the Description of the product and HSN (Note: - In case you do not find this field -> Press 12: Configure and enable the option ‘Allow HSN/SAC details to ‘Yes’)

- Specify the tax details and GST applicable rate. (Note: - by default the CGST and SGST rate field will not be visible. Nevertheless, Tally will auto allocate the IGST rate specified equally between CGST and SGST. In case, you want to view, Press12: Configure and enable the option ‘Show all GST tax type’ to ‘Yes’)

- Once all the relevant information is captured, save the screen and accept the F11: Statutory & Taxation screen and come back to ‘Gateway of Tally’

For the above Use case scenario, in Tally, the above configuration is all that is required for the taxable person to be GST compliance for all his ‘Inward’ and ‘Outward’ Supply of goods.

The questions that would linger in your mind are:

Inventory related:

- There are multiple ‘Stock Groups’ and in each of the group there are multiple ‘Stock Items’ and there are some stock items which are grouped at the ‘Primary’ level – What configuration needs to be done.

- What happens later during the course of business, new items are being traded and new groups and sub groups are being created in Tally.

The Answer is: You need not have to do any configuration for your existing stock groups and stock items. Tally will auto ‘infer’ the details specified at the Company level to all the stock items. Similarly, you do not have the do any GST configuration for any of the future stock group or stock items to be created in Tally, it will auto infer the details from the company configuration level.

In short, you will manage all your stock group and items, the way you have handling pre-GST era or as a normal inventory management practice.

(Note: The above simple configuration of GST can be done of existing master of Tally company at any given time)

Accounts related:

- Should I have to create a new Sales & Purchase ledger, what will happen to the existing purchase and sales ledgers.

If GST is being configured to an existing company with accounting masters. Tally will auto configure all your purchase and sales ledgers for GST. The user need not have to specify anything for GST purpose. Similarly, While GST is set-up for a newly created company, you will just create Purchase and Sales ledger as earlier and no need to specify any GST configuration for ledgers under Sales and Purchases. (In the upcoming series, we shall explain on the scenario, which requires configuration for accounting ledgers)

Create, the 3 GST ledgers, viz. CGST, SGST & IGST, you are ready to start your transactions as you are completely GST compliant in Tally.

Use case Scenario – 2

Service Providers

The big question, that will arise in your mind is, it seems fine in case of a taxable person dealing in ‘Goods’, but how will I configure GST for companies who supply ‘Services’ as generally there are no stock items.

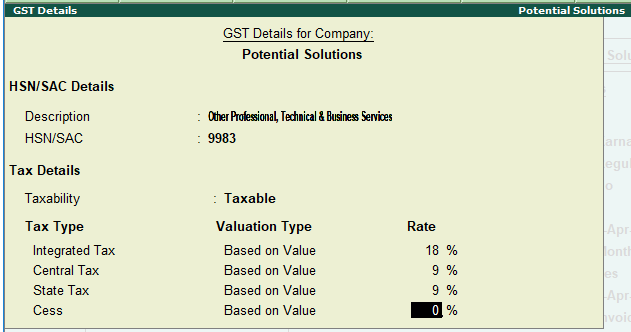

In case of ‘Service Providers’ also similar configuration is done. Let us take a case of GST Practitioner, and assuming all services he or she provides is of a single ‘Service Account Code- SAC’ and the rate of GST is 18%.

The same principle will apply in this case also. You will configure at the company level and all other ledgers will be auto enabled for GST (you will have to set as ‘Not Applicable’ for ledgers which are not impacted by GST)

Company Level GST configuration screen for Service Providers:

The above scenario discussed, will not be an all Use case scenario. What if a Taxable person has different HSN or SAC for the same rate of GST or has a different rate of tax, how do we handle these scenarios will be discussed in your next series.

In conclusion, it is simple and easy to configure GST in Tally for a taxable person dealing in Goods and or Services with single HSN/SAC and rate of GST. GST can be enabled and configured during any part of the financial year also, you really do not have to wait till the year end for enabling GST in Tally. Do it right away.