GST, or Goods and Services Tax, has become the cornerstone of taxation in India since its implementation in 2017. It represents a unified tax system that replaces a web of indirect taxes, making compliance easier and reducing tax cascading. For businesses, understanding GST goes beyond compliance—it's about boosting efficiency, staying competitive, and fueling growth.

In India's GST system, CGST, SGST, and IGST play pivotal roles in simplifying tax administration. CGST, imposed by the Central Government, and SGST, by State Governments, ensure revenue autonomy while IGST facilitates seamless inter-state transactions, fostering economic integration. Together, they form the backbone of India's taxation framework, ensuring a smoother and more efficient tax regime for businesses across the nation.

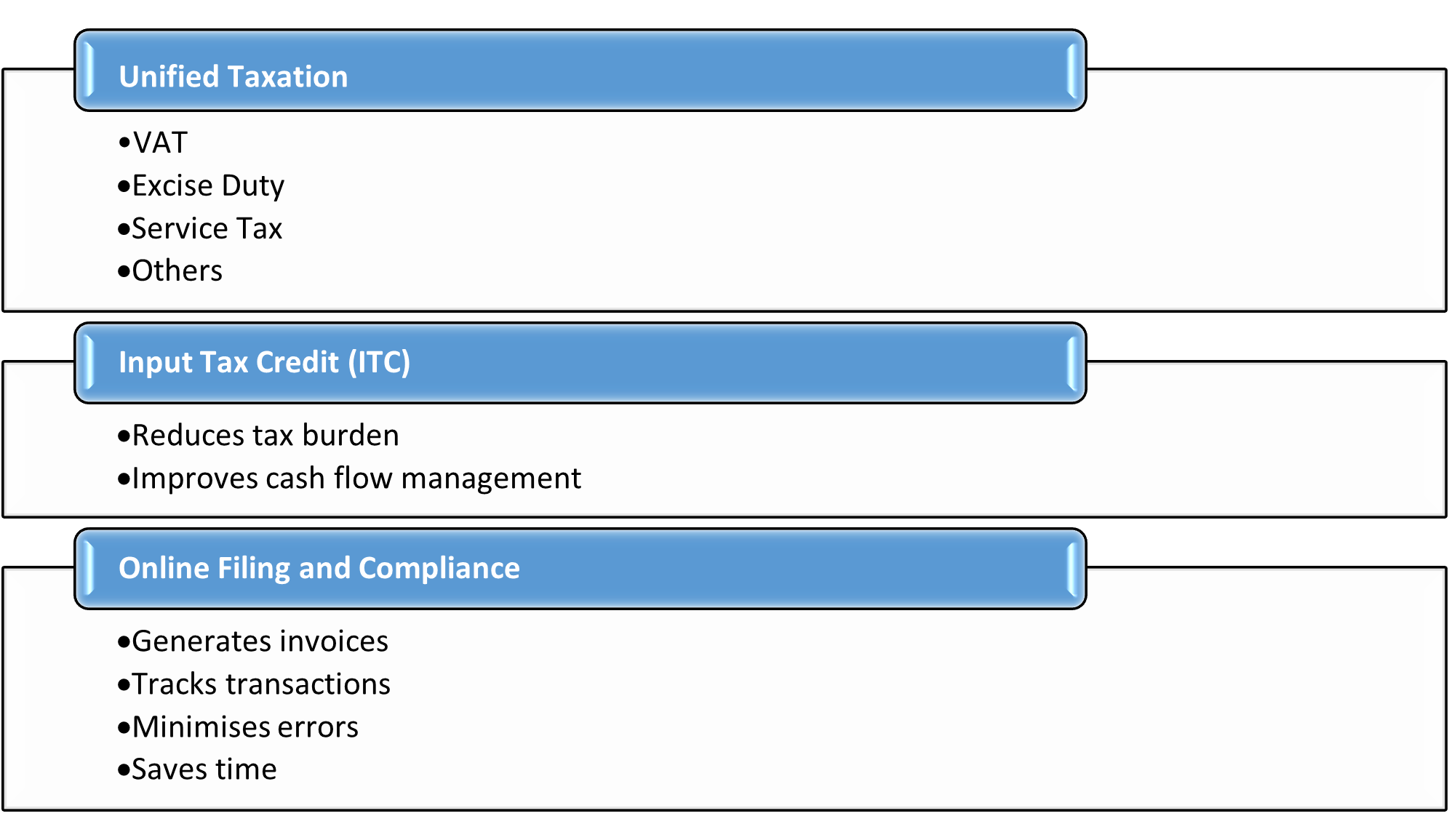

Key Features of Indian GST System

Explore the essential features of the Indian GST system that simplify taxation for businesses.

Challenges in GST Compliance

The complex system of tax laws and regulations can be overwhelming for entrepreneurs. Deciphering intricate tax codes and handling numerous filings and reconciliations pose challenges at every step. One of the major hurdles is ensuring accurate input tax credit (ITC) claims while reconciling purchases and sales across various transactions. Businesses often struggle with data management and integration issues, leading to discrepancies and errors in GST filings. Additionally, staying updated with changing compliance requirements and deadlines poses a constant challenge, especially for organizations operating across multiple states or countries.

To address these challenges effectively, businesses require efficient tools and systems to streamline GST-related tasks. Advanced accounting software with built-in GST compliance features can automate invoicing, tax calculations, and return filing processes. These tools not only ensure accuracy and compliance but also save valuable time and resources. Furthermore, access to real-time reporting and analytics enables businesses to gain actionable insights into their GST obligations, helping them make informed decisions and mitigate risks. By leveraging such tools, businesses can overcome the complexities of GST compliance and focus on driving growth and innovation in their operations.

The Role of GST Software

GST software is a vital tool for businesses, streamlining compliance by automating tasks and simplifying the complex process of GST management. It facilitates efficient return filing, ensuring timely submission and adherence to regulations. Additionally, it enables seamless invoicing, generating accurate and compliant invoices with ease. Furthermore, it automates reconciliation, matching input and output taxes accurately.

The goal of GST is to digitize taxation, making business easier. Utilizing intelligent software, businesses can compute GST for every transaction, simplifying financial accounting for taxes. The software also eases the extraction of GST reports and invoices, ensuring compliance. Businesses can effortlessly generate reports and file taxes on time throughout the year, making GST returns in a digital format effortless.

Benefits of Leveraging GST Software for Businesses in India

By streamlining processes and providing accurate solutions, a reliable GST software delivers several benefits to businesses in India. These include:

Compliance Automation

GST software automates compliance processes, ensuring adherence to regulations and minimizing non-compliance risks and penalties.

Time and Cost Savings

Automation reduces manual GST tasks, such as return filing and invoicing, saving businesses valuable time and resources for core operations.

Accuracy and Error Reduction

Automating data entry and calculations minimizes errors, ensuring accurate reporting and confident GST return submissions.

Informed Decision-Making

Real-time insights enable businesses to make informed decisions, optimizing operations, and driving growth.

Effective Cash Flow Management

Automated invoicing and payment tracking improve cash flow management, reducing late payments and enhancing financial stability.

Scalability and Adaptability

GST software accommodates evolving business needs, offering scalability and flexibility for businesses of all sizes.

Features to Look for in Indian GST Software

Imagine your business as a well-oiled machine, with each component working in harmony to drive success. Now, ask yourself: Is your current tax management system keeping pace with the demands of this dynamic ecosystem? Or is it dragging you down, slowing your progress, and leaving you vulnerable to risks and inefficiencies?

Selecting the right GST software is crucial for businesses to ensure smooth compliance and efficiency in tax management. Here’s a checklist of features that you should look out for in your GST software. These include:

GST Return Filing

Ensure the software simplifies and automates the GST return filing process, enabling businesses to file returns easily and on time, thus avoiding penalties and compliance issues.

Invoicing

Seek software with robust invoicing features that generate GST-compliant invoices swiftly and accurately. This ensures adherence to GST regulations and facilitates seamless transactions with customers and suppliers.

HSN/SAC Code Integration

Opt for software that seamlessly integrates HSN and SAC codes, enhancing the accuracy of tax calculations and simplifying the classification of goods and services. This integration streamlines reporting and reduces the risk of errors in GST filings.

Real-time Reporting

Look for software that provides real-time reporting capabilities, allowing businesses to track GST transactions, monitor compliance status, and make informed decisions promptly.

Automated Reconciliation

Choose software with automated reconciliation features that match input tax credit with vendor invoices, minimizing errors and discrepancies in GST filings.

Multi-user Accessibility

Consider software that offers multi-user accessibility, allowing different team members to collaborate on GST-related tasks efficiently while maintaining data security and integrity.

Compliance Updates

Ensure the software regularly updates to reflect changes in GST regulations and compliance requirements, keeping businesses informed and ensuring adherence to the latest tax laws.

Tips To Consider When Selecting the Right GST Software

With the implementation of GST, the complexity of tax calculations has surged, leaving many entrepreneurs seeking efficient solutions. While professional assistance from Chartered Accountants is common, having the right GST software can significantly streamline operations. Check out our insights on Tips to Choose a GST Software for Your Business.

Conclusion

While choosing the right GST software can feel like an uphill battle. Here’s a solution that transcends confusion and empowers efficiency: TallyPrime.

Crafted with precision and expertise, TallyPrime emerges as the quintessential answer to all your GST software needs. Its intuitive interface and seamless functionality alleviate the burdens of tax management, transforming compliance into a seamless process. Gain access to a suite of features designed to simplify GST calculations, streamline invoicing, and ensure timely return filing—all while remaining vigilant to regulatory shifts. And, what truly distinguishes this software is its holistic approach, seamlessly integrating GST functionalities with robust accounting and bookkeeping tools.