The COVID-19 pandemic has created havoc around the world with increasing cases and posing unprecedented challenges in our everyday lives. Consumers, MSMEs, self-employed workers and accountants are struggling to make ends meet and provide for their families with major loss of income, lack of adequate savings to weather the storm or poor access to health care. With lockdowns and quarantine in several countries across the globe, many small businesses have had to shut their doors for a prolonged period (which continues till date). While a lot of countries have taken several measures to contain the deadly virus, it still seems quite a challenge to overcome the possibilities of it spreading further.

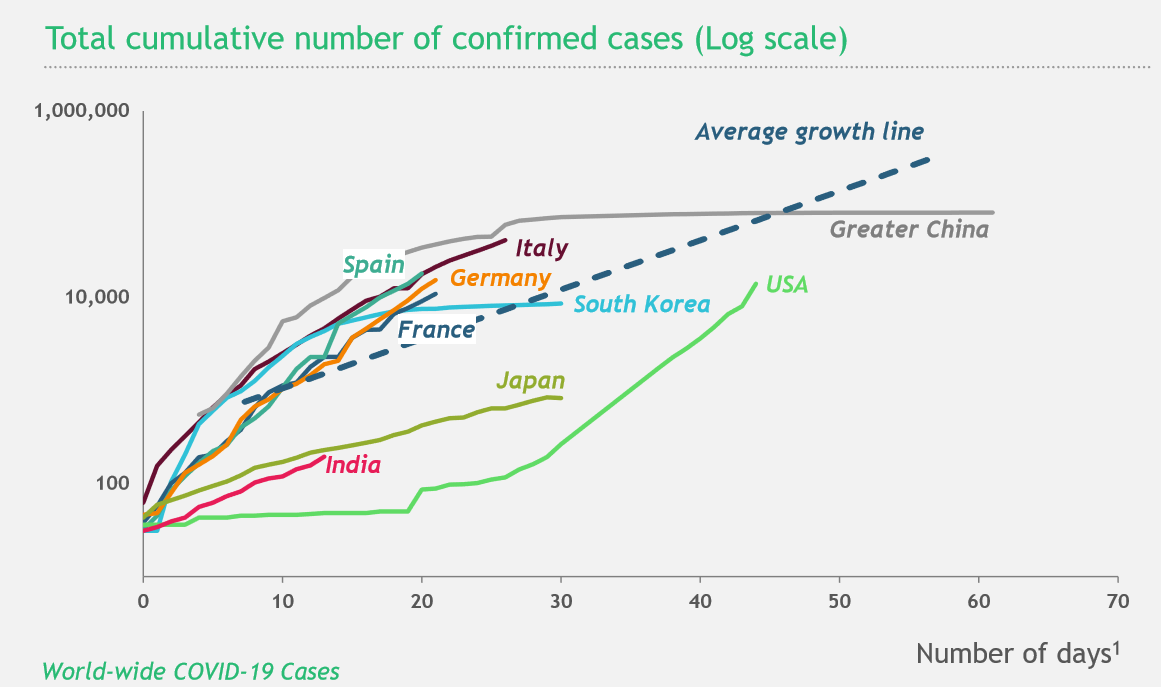

160 countries infected; most following similar path of exponential growth until strong interventions made

COVID-19 and Its Implications in Businesses - India

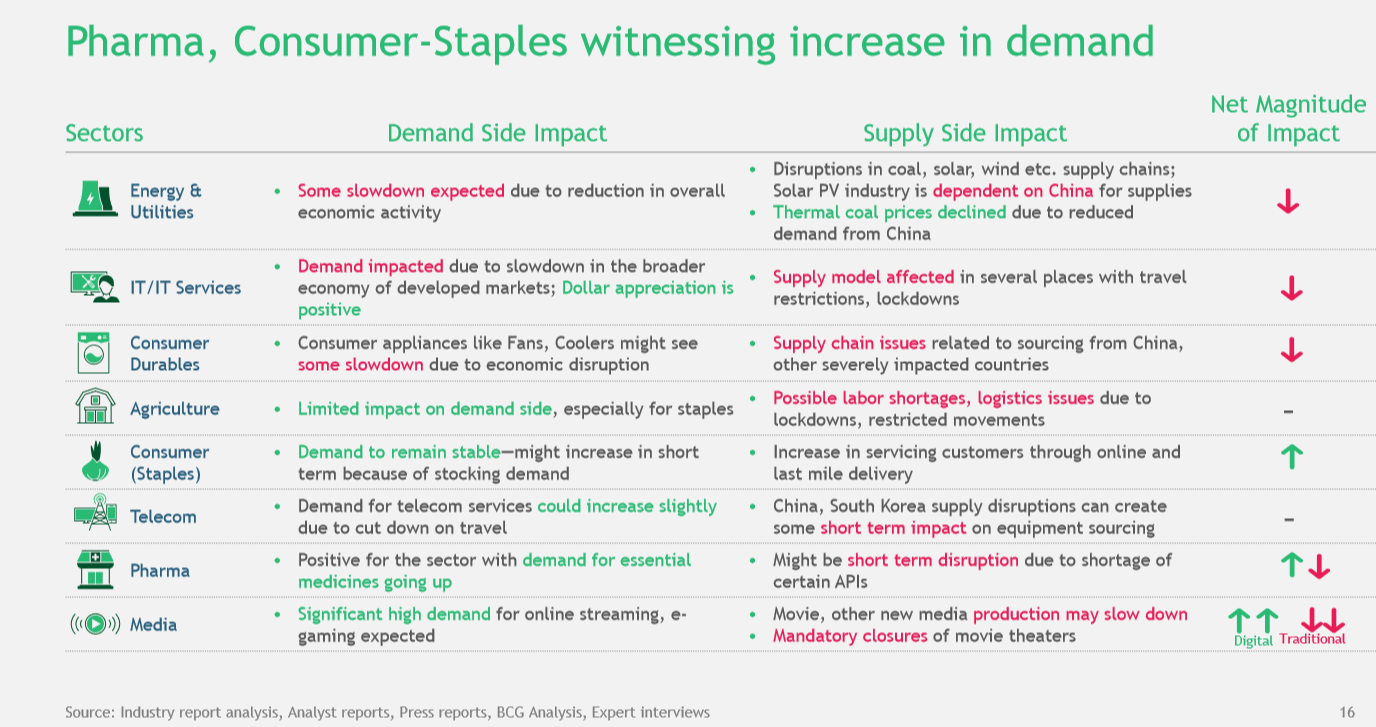

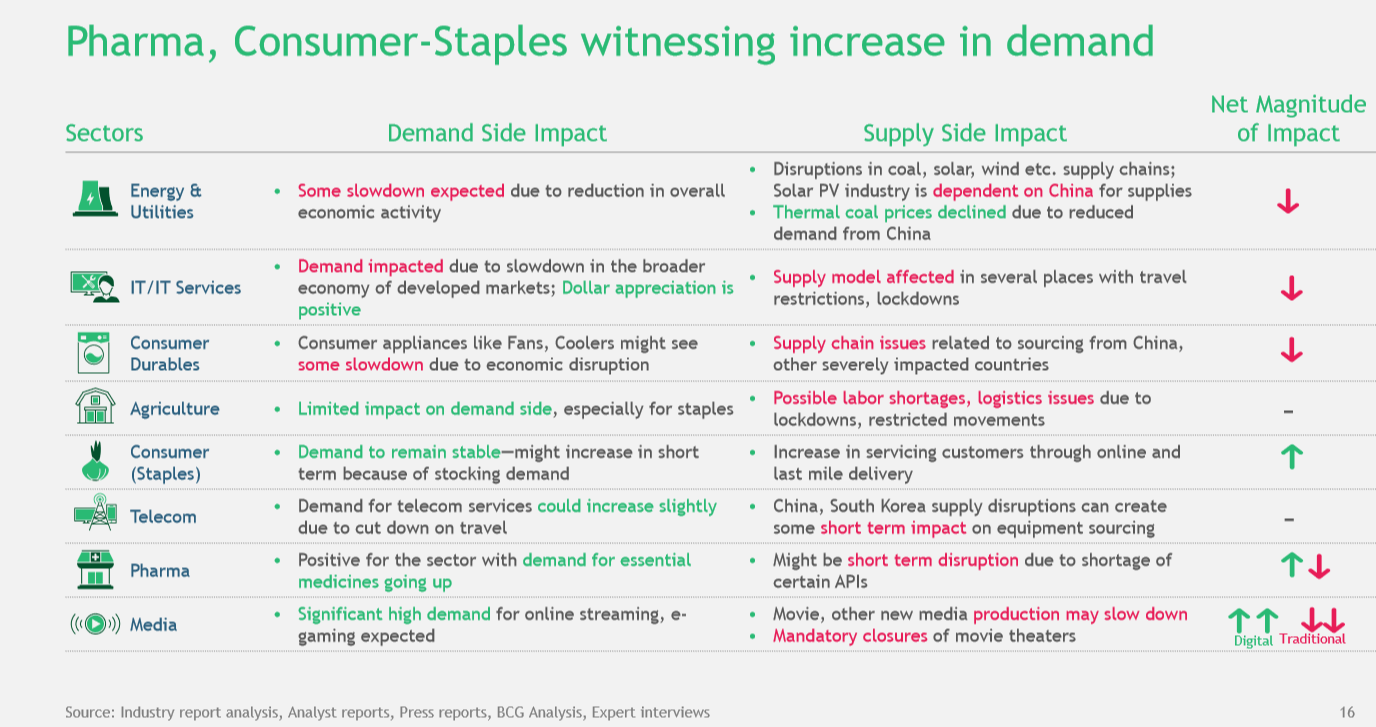

As a result of some of the preventive measures taken by respective governments worldwide to control the pandemic, small businesses, startups, and entrepreneurs have come out to be one the most vulnerable groups that have been directly affected by these measures. Whether it’s the preventive measures or the general chaos, COVID-19 has caused extreme disruption socially and economically. The subsequent lockdowns have posed several challenges for the Indian industry, which include liquidity crisis, lack of manpower and disruption of business operations; affecting continuity and sustainability of businesses. Virtually all major sectors of the economy such as aviation, hospitality, automobiles, real estate, construction, steel, and energy, among others, are facing the brunt of the pandemic.

While little can be done to avoid the damage to the economy, the government and various regulatory bodies in India are working in a war footing manner to minimize the negative impact of the pandemic on several fronts, including the functioning of businesses. They have allowed critical sectors of the economy, like goods transport, food processing, pharmaceutical raw materials, petroleum etc., to continue functioning. With a view to reduce the regulatory burden on firms, compliance requirements for businesses have also been cut down and rationalised drastically in several areas.

The authorities have been introducing specialised policies and relaxations for MSMEs, which have been one of the worst hit by the pandemic. Measures are being undertaken to reduce the borrowing cost and increase availability of credit to reduce cost of capital in this challenging time. Initiatives such as these will go a long way in ensuring sustainability and continuity of businesses during and post COVID-19. Since the MSMEs play a vital in the country’s economic growth and stability, there have several measures taken to lessen the impact of COVID-19.

Wage-related support

- A consolidated list for supporting MSMEs in terms of additional liquidity to meet their wage liabilities during the shutdown

- Utilising the ESIC funds under Rajiv Gandhi Shramik Kalyan Yojana, Atal Beemit Vyakti Kalyan Yojana to pay workers for the lockdown period i.e. to consider the lockdown period as national emergency leading to temporary closure of workplace due to natural calamity

- Provide a Moratorium for all PF, ESI and Gratuity payments by employer for six months if the employer does not retrench or remove more than 10% of its workforce

Flexible repayment options for loans and other EMIs

- The repayment of various loans and EMIs to be deferred till things normalise. In fact, RBI has already allowed a deferment for 3 months, however as a special dispensation to MSMEs the period could be extended to 6 months

- Delays in discharging social security liabilities, may be condoned without any penal action for next 6 months

GST Filing

- Reduce interest rate liability from 18 % to 3% or maximum to 6% on delayed payment of GST on payment of tax after due dates

- GST refunds to be further expedited on priority and documentation requirements to be reduced

- Reduction or waiver of GST on goods which are notified now as essential commodities in the context of COVID-19, such as hand sanitizers

- Validity of E way Bill period be extended automatically, or requirement waived till 30 April as vehicles are stuck up due to restricted movement due to COVID 19

- Reduce interest rate liability from 24% to 6% on availing excess or inadmissible input tax credit

Income Tax

- No issuing of notices for time bound compliance

- Expedite Tax refunds due to MSMEs. Set up a Monitoring portal where MSMEs can list delayed refunds, and MoF can ensure quick disbursal

Facilitate seamless Banking services

- MSMEs have been permitted additional 10% working capita loan, which should be increased to 25% for a limited period 3-4-month time, without the need for additional collaterals or securities, provided 80% of the proposed limits are backed by value of the stock receivables

- Allow skeletal staff in banking and financial services to temporarily work onsite up to 10 April 2020 to complete international client obligations like book closure and regulation filing

- RBI has significantly reduced the interest rate and increased the liquidity in the systems. Commercial Banks and NBFC should be asked to pass on the full benefits to borrowers immediately

Several other such initiatives have been undertaken and can be regulated in order to curb some damage in the long run.

Mr. Praveen Khandelwal, Secretary General Confederation of All India Traders (CAIT) shares his thoughts on the ongoing situation and what safety measures are businesses taking to mitigate the risks caused by the pandemic.