The COVID-19 pandemic has created havoc around the world with increasing cases, disrupting our routine. Consumers, MSMEs, self-employed workers and accountants are struggling to make ends meet and provide for their families with major loss of income, lack of adequate savings to weather the storm or poor access to health care. With lockdowns and quarantine in India, many small businesses have had to shut their doors for a prolonged period (which continues till date).

The Government of India has taken several measures and key initiatives to help MSMEs triumph through the pandemic. Here's a guide to the initiatives undertaken by our government and how you can avail them to get your business back on track.

₹3 lakh crore emergency automatic loan (MSME and traders)

All MSMEs with a turnover of up to ₹100 crores and with outstanding credit of up to ₹25 crores will be eligible to borrow up to 20% of their total outstanding credit as on February 29, 2020. These loans will have a four-year tenure and the scheme will be open until October 31. A total of ₹3-lakh crore has been allocated for this. These loans will have a 4-year tenure with moratorium period of 12 months on the principal repayment and capped interest. No guarantee fee, no fresh collateral and 100% credit guarantee cover provided to banks and NBFCs on principal and interest.

|

Who can apply? |

All businesses/MSMEs are eligible |

|

How to Apply |

Through Banks, DFS and National Credit Guarantee Trustee Company Ltd (NCGTC). |

Rs 20,000 crores subordinate debt for stressed MSMEs

MSMEs face a severe shortage of equity. So, a total of ₹20,000 crores will be funnelled through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) whereby banks will lend money to promoters which can be infused as equity in their businesses. GOI will provide guarantee coverage of up to 85% for loans up to Rs. 5 lakh and 75% for loans beyond Rs 5 lakh to MSMEs for them to raise funds from Financial Institutions. About two lakh stressed MSMEs with non-performing assets (NPAs) are projected to benefit from this. The CGTMSE will offer a partial credit guarantee to banks. With Government intervention, this scheme would be able to intermediate different types of funds into underserved MSMEs and address the growing needs of viable and high growth MSMEs.

|

Who can apply? |

Functioning MSMEs which are NPA or are stressed will be eligible Promoter(s) of such units can apply |

|

How to Apply |

Promoter(s) of MSMEs meeting the eligibility criteria may approach scheduled commercial banks to avail benefit under the scheme |

MSMEs performing well, they may go public, for growing companies

Fund of funds with Corpus of ₹10,000 crores will be set up which will provide equity funding for MSMEs with growth potential and viability. FoF will be operated through a mother fund and a few daughter funds. This fund structure will help leverage ₹50,000 crores of funds at daughter funds level. Fund of Funds aims to achieve private funding leverage using professional fund managers with access to funding and strategic performance oversight. This will help attract a wide range of investors, including financial institutions, corporate investors, banks, other government funds, HNW individuals to invest into MSMEs.

|

Who can apply? |

All MSMEs are eligible |

|

How to Apply |

Through Investor Funds onboarded and registered with proposed Fund of Funds |

Redefinition of MSMEs

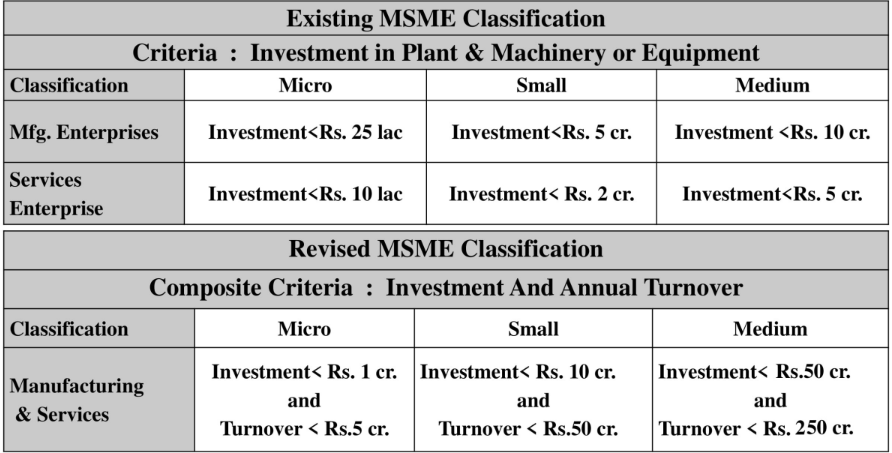

Businesses which come in the lower threshold of the MSME definition often have a fear of graduating out of benefits and hence mitigating the urge to grow. With a long-pending of redefining of MSMEs being due, the government announced a different way to look at this sector and the capping. The investment limit is said to be revised upwards with an additional criterion of turnover being introduced. There won’t be any distinction between manufacturing and the service sector anymore and necessary amendments to the law will be brought about.

Tenders up to ₹200 crores need to be mandatorily floated inside India

Competing with foreign brands and companies has always been a huge challenge for Indian MSMEs. Thus, to strike a balance between foreign and local goods/services consumption, and empowering “Go-Local” approach, global tenders will be disallowed in Government procurement tenders up to ₹200 crores. While necessary amendments of General Financial Rules will be applicable, this still will be a big step towards “Self-Reliant India”.

Other key initiatives to help boost the MSME sector

The government and Central Public Sector Enterprises (CPSEs) will clear receivables owed to MSMEs within 45 days. The government has also provided ₹2500 crores EPF support for business and workers for 3 months as businesses continue to face financial stress. This will provide liquidity relief of ₹2500 crores to 3.67 lakh establishments and for 72.22 lakh employees. All these initiatives together aim at making MSMEs sail through these difficult times in a slightly better way. Not only will this boost the MSME sector but also encourage local consumption.