- What is a cheque?

- What is a post-dated cheque?

- How to write a post-dated cheque?

- Why do we issue a post-dated cheque?

- Post-dated cheque situations

- Post-dated cheque validity

- Why is it not advisable to issue a post-dated cheque?

- What are the alternatives for post-dated cheque?

- Managing post-dated cheque

Before we understand the definition of post-dated cheque and why it is issued, let’s understand little more about the cheque.

What is a cheque?

A cheque is a bill of exchange drawn on a specified banker and to be payable on demand. It includes the printed form and a cheque in the electronic form.

In simple words, a cheque is a form of a bill of exchange which orders the bank to pay an amount of money from a person’s account to another individual’s or company’s account in whose name the cheque has been issued.

Now we know the definition of cheque, let’s understand post-dated cheque.

What is a post-dated cheque?

To define post-dated cheque, it is a form of a cheque drawn with a future date written on it. To simply put, post-dated cheque is one which is drawn with a date which is after the date on which cheque was written.

Let’s understand with an example.

Assume that today is 27th Jan and you are writing a cheque. Generally, if you write a cheque, you will write the current date of the cheque i.e., 27th Jan. But when you write a date which is later than the current date, say you write a date of a cheque as 3rd Feb, this is when it becomes post-dated cheque.

This arrangement of issuing a post-dated cheque to the recipient (the person or business receiving the payment, also known as the payee) is only made when the drawer wants the recipient to wait before depositing the cheque.

Here, it is important to note that cheque will be presented to the bank either on the date written on cheque and after the date.

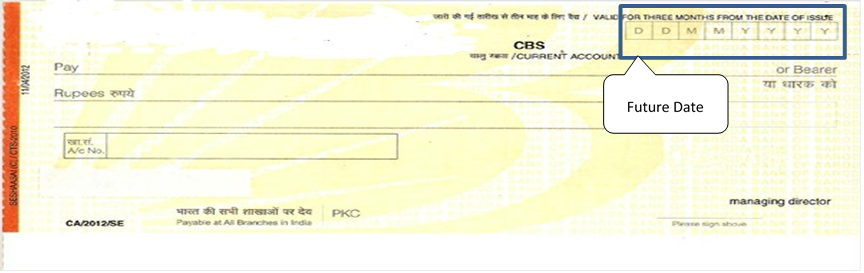

Post-dated cheque image

How to write a post-dated cheque?

Writing the post-dated cheque is no different from writing a regular or normal cheque. In writing a post-dated cheque, the only difference is that you will write a future date instead of the current date. The rest remains the same.

Why do we issue a post-dated cheque?

If you are a drawer of the cheque and if you have issued a post-dated cheque to the recipient, it implies that a written communication from your end to the recipient asking him to wait for the time, from the date the cheque is physically issued till the date mentioned in the face of the cheque.

In the above example, if you are a recipient of the cheque, you can deposit the cheque on 3rd Feb or after that though the cheque was physically written and received to you on 27th Jan. The gap between 27th Jan and 3rd Feb is the wait time here.

Post date cheque situations

While we know why businesses issue a post-dated cheque, it is also important to know the possible situations under which the post-dated cheque is issued.

- Insufficient funds: You do not have sufficient funds available on the date of writing the cheque, but you are sure funds will be available on the future date or the date mentioned on the cheque.

- Writing a cheque in advance: A cheque is written for paying something ahead of time i.e. before the payment is due or the service has been completed.

Post-dated cheque validity

In India, the validity of a post-dated cheque is 3 months from the date mentioned on the cheque. Similarly, each country has specific rules related to the issue and validity of the post-dated cheque

Why is it not advisable to issue a post-dated cheque?

So, the story of the post-dated cheque is that you don’t have sufficient balance on the date the drawee demands the sum from you and you issue him a post-dated cheque with a future date. This is kind of giving assurance to the recipient or the drawee that on this future date, the payment will be honoured.

But in reality, it is not always advisable to issue a post-dated cheque. This is because there could be possibilities that you may not be able to honour the cheque on the given future date. The possible reason could be expected funds have not come into the bank.

On the other side, the recipient may not be aware of this and he may deposit the cheque into bank resulting in a cheque bounce. This will not cost you in terms of additional charges that a bank may charge you but a loss of credibility and relationship that has been built so far.

Today, most of the banking process has been automated and banks rarely look at the date mentioned on the cheque. Sometimes, this may also possibly lead to cheque bounce.

Issuing a post-dated cheque also involves a process of informing the bank with the written instructions which are cumbersome. To add to it, each bank has different policies monitoring and preventing premature payment.

Do we have any other alternatives? Take a look at the next section.

What are the alternatives for post-dated cheque?

If you have an option to exercise, then it is best to avoid writing a postdated cheque. Even if your payee (the recipient) is honest, they may make the honest mistake of forgetting and leaving you with bad cheque fee.

Usually, a postdated cheque is used when you are short on money and that’s exactly when you can’t afford extra fees. In those circumstances, instead of writing a postdated cheque, you can try the following:

- If you’re postdating a check for timing or convenience reasons, say you will be out of town and will unable to pay when you usually do, schedule the payment through your bank’s online bill payment service such as Net banking, mobile banking etc.,

- Sign up for automatic electronic payments - only if you trust the payee. Dishonest or disorganized businesses may make withdrawals from your account before you’re ready.

Managing post-dated cheque

Sometimes, the alternative doesn’t work, and you choose to issue post-dated cheque(s) assuming the funds will be available on the future date. To make the situation little more interesting, you may have received the post-dated cheques promising to honour the payment on a given date. You might have considered this as well in issuing a post-dated cheque.

Now, you are in a situation where you have one or more post-dated cheques received as well as issued? This requires you to track and manage the post-dated cheques. Also, you need to have a special accounting treatment so that the transaction will automatically affect the accounting books on the date of the post-dated cheque.

TallyPrime, comprehensive business management software facilitates the smooth management of post-dated cheques. The post-dated cheque management feature supports the following:

- You can mark an entry as post-dated and specify the date on which the cheque was received/issued

- The transaction will automatically affect the accounting books on the date of the post-dated cheque

- You can obtain a comprehensive summary of all transactions involving post-dated cheques, using the post-dated summary report

- You can include post-dated transactions in other accounting reports like bills outstanding’s reports and accordingly make the decisions

Take a look at complete features of TallyPrime.