In the financial industry, "Accounting Periods" and "Fiscal Years" are necessary for measuring a company's financial success. It helps business owners make wise business decisions by continuously giving them insight into the company's profitability. Accountants invented the periodicity notion to facilitate the idea that allows for the division of ongoing and complicated corporate projects into manageable periods that are then reported in monthly, quarterly, and yearly financial statements.

These terminologies may appear complicated, but they are just time frames used in financial reporting. In this article, we'll explain what these terms signify and why they're important. Let's get started by deconstructing the notions of Accounting Periods and Fiscal Years.

| "Simplify Your Financial Journey with Tally Solutions: Unlock Efficiency and Make Informed Decisions" |

What is an accounting period?

Consider an accounting period a chapter in a business' life story. This period, commonly a month, quarter, or year, acts as a snapshot of your income, expenses, and overall financial health.

Consider your favorite TV program broken down into episodes. Each episode has its plot, revealing new events while adding to the story. Similarly, an accounting period displays your financial story, highlighting profits, losses, and trends.

These accounting periods make precise financial reporting possible, allowing you to comply with tax requirements and make sound judgments. Whether you're a small company owner or new to the world of finance, knowing accounting periods allows you to navigate the monetary maze confidently.

In a nutshell, an accounting period establishes common timeframes for reporting finances, paying taxes, and evaluating business growth. It adds structure and insight to the numbers game of running a business! Establishing distinct accounting periods is critical for measuring performance over time.

What is a period assumption?

The period assumption is a guiding principle that recognizes the necessity to divide the continuous flow of financial activity into smaller, more manageable chunks. It is a key concept for correctly matching revenues with related expenses throughout each accounting period.

Consider it the lens through which you evaluate your financial situation. Accounting relies on period assumption to capture and understand your company's financial voyage, similar to how a photographer compiles an album from a series of photographs.

Consider breaking down your financial year into bite-sized episodes to help you notice trends, detect anomalies, and make sound decisions. This procedure is similar to analyzing a sequence of interconnected events to understand the greater picture. Just as dissecting a novel chapter by chapter reveals the storyline, the period assumption reveals the hidden aspects of your financial narrative.

Why is this so important? Because it relates to our reality—a world in which financial positions change throughout time. By accepting the period assumption, accounting becomes a dynamic tool for navigating this ever-evolving landscape. Understanding the period assumption allows you to use time as a strategic advantage in your financial activities, whether managing your finances or leading a company.

Types of accounting periods

Understanding the different types of accounting periods is similar to knowing the numerous ways to your financial destination. These periods shape how businesses slice and dice time to obtain insights, make decisions, and stay on course.

Let's look at the different types of accounting periods and how they might help you:

Calendar year

Consider the calendar year the well-trodden path in the accounting world, from the start of January to the end of December. The calendar year is an obvious choice for many people. It's equivalent to resetting the financial odometer at the start of each year, providing a clean slate for recording transactions, monitoring growth, and evaluating success. The elegance is simple: January to December, twelve months that nicely match the tax cycle. However, it is critical to remember that businesses differ in their rhythms and seasonal fluctuations. Some sectors may have peak seasons in different months, making the calendar year a less-than-ideal option.

Fiscal year

The fiscal year is your company's calendar—a twelve-month period that begins on your chosen date. Unlike the calendar year with rigid confines, the fiscal year allows businesses to march to their financial beat. Assume you own a ski resort. Your peak season doesn't correspond to the traditional calendar year because it's all about snow and slopes. With a fiscal year, you may adjust your financial reporting to your busiest months. Beginning in September, for example, might give a stronger view of your resort's financial health, reflecting earnings from the busy winter season and preparations for the next one.

4-4-5 calendar

The 4-4-5 calendar serves as a quarterly marker in accounting, dividing the year into four quarters—two with four-week months and one with five weeks. It is widely used in retail and business to compare performance over similar periods. It assists retailers and manufacturers in tracking trends by reflecting natural business cycles. Although minor tweaks keep the calendar accurate, they act as a dependable compass, leading businesses through their financial landscapes and providing sharper insights for strategic decisions.

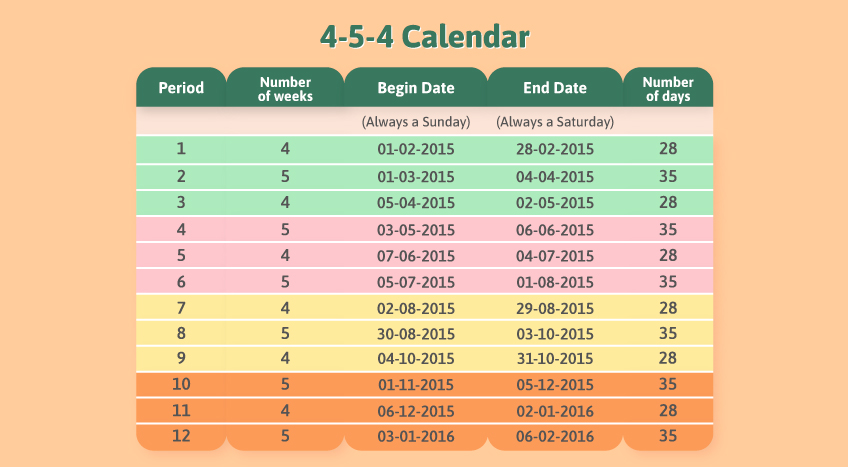

4-5-4 calendar

The 4-5-4 calendar is a balanced solution for enterprises with irregular schedules. This technique maintains a consistent 52-week year by dividing the year into four quarters with alternating lengths of 13 and 14 weeks. It provides reliable quarter-to-quarter financial comparisons by providing consistency. It harmonizes financial information, simplifies trend detection and strategic modifications, and is ideal for industries such as retail and seasonal firms. This flexible calendar connects financial reporting with operational cycles, making it a helpful tool for companies looking for consistent financial insights.

Short period

Short durations are pit stops for rapid shifts in the financial race. When your company experiences substantial changes in the middle of the year, such as mergers or acquisitions, short periods provide a breather. They help in the realignment of financial reporting, assuring correctness and coherence. Short durations allow you to change your financial plan to changing conditions. They're more than just pauses; they're smart tools for managing changes and staying on track with your financial story.

Fiscal quarters

Fiscal quarters are critical points in your financial journey, providing real-time knowledge. Instead of the static calendar year, these four periods enable agile adaptability, quick decision-making, and regular progress assessment. You may find trends and strategize successfully by comparing quarterly results. These checkpoints allow optimal resource allocation, which drives development and ensures your company sails comfortably through changing financial tides.

Final takeaways

Understanding accounting periods and fiscal years is critical in the financial sector. Tally Solutions is a trusted ally, providing solutions that enable businesses to navigate these ideas easily. Tally Solutions streamlines accounting operations while maintaining financial statement accuracy and giving real-time information. Use Tally Solutions to simplify your financial journey and make educated decisions to move your organization forward. Are you ready to start on an adventure of efficiency and growth? Contact Tally Solutions today to take your financial management to new heights.