- Purchase register

- Format of purchase register

- Difference between purchase register and purchase accounts

- Purchase register in TallyPrime

Purchase register

A purchase register displays the information on the periodic purchases of a business concern. Purchase register shows the details of the transactions that are of purchase nature.

Check out how to record purchases in TallyPrime:

Format of purchase register

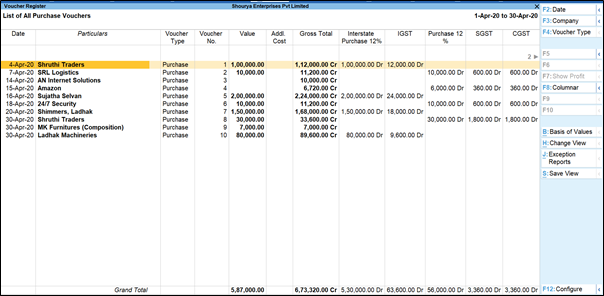

A purchase register will contain details of all the purchases made for a period. Thus, the components that are crucial for a purchase register are: date, supplier name, voucher type (purchase), voucher number, amount credited to the supplier.

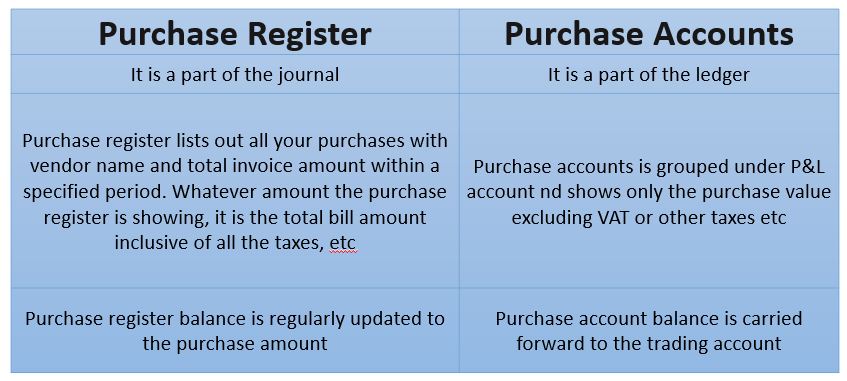

Difference between purchase register and purchase accounts

While purchase register and purchase accounts serve the same purpose, there are still a few key differences between the two.

Purchase register in TallyPrime

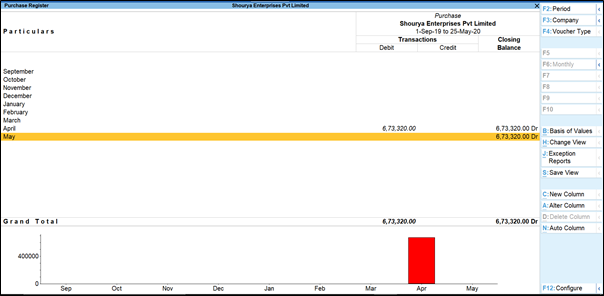

Purchase register is crucial to manage the movement of purchased goods and take appropriate business decisions. Thus, TallyPrime gives you various pre-built configurations that will help you analyse the purchase register to the optimum. Not only can you view the columnar register for purchase, but also view this report in browser.

In fact, you can also trace the purchases made during a certain period. The parties to whom the purchase returns have been made and the causes thereof can be analysed to draw conclusions on the supplier and the quality of purchases made.

Now when these purchases are recorded, you can simply go to the Purchase Register report, which will provide a comprehensive view of the month-wise purchases done in your business. You can drill down from the selected month to view the voucher-wise listing of purchases.

You can further configure the report to view the data for different periods and represent the purchase details in different ways, based on your business needs.