As a business owner, understanding depreciation is crucial for accurate expense tracking and maximizing tax benefits. Depreciation allows you to spread the cost of an asset over its useful life, reducing taxable income in the early years. Failing to account for depreciation properly can lead to poor financial decisions.

This guide covers the fundamentals of depreciation, different calculation methods, and real-world examples across industries. Mastering depreciation is essential for informed decision-making and steering your business towards success and efficiency.

What is depreciation?

The depreciation concept in accounting refers to a measure that calculates the monetary value of an asset that decreases over time due to use, wear and tear, or obsolescence. The depreciation accounting principle entails the distribution of the cost of a fixed asset throughout its anticipated useful life. A portion of the cost of an asset is expensed annually as opposed to the entire cost being expensed in advance. This encompasses the gradual depreciation in value caused by usage, deterioration, or obsolescence.

Consider a scenario in which a restaurant invests $10,000 in a brand-new commercial oven with a projected lifespan of ten years. The restaurant would incur annual expenses of $1,000 for a period of ten years under straight-line depreciation, as opposed to deducting the entire $10,000 in year one. This effectively amortizes the cost of the asset over its operational lifespan.

Why is depreciation important for businesses?

In the realm of business, depreciable assets are frequently encountered and comprise machinery, vehicles, structures, computers, office equipment, and furniture. Despite being utilized to generate income, these assets progressively depreciate in value and utility. Depreciation permits businesses to recoup the expense of these costly investments through the generation of revenue.

Depreciation recognition has significant effects on cash flow and tax liability. An increase in depreciation results in a decrease in taxable income, thereby mitigating present income tax liabilities. Annually, the depreciation expense is subtracted from the income statement, resulting in a reduction of net income. This promotes cash flow optimization during the initial years of an asset's lifespan. When companies acquire substantial amounts of capital, maximizing depreciation where applicable is a crucial tax reduction strategy.

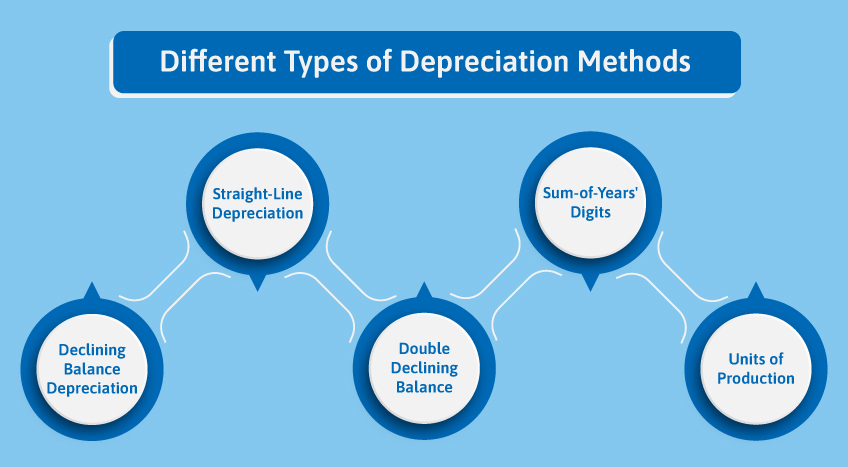

Different types of depreciation methods

Understanding the fundamentals of accounting includes knowing the main methods of calculating depreciation expenses.

The most prevalent forms of depreciation include:

Straight-line depreciation

An asset's straight-line method depreciation expense is recorded at the same rate each year for the duration of its useful life until it reaches its salvage value. For example, a piece of equipment that costs ₹50,000 with a 10-year life and ₹5,000 salvage value would be depreciated at ₹4,500 per year (₹50,000 cost - ₹5,000 salvage value = ₹45,000 depreciable amount / 10 years = ₹4,500 annual depreciation). As a result, an annual depreciation rate of 10% is maintained. The straight-line method is the most prevalent and straightforward approach.

Declining balance depreciation

This accelerated method accelerates the depreciation of assets during their initial years of service. Annually, the depreciation expense is computed as a fixed percentage of the book value of the asset. Using a declining balance rate of 25% as an example, the annual depreciation on a 10-year asset would amount to 25% of its book value. In year one, it would be 25% of the full ₹50,000 cost = ₹12,500 depreciation. Depreciation in year two would amount to ₹9,375, or 25% of the remaining ▹37,500 book value.

Double declining balance (DDB)

DDB, as its name implies, doubles the declining balance depreciation rate, accelerating it even further. For example, annual depreciation would be 50% of the book value rather than 25%. This causes depreciation expenses to be even more significant during the initial years of an asset's useful life.

Sum-of-years' digits (SYD)

In the early years, this method depreciates a greater proportion of the depreciable base, analogous to declining balance methods. The annual depreciation rate is determined by a fraction computed from the sum of the useful life digits of the asset.

Units of production

This approach establishes a correlation between usage and depreciation by basing annual expense calculations on actual output. The estimated number of expected lifetime units is utilized to calculate the per-unit depreciation cost by dividing the cost by this quantity.

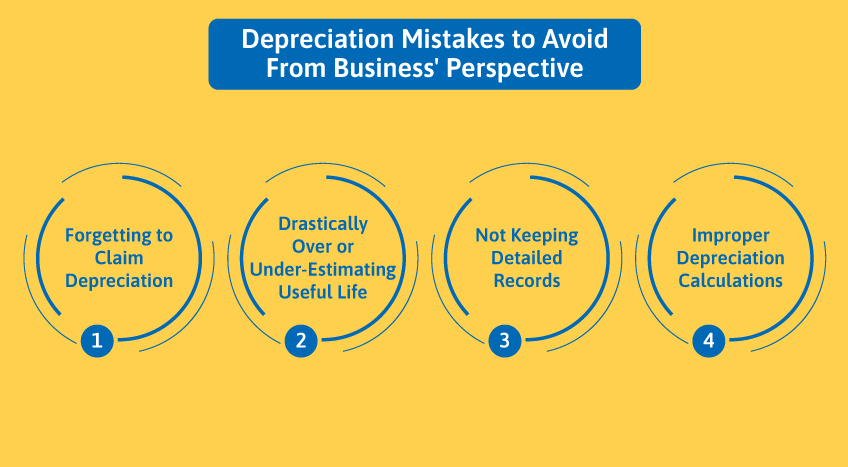

Depreciation mistakes to avoid from business' perspective

Avoiding repeated depreciation mistakes helps you get a better understanding and hold of the financial position of your business.

The first step in avoiding depreciation mistakes is to get a strong hold on fundamentals of accounting, whereas the rest are:

Forgetting to claim depreciation

Neglecting depreciation overstates profits and asset book values. Properly tracking fixed assets and maximizing depreciation deductions is essential for accurate financials.

Drastically over or under-estimating useful life

Estimating asset useful life greatly affects depreciation cost estimates. Overestimating useful life causes early deductions to be missed, while underestimating may prohibit excessive depreciation. Asset categorization, industry standards, decline rates, and frequent reevaluations are essential for determining practical and complying usable lifetimes.

Not keeping detailed records

Detailed fixed asset records containing information such as purchase date, cost, depreciation method, anticipated useful life, and cumulative depreciation are required. Meticulous record keeping enables accurate depreciation calculations annually. Errors and permitted deductions are significantly more likely to occur when sufficient documentation is lacking.

Improper depreciation calculations

Numerous depreciation calculation methods, including straight-line, declining balance, and units of production, can complicate the process. Errors when applying formulas or procedures may result in inaccurate depreciation expenses. All calculations must be double-checked to ensure that the methods employed are examined and that accuracy is ensured. Seeking the advice of accounting professionals may help in reducing errors and optimizing valid depreciation deductions.

Wrapping up

Any company owner has to understand depreciation. The cost of assets is depreciated throughout their useful lifetimes to account for use and obsolescence. Correct depreciation accounting improves cash flow, minimizes taxes, and improves financial reporting.

Businesses should avoid frequent depreciation problems such as not claiming depreciation, over- or under-estimating usable lifetimes, missing thorough asset records, and making calculation errors. Depreciation calculations may be automated and precise, asset records kept, and financial reports generated in accordance with Indian accounting rules using Tally.

Business owners may make smart choices, boost productivity, and maximize fixed asset tax advantages by understanding depreciation and using technologies like Tally.