Besides making sense of every cent, accounting in business helps balance the book and manage finances in a way that leads to success and expansion. Accounting is critical in the company because it helps track income and expenses, guarantees statutory compliance, and gives quantitative financial information to investors. Every entrepreneur and business person, however, has to familiarize themselves with both cash accounting and accrual accounting.

The choice between cash and accrual accounting is crucial for businesses. The distinction may seem simple, but the effects of selecting a particular approach over another can be substantial in terms of financing acquisition, tax compliance, profitability analysis, and strategic planning. In this accounting guide, we will explore the primary difference between cash and accrual accounting, along with the importance of both.

Importance of cash accounting for business and entrepreneurial success

Cash accounting is a bookkeeping method in which transactions are reported and recorded exclusively when cash changes hands. This method requires revenues to be recorded when cash is received from customers and expenses recorded when cash is used to pay bills. It makes cash accounting for small businesses extraordinarily straightforward and simple to understand.

Real-time recording of transactions, which occurs as cash is received or paid out, offers business operators unrestricted insight into the current cash flow state. Numerous sole proprietors and small businesses favor cash accounting due to its straightforward nature, eliminating the need to record unpaid invoices or track payables and receivables.

Cash accounting: key advantages for business owners

The prime advantage of cash accounting is that it makes maintaining cash-only transactions easier. It also makes preparing accounts easier as firms would not have to make year-end accounting adjustments. However, these are not the only advantages of cash accounting.

Ease of cash flow tracking

Cash accounting offers a straightforward method for established business persons and new entrepreneurs to monitor and record cash inflows and outflows in real time. The fact that transactions are documented exclusively when actual cash changes hands provides entrepreneurs with straightforward insight into the liquidity status of the company. It facilitates the monitoring of available currency for daily operational expenses.

Alignment with cash-based operations

In the initial years, many small sole proprietorships and partnerships function predominantly on a cash basis. These types of businesses are well-suited to cash accounting, as revenue is exclusively recognized upon consumers making cash payments for invoices. The alignment between the recognition of revenue and expenses and currency receipt and payment simplifies the financial reporting process.

Low compliance burden

In the early phases, when there are few transactions, cash accounting generates a negligible accounting workload. Entrepreneurs gain valuable time to allocate towards the expansion of their businesses. Additionally, the financial statements necessitate only minor changes, simplifying and cost-efficient conformance for small-scale businesses.

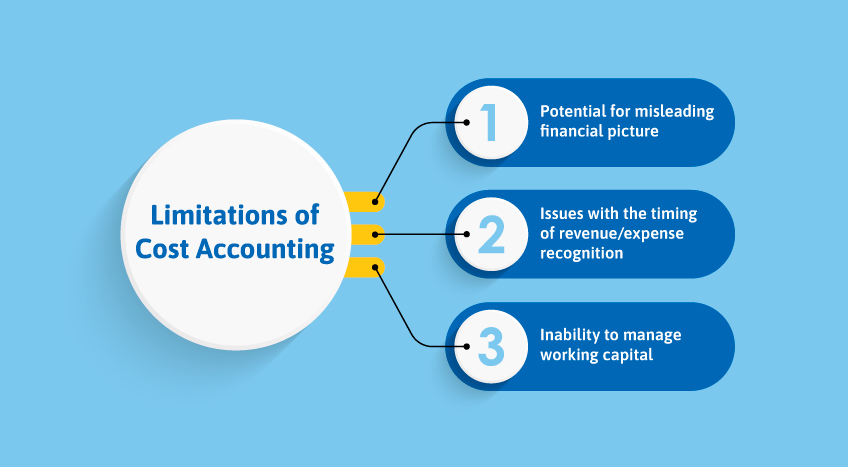

Limitations of cost accounting business owners must consider

For as many benefits as cash accounting offers, there are a few limitations that business people and entrepreneurs have to deal with. The primary limitations of cash accounting include:

- Potential for misleading financial picture: Although cash accounting offers a concise representation of the current cash position, it fails to encompass the complete financial landscape of a company. The exclusion of accounts receivable and payable results in a failure to yield precise indicators of long-term financial well-being, such as profitability.

- Issues with the timing of revenue/expense recognition: In cash accounting, revenue is not recognized at the point of sale or service but upon its actual receipt. The discrepancy in timing has the potential to introduce distortion into the financial outcomes disclosed to entrepreneurs and tax authorities.

- Inability to manage working capital: Cash accounting's inability to record quantities owed to suppliers as payables or money owed by debtors as receivables restricts visibility into the working capital invested in the business.

Accrual accounting for business owners: what you need to know

Accrual accounting records the expected business transactions that provide business owners with an accurate picture of the business's financial situation. Accrual accounting deviates from the cash-based method in that transactions are recorded when economic activities transpire, irrespective of the actual cash flow. Every business expense is recorded when products or services are consumed or a liability is incurred. In contrast, business revenues are recorded in the accounting period when a service is rendered or a sale is made. It enables businesses to acknowledge revenue even without complete payment at the moment of service or sale.

Accrual accounting achieves a more comprehensive depiction of a business's financial position at any given moment by designating unresolved expenses as accruals and money owed to the business as receivables. It demonstrates the accurate profitability achieved by allocating revenues to the costs incurred in their production. It enables business owners and executives to make more informed decisions by accurately depicting operational performance.

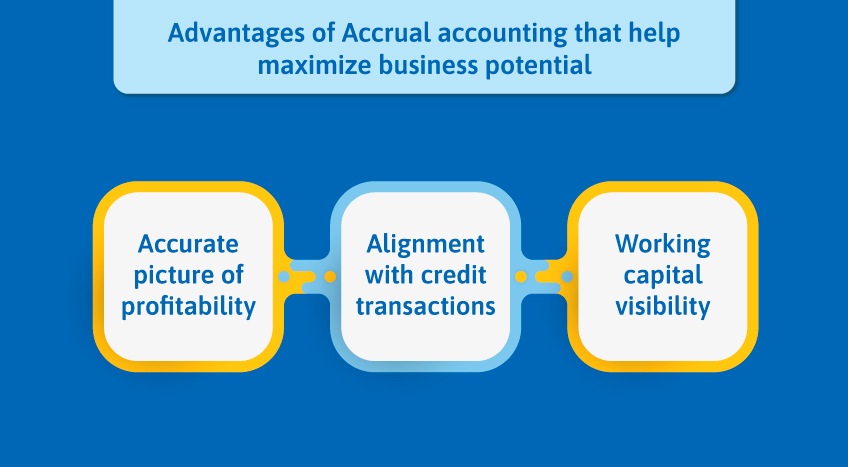

Advantages of accrual accounting that help maximize business potential

Accrual accounting offers a set of advantages that differ from cash accounting. The most prominent advantages of accrual accounting are:

- Accurate picture of profitability: By documenting revenues at the time they are earned and expenses at the time they are incurred, entrepreneurs are afforded an accurate assessment of the long-term operational profitability. It facilitates more accurate assessments of strategic investments, pricing, and business operations.

- Alignment with credit transactions: Numerous well-established businesses incorporate consumer credit into their business framework. This is consistent with accrual accounting, which recognizes revenue on credit sales at the time the transaction is completed, as opposed to upon receipt of payment.

- Working capital visibility: By monitoring accounts payable and receivable, accrual accounting illuminates the working capital invested in a business. For sustained scalability, this facilitates the management of inventory levels, debtors, credit terms, and cash flows.

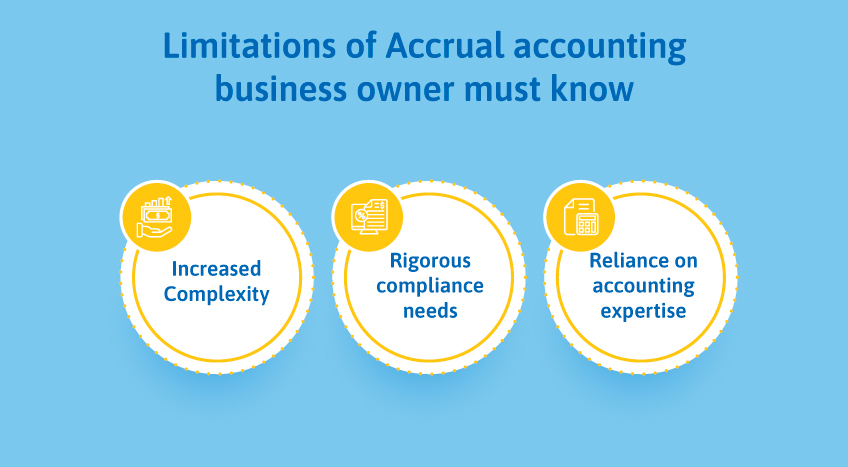

Limitations of accrual accounting business owner must know

Like cash accounting, accrual accounting also carries its own set of limitations. Some of the most eminent limitations of accrual accounting are:

- Increased Complexity: Although accrual accounting offers a more holistic financial perspective than cash accounting, it entails substantial complexity. Analytical ability and diligence are required to compute accruals and deferrals.

- Rigorous compliance needs: Attention to accrual accounting principles and tax regulations is paramount to prevent penalties or conflicts. It requires daily maintenance of accurate and comprehensive records about invoices, receipts, expenses, and other transactions.

- Reliance on accounting expertise: Accrual basis accounting requires greater proficiency in monitoring accounts receivable, payable, inventory, and other related matters than cash accounting. Expanding businesses must employ or outsource accounting functions to professionals to ensure compliance.

Difference between cash accounting and accrual accounting: comparative analysis for business owners

The prime difference between cash and accrual accounting is that cash accounting records expenses when money is paid out and revenue when it is received, whereas accrual accounting records income as earned and costs when they are incurred. The key differences between cash and accrual accounting are:

|

Criteria |

Cash Accounting |

Accrual Accounting |

|

Timing of Revenue Recognition |

Recognized when cash is received from customers |

Recognized when the sale is made or service is delivered, even if full payment is not received |

|

Timing of Expense Recognition |

Recognized when bills are paid in cash |

Recognized when costs are incurred, regardless of when payment is made |

|

Treatment of Receivables |

Not recorded as accounts receivable |

Amounts owed by debtors are recorded as accounts receivable |

|

Treatment of Payables |

Not recorded as accounts payable |

Amounts owed to creditors are recorded as accounts payable |

|

Financial Statements |

Can provide a misleading view of long-term profitability |

Provides an accurate picture of profitability by matching revenues to expenses |

|

Suitable for |

Small sole proprietorships and businesses with cash transactions |

Growing businesses, especially those with credit sales and complex operations |

Final takeaways, for streamlining and simplifying accounting

While cash accounting is easier since it is based on cash transactions, accrual accounting gives a more realistic picture of long-term financial performance through revenue-expense matching. The optimal selection among these approaches is contingent upon the business's scale, functioning, and financial objectives. Compliance is simplified for sole proprietorships and small businesses through cash accounting.

It is critical to have access to efficient accounting software, regardless of the accounting method employed. Tally Solutions provides integrated, GST-compliant accounting software capable of processing cash and accruals. Entrepreneurs can easily manage accounts, stick to tax and accounting standards, and obtain insightful reports and analytics for financial oversight.