- Audit report

- Types of audit report

- Format or content of an audit report

- Sample format of audit report

- How TallyPrime can help?

Understanding your company’s audit report is crucial for financial transparency and compliance. Every year, businesses undergo audits to confirm whether their financial statements are accurate and follow accounting standards.

What is Audit Report?

The audit report is generally accompanied by the company’s annual report. The audit report is required by banks, financial institutions, investors, creditors, and regulators. When the auditor issues a clean report, it means that the company’s financial statements have been found to be fully compliant with accounting standards. An unqualified report will tell you that the financial statement could have some errors.

Audit reports are very important to a company. Investors rely on the audit report to assess the financial health of the company and they base many important decisions on the audit report. Regulatory bodies also read the audit report as it tells them how accurate the financial information reported is. When an audit report is adverse it can seriously affect the company’s status and reputation. It is essential to have good accounting practices so that the audit of accounts goes well.

| Audited Financial Statements | Generally Accepted Auditing Standards (GAAS) |

Why Is It Important?

Audit reports play a vital role in business credibility. According to the Institute of Chartered Accountants of India (ICAI), over 70% of investor decisions rely on audit reports to assess a company’s financial health and reliability.

A good audit report builds trust, while an adverse or qualified report can damage a company’s image, limit financing, and raise regulatory red flags.

Tally makes it easy for the organization to accurately record all their transactions in compliance with GAAP. If you are worried about how to prepare a balance sheet with no errors, Tally is your answer. It also makes it more straightforward for auditors to access all the information that they need in a very simple and transparent manner. Tally also makes it easy for the internal accounting personnel to ensure that their accounts are in order even before the external audit commences by generating balance sheet and trial balance etc.

Types of audit report

An auditor releases an audit report that states the auditor’s opinion on the financial statements of the company. There are four common types of auditors reports:

Clean or unqualified report

This is the best type of report that a company can receive from an auditor. A clean report is one that states that the financial statements of the company fully comply with GAAP and are free of any material misstatement. It indicates that the auditors are satisfied with the company’s financial reporting and that they comply with the governing principles and laws applicable.

Key Features of clean or unqualified report:

- No discrepancies or material misstatements

- Reflects complete transparency

- Indicates strong internal financial control

Most audits result in clean or unqualified audit reports. Mostly SMEs, startups, and enterprises looking to build investor trust or secure loans needs this report.

Qualified opinion

It issued when auditors find minor errors or incomplete evidence, but they don’t impact the entire report. There are two situations in which a qualified report would be issued by the auditor.

- If there are material misstatements in the financial statements but they are not pervasive

- If there is insufficient evidence to base the audit opinion on but the possible effects of any material misstatements are not pervasive

The problem areas where there has been some calculation mistake will usually be specified by the auditors in the reports. This enables the company to fix the errors. Businesses still improving internal control or accounting systems can use this report.

When you use Tally software for your accounting, you stay in compliance with regulations and there is no scope for a calculation error in computing the reports.

Adverse opinion

An adverse opinion on an audit report is the worst possible report that you can get. Issued when financial statements contain major inaccuracies or misleading information.

Key Features:

- Significant non-compliance with accounting standards

- Possible risk of fraud or manipulation

- May attract legal action or investor withdrawal

An adverse opinion means that the misstatements in the financial statements are both material and pervasive. An adverse opinion can damage a company’s reputation and even have legal ramifications unless the issues are corrected. There are chances that the errors could have crept in by mistake, but they could also be the result of fraud. If there is an adverse opinion on account of illegal activities in the company, the corporate officers may face criminal charges. Investors and regulators will also reject the company’s financial statements as a result of the adverse opinion in the audit report. If there are errors that were corrected, the company will have to have their financial statements re-audited satisfied before the statements are accepted.

Disclaimer of opinion

Given when auditors cannot form an opinion due to insufficient information or lack of access. An auditor would issue a disclaimer of opinion if:

- The auditor was unable to get enough audit evidence to base an opinion on

- They did not get satisfactory answers to their questions

- The possible effects of the undetected misstatements could be material and pervasive

This may happen if the auditor was denied access to certain financial information or if the auditor is unable to be impartial. A disclaimer of opinion means that the financial status of the company could not be ascertained.

Emphasis of Matter Report

An Emphasis of Matter paragraph is included in an auditor’s report to highlight a specific issue—such as a legal dispute or uncertainty—that is crucial for readers to understand, even though it doesn’t alter the auditor’s overall opinion. It draws attention to significant events or conditions, allowing stakeholders to be aware of potential risks while maintaining a clean audit opinion. This note is commonly used by corporates and listed companies dealing with ongoing exposures like tax litigations or regulatory cases.

Format or content of an audit report

|

Section/Heading |

Description |

|

Title |

Independent Auditor’s Report. The title of the audit report should be simple and include the word “independent”. This indicates that the audit was performed by an external, independent, and unbiased third party. |

|

Addressee |

The report will clearly state to whom it is addressed. Example: To The Shareholders Of Company Name or The Directors |

|

Introduction |

This would be a statement that states the name of the company that is being audited, the dates of the financial period that the audit covers, which is usually the fiscal year. |

|

Responsibilities of directors and auditors |

This section clearly states the responsibilities of the directors of the company being audited, and the responsibilities of the auditor. It states that the management and directors of the company accept the duty of providing the auditor with all the financial documentation required for the audit. It also states that the documentation provided is true and accurate to the best of the director’s knowledge. It is stated that the auditor’s role is to audit the financial statements given by the company. It also states that the auditor must form his opinion based on the information provided. |

|

Opinion |

This section clearly states the auditor’s opinion. |

|

Basis of opinion |

The section states that the audit was conducted in compliance with the standards and describes the audit process and resources. This section may be longer than the rest. |

|

Other reporting responsibility |

If there are any other reporting responsibilities such as legal or regulatory requirements they are mentioned here. |

|

Signature of the auditor |

Signed by the auditor |

|

Date And place |

The date and city where the report was signed by the auditor. |

Sample format Of audit report

Given below is an example of a clean audit report.

|

Independent Auditors' Report

To the Board of Directors and The Shareholders, Company ABC, Address. Report On The Financial Statements We XYX have audited the accompanying balance sheets of ABC Company as of December 31, 20X2, 20X1 and 20X0, and the related statements of income, earnings, and cash flows for the years then ended, and the related notes to the financial statements. Management's Responsibility for the Financial Statements Management is responsible for … Auditor's Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with ... Opinion In our opinion, the financial statements referred to previously present justly, in all material respects, the true financial position of ABC Company as of December 31, 20X2, 20X1 and 20X0, and the results of its operations and its cash flows for the years then ended in conformity with the accounting principles that are generally accepted in the United States of America. (Signature) (Date) |

How TallyPrime can help?

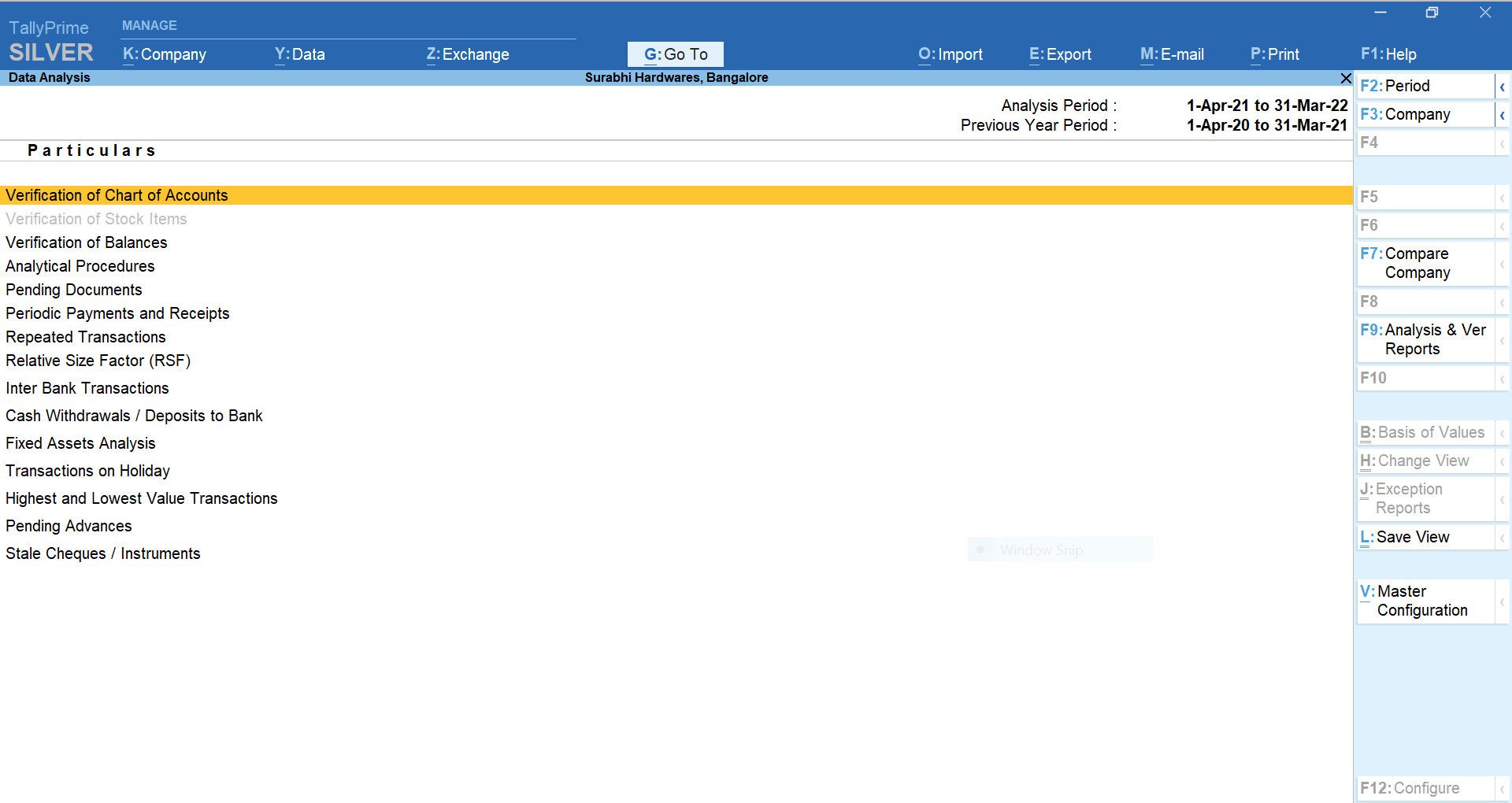

Tally makes life easier for your accountants, auditors and other users. Auditors will find their work easier with inbuilt audit/verification tools available in TallyPrime. The data analysis tools facilitate in conducting internal analysis and verification of the company's financial data. Thus, helping in identifying exceptional areas and thereby ease the process of verification.

TallyPrime also comes with a voucher verification tool that helps you verify all the transactions or apply the required sampling method and verify only the sampled transactions to form the auditor opinion. The same process applies can be applied for forex vouchers as well.

FAQs

1.What are the 4 major types of audit reports?

The four primary types are Clean, Qualified, Adverse, and Disclaimer of Opinion. Some auditors may also issue an Emphasis of Matter report for special cases.

2. What is the importance of an audit report in business?

An audit report ensures transparency, boosts investor confidence, and helps businesses stay compliant with financial and legal standards.

3. What is the difference between qualified and unqualified audit reports?

A qualified report points out limited issues, while an unqualified report confirms complete compliance and accuracy.

Watch Video on TallyPrime’s Audit

Read more: