Driving a successful business today demands tight control over administrative expenses. These costs, spanning legal fees, office rent, utilities, and supplies, are critical for daily operations yet can quickly spiral if not carefully managed. Administrative expenses are a key fundamental impacting your financials and bottom line.

Ineffective administration expense management allows overhead to needlessly escalate, hurting profitability. Mastering this area equips you to streamline operations and optimize spending. In this guide, we'll explore the definition of administrative expenses and review real-world examples. Understanding and controlling these costs enables business owners to enhance financial performance and growth.

What are administrative expenses?

Administrative expenditures are corporate operations and management overhead, not core function costs. Effectively managing the bottom line requires understanding administrative expenditures.

Accounting administrative expenditures include payroll, utilities, office rent, supplies, and other non-production or sales-related expenses. These include HR, finance, executive leadership, and general administration expenditures.

Organizing and limiting administrative costs streamlines operations and boosts profits. To improve financial performance, businesses must understand overhead expenses. This includes a wide variety of normal company expenditures, such as:

- Office rent and utilities

- Office supplies - stationery, printer ink, refreshments etc.

- Insurance - property, liability, health

- Legal, accounting, and other professional services

- Repairs and maintenance

- Licenses, fees, and subscriptions

- Payroll expenses like salaries and benefits

- Software costs

- Marketing overheads

- Interest paid on loans

Administrative expenses examples

Executives salaries, professional fees, and office supplies are some of the primary examples of administrative expenses. However, the expenses are just not limited to these examples. Taking the time to understand exactly where your money is going under this broad expense category helps ensure nothing slips under the radar. To understand this better, let's look at some real-world administrative expenses examples:

- Executive and management salaries: Administrative expenses incur the salaries of executives and senior management.

- Office rent/utilities: Fixed costs essential to your business's operation include the monthly rent and utility expenses. These furnish the necessary physical workspace for your team.

- Insurance: It is imperative that you procure sufficient general liability, professional, and health insurance for the company and its employees.

- Travel/transportation: Whether to administer remote teams, attend conferences, or meet with clients, travel expenses are almost always a component of business operations.

- Legal/professional fees: Consulting, accounting, and compliance services assist in maintaining the compliance and efficiency of your business.

- Office equipment and supplies: These items help your staff be more productive, from stationery to PCs to printers.

Administrative expenses = Employee Salaries + Rent for Office Space + Utilities + Office Supplies + Insurance Premiums

The importance of administrative expenses for streamlining operations

Efficient accounting practices are crucial for streamlining administrative processes and controlling expenses. Firms can easily lose track of where their money is going without effectively controlling and managing administrative expenditures.

As a business owner, you must streamline and declutter how your business manages routine administrative processes. This enables one to enhance profitability, allocate resources towards core operations, and optimize unnecessary expenses. So, what are some ways to streamline administrative processes?

- Spend less time and money by automating repetitive duties such as bills and data entry.

- Implement electronic document management to decrease expenses associated with paper and storage.

- Office leases, insurance premiums, and other substantial administrative expenses should be renegotiated.

- Analyze licenses and subscriptions to reduce unnecessary expenditures.

- Implement spending limits and approval workflows for administrative purchases.

- Utilize a robust accounting application, such as Tally Solution, to completely understand all administrative expenses and make decisions based on data.

- The implementation of automated expense monitoring, reporting, and analytics reduces the need for manual labor.

Enhanced administrative workflows and intelligent accounting tools enable you to allocate your resources toward critical business operations. Not only do streamlined operations result in decreased administrative costs, but they also increase organization-wide productivity. Make an intentional attempt to streamline the administrative processes and overheads of your business. Achieving efficiency and cost savings in the long run is well worth the effort.

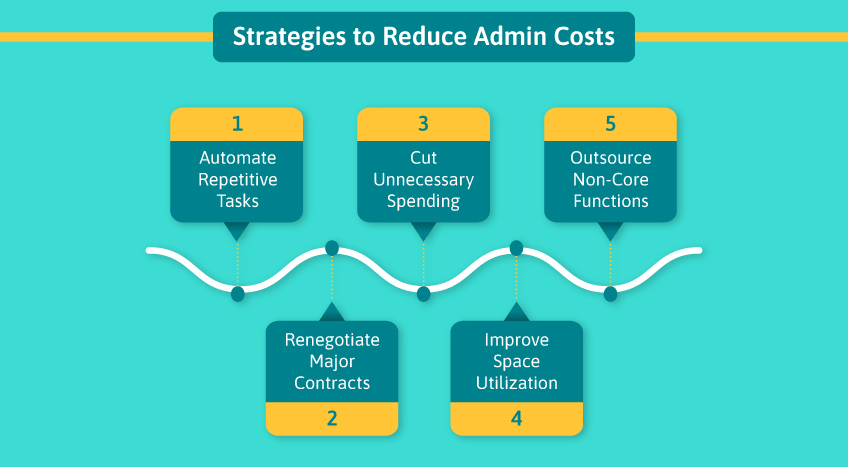

Strategies to reduce admin costs

Implementing effective strategies in your business helps you reduce admin costs. Here are some strategies that will help you reduce admin costs:

Automate repetitive tasks

Implementing automation is a highly efficient method for reducing administrative expenses. Implementing workflows and software can streamline data entry, invoicing, payroll, and reporting processes. This decreases manual work and the associated costs of salaries and errors. Integrating accounting software such as Tally Solutions can automate critical financial processes.

Renegotiate major contracts

Attempt to identify opportunities for fixed administrative expense optimization. Negotiate office leases, insurance fees, maintenance contracts, and subscriptions to identify where you may save money. A mere 10–20% decrease in significant recurring expenditures can immediately positively impact one's financial performance.

Cut unnecessary spending

Examine every administrative expense with a frugality mindset. Credit card statements and accounting ledgers should be analyzed to prevent unnecessary expenses. To prevent inefficiencies, enforce approval workflows for administrative purchases. Profit margins are enhanced by a few thousand dollars of reduced expenses; even the smallest savings accumulate.

Improve space utilization

Office-based businesses incur significant administrative expenses in the form of rent and utilities. Optimize office space utilization by considering options like cubicle sharing, hoteling, and remote working. This increases cost-effectiveness and provides employees with greater flexibility. Accounting fundamentals facilitate data-driven real estate decision-making.

Outsource non-core functions

Not all administrative duties require in-house specialists. The cost of outsourcing repetitive tasks such as debt collection, tech support, and payroll to specialized services firms is often less than the cost of administering them internally. Furthermore, this enables your group to concentrate on high-value goals.

Wrapping up

Business owners seeking to simplify operations and increase profits must understand and optimise administrative expenditures. While not directly related to production or sales, these overhead expenditures are essential for HR, finance, management, and administration to run smoothly.

Businesses may detect inefficient expenditure and cost reductions by tracking office rent, utilities, professional services, supplies, and staff salaries. Automation, contract renegotiations, expenditure limits, and office space optimisation reduce administrative costs.

Most importantly, powerful accounting software like Tally Solutions enables data-driven expenditure monitoring, approval procedures, and analytics-backed insights to monitor and decrease administrative expenses.

Prudent spending management boosts profitability, competitiveness, and resources that may be strategically transferred to revenue-generating core businesses. Businesses that prioritise administrative expenditure containment thrive and succeed.