Every company, small or big, relies on accounting and auditing to keep its finances in order. While auditing is essential for keeping financial records accurate and transparent, effective accounting processes establish the groundwork for both. Accounting and auditing work hand in hand to guarantee accurate financial reporting and conformity with rules and regulations. It is impossible to exaggerate the significance of these tasks in today's corporate environment when accountability requirements are rising, and financial transactions are becoming more intricate.

Investors, lenders, consumers, and government agencies can have faith in only a company that uses trustworthy accounting procedures and undergoes independent audits. Besides all these, accounting and auditing also aid internal decision-making and performance evaluation. Today, we will go into the reasons why accounting and auditing are crucial for businesses and how they help companies and their stakeholders.

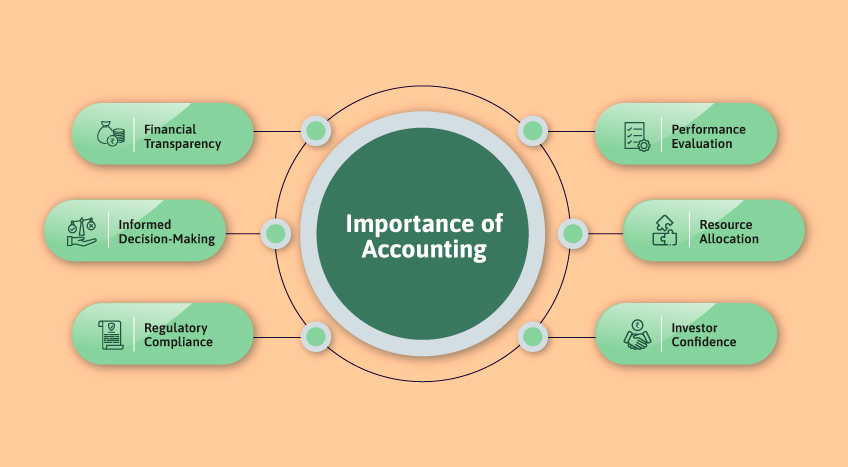

Importance of accounting for running a successful business

From tracking incomes and expenditures to evaluating business performance, accounting plays a vital role in running a business and providing a clear picture of its financial health. Accounting in business is a process that documents, summarizes, evaluates, and reports a company's financial transactions. It helps make financial decisions with clarity and transparency. As a strategic tool, it is essential for small businesses and giant firms, and its impact is seen across many areas.

Financial transparency

Accounting records help get a clear and accurate understanding of a business's financial health. It offers anyone with a stake in a company's financial health—including investors, managers, and regulatory agencies—insight into the company's earnings, debt, and holdings.

Informed decision-making

Accounting provides decision-makers with up-to-date and correct information, which is crucial for businesses since it allows them to make educated decisions. A good grasp of the financial situation and clearer insight allow one to make educated decisions regarding budgeting, resource allocation, and investment plans.

Regulatory compliance

It is critical for businesses to follow all applicable regulations and standards. By following accounting standards, businesses can reduce their exposure to legal risk and increase stakeholder confidence by meeting all financial reporting and regulatory obligations.

Performance evaluation

Accounting allows for measuring a company's success over time by keeping track of revenue, expenditures, and profits. This performance data is essential in spotting patterns, evaluating progress, and tweaking tactics for long-term success.

Resource allocation

The foundation of good management is the efficient distribution of resources. Businesses may maximize their efficiency and production by allocating resources according to their strengths and weaknesses, which accounting helps to reveal.

Investor confidence

Investors' confidence solely depends on transparency and openness. Investors are encouraged to have faith in companies with strong accounting standards. They can depend on reliable financial data to make educated investment decisions.

6 reasons why auditing is important for businesses

Businesses create financial statements to show stakeholders their financial performance, but how can you ensure these financial figures are correct? The answer is financial auditing, a process of inspecting and verifying a company's financial records. It guarantees the honesty, openness, and dependability of the financial information that is included inside a corporation. The following is a rundown of the most critical characteristics that show the significance of auditing:

Financial accuracy and reliability

Auditing is a process that verifies the correctness of financial records, which gives stakeholders the comfort and confidence that the information given is trustworthy and accurately reflects the organization's actual financial status.

Compliance assurance

Auditors are responsible for determining whether or not the financial statements and records comply with the accounting principles and regulatory standards. Consequently, this guarantees that the firm satisfies the legal criteria, which in turn helps to cultivate confidence among investors, creditors, and regulatory committees.

Fraud detection and prevention

Auditors are an essential component in the process of identifying fraudulent activity. Their comprehensive analysis enables them to uncover inconsistencies, abnormalities, or indications of financial mismanagement, which in turn assists companies in putting into place effective fraud prevention measures into place.

Risk management

The efficacy of internal controls and risk management systems is evaluated through auditing within the context of risk management. Auditors allow firms to strengthen their internal procedures by detecting flaws, which, in turn, reduces the risk of financial errors or irregularities occurring throughout the organization at large.

Enhancing accountability

The use of audited financial statements helps improve accountability among management and stakeholders. In addition to ensuring that people entrusted with financial obligations are held accountable for their actions, auditors' confidence fosters prudent decision-making about financial matters.

Investor and creditor confidence

The stamp of approval from auditors instills trust in both investors and creditors. They rely on audited financial accounts to make educated judgments, evaluate the status of an organization's finances, and determine whether it is feasible to invest or lend money.

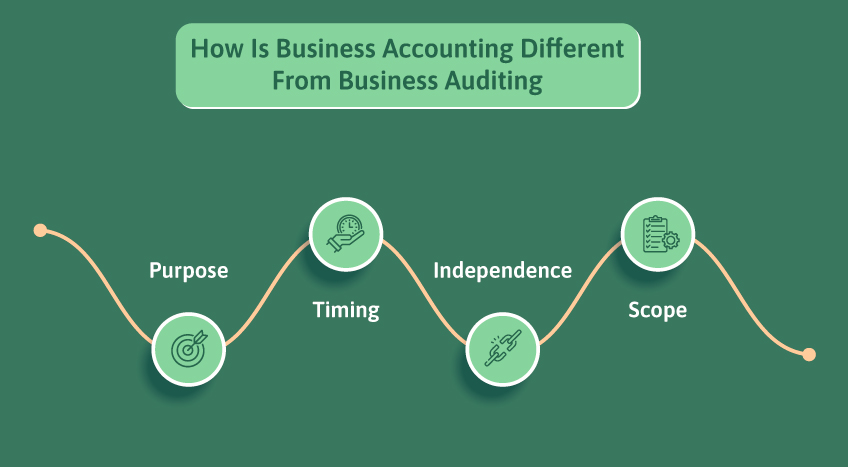

How is business accounting different from business auditing

Accounting and auditing are equally important for every business and its growth. The two, however, differ in their purpose, nature, and functions.

Here is the prime difference between accounting and auditing you must know:

Purpose

- Accounting is the process of detecting, measuring, documenting, categorizing, summarizing, and reporting financial transactions. Its function is to keep financial records for a company.

- Auditing is the process of verifying and evaluating the quality and dependability of accounting records and financial statements. Auditors assure standard compliance through independent assessment.

Timing

- Accounting operations occur daily, weekly, or monthly during the accounting period to record all company transactions as they occur.

- Auditing occurs after the accounting period, which is usually once a year. It is a procedure that examines accounting work completed in the previous period.

Independence

- Accountants in a business are often involved in day-to-day accounting duties and financial record management as part of their jobs.

- On the other hand, auditors are objective third parties who are not involved in the upkeep of the accounting records. They offer an independent outside perspective on the financial statements.

Scope

- More extensive tasks include bookkeeping, financial reporting, budgeting, and internal financial analysis.

- Auditing has a tighter emphasis, focussing on financial statements and internal controls. Auditors attempt to guarantee that accounting standards and regulatory obligations are followed.

Final takeaways: TallyPrime for accurate accounting

Accounting and auditing hold their own unique significance in every business. Accounting gives a clear and accurate understanding of the organization's financial health, whereas auditing ensures the integrity and correctness of financial records. TallyPrime is an accounting software designed to simplify corporate administration. With the help of our automatic accounting software, you can keep track of and interpret your financial activities for a better and more comprehensive understanding.

TallyPrime allows MSMEs to create over 400 distinct reports, such as invoicing, accounting, and management control reports. TallyPrime also offers financial flow and credit management. The software can also be integrated with payroll management, allowing you to automate employee payments and guarantee transparency. Depending on your business strategy, you can categorize personnel and monitor attendance. For easy payment, TallyPrime includes features for check management and automatic bank reconciliation.