- Accounting Equation – Definition

- Accounting Equations Rules

- Accounting Equation Fundamentals

- Types of Accounting Equation and Formulae correlation

- Accounting Equation Examples

What is accounting equation?

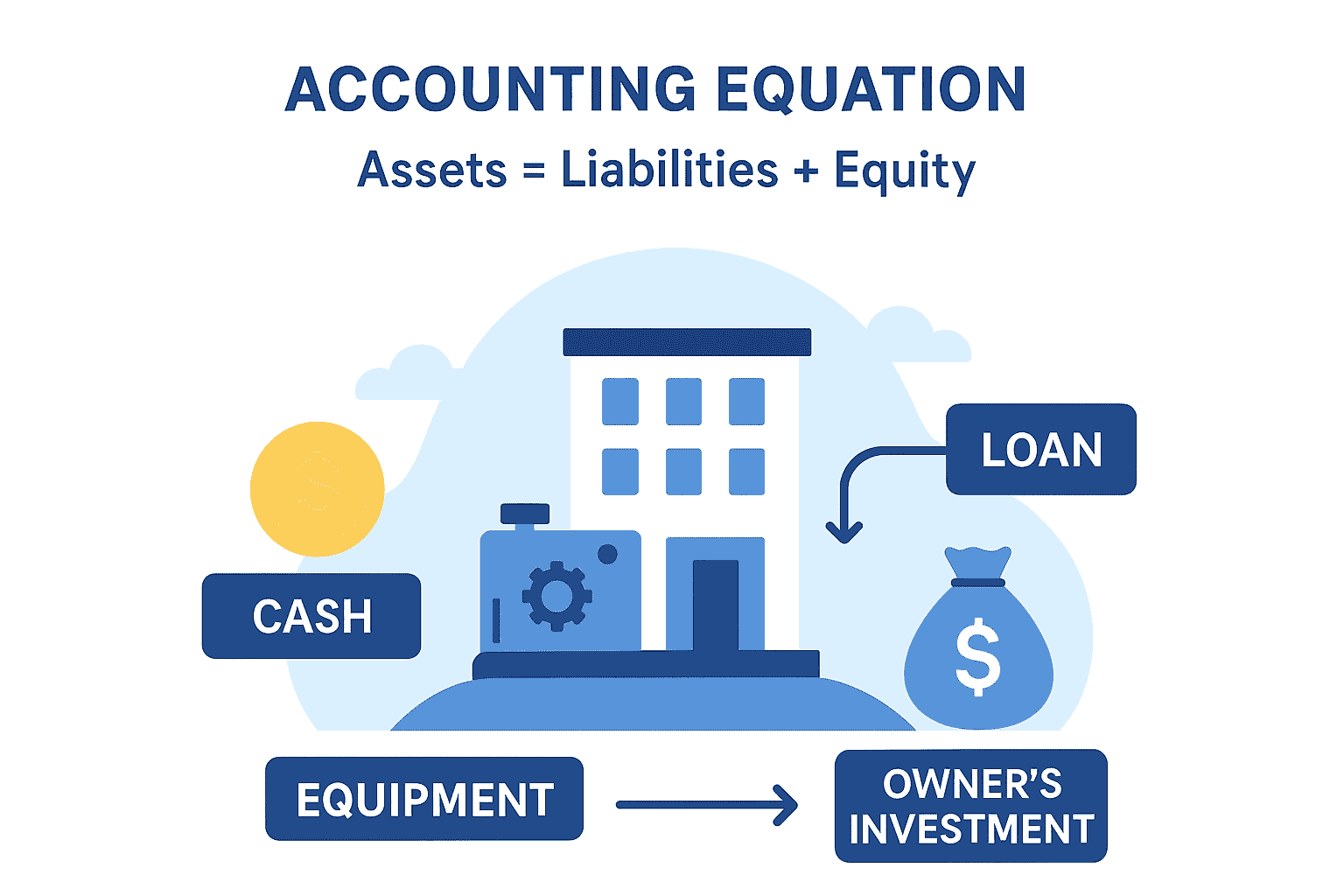

The accounting equation summarizes the essential nature of double-entry system of accounting. Under which, the debit always equal to credit (Debit=Credit), and assets always equal to the sum of equities and liabilities (Asset=Equity + Liability). Accounting equation can be simply defined as a relationship between assets, liabilities and owner’s equity in the business.

Components of the Equation:

- Assets: Resources owned by the company, such as cash, inventory, equipment, and accounts receivable.

- Liabilities: Obligations or debts the company owes, like loans, accounts payable, or mortgages.

- Equity: The owner's stake in the company, including investments and retained earnings.

How it works with real-world example

Let's understand these fundamentals through some real-world examples.

Example 1: Purchasing Equipment with Cash

Imagine you run a small coffee shop and decide to buy a new espresso machine for 70,000 using cash from your business bank account.

Here's how this affects the accounting equation:

Assets: The transaction causes two changes within your assets. Your Equipment (an asset) increases by 70,000. At the same time, your Cash (another asset) decreases by 70,000.

Liabilities & Equity: There is no change to your liabilities or equity.

The equation remains perfectly balanced because one asset went up while another went down by the exact same amount.

Before: Assets (Rs 50,000) = Liabilities (Rs 10,000) + Equity (Rs 40,000)

Transaction: +70,000 Equipment, -70,000 Cash

After: Assets (Rs 50,000) = Liabilities (Rs 10,000) + Equity (Rs 40,000)

Example 2: Taking Out a Loan for Expansion

Now, let's say your coffee shop is thriving, and you want to expand. You secure a business loan of Rs 2,50,000 from a bank to fund the renovation.

Here's the impact on your books:

Assets: Your Cash increases by Rs 2,50,000 because the loan money is deposited into your account.

Liabilities: Your Loans Payable (a liability) also increases by Rs 2,50,000, as you now owe this amount back to the bank.

Equity: Your equity is not directly affected by this transaction.

Both sides of the equation increase by Rs 2,50,000, keeping everything in balance.

Before: Assets (50,000) = Liabilities (10,000) + Equity (40,000)

Transaction: +2,50,000 Cash, +2,50,000 Loan

After: Assets (3,00,000) = Liabilities (2,60,000) + Equity (40,000)

Example 3: Earning Revenue from Sales

Throughout the day, you sell coffee and pastries to your happy customers. Let's say you make 15,000 in cash sales.

This is how it affects the equation:

Assets: Your Cash increases by 15,000.

Liabilities: There is no change to your liabilities.

Equity: Your Retained Earnings (a component of equity) increases by 15,000. Revenue increases profit, and profit increases the owner's stake in the business.

Again, both sides of the equation increase by the same amount, maintaining the balance.

Before: Assets (3,00,000) = Liabilities (2,60,000) + Equity (40,000)

Transaction: +15,000 Cash, +15,000 Retained Earnings

After: Assets (3,15,000) = Liabilities (2,60,000) + Equity (55,000)

Accounting equation rules

The accounting equation connotes two equations that are basic and core to accrual accounting and double-entry accounting system.

The following are two basic rules of accounting equation that distinguishes the accrual system of accounting from cash basis accounting, and single-entry system from the double-entry system:

- The first among them is the basic accounting equation which written as Assets = Liabilities + Equities.

- The second one is termed as ‘Expanded Accounting Equation’ which is a combination of the basic equation and secondary equation i.e. Debit = Credit.

It derives its status only from the accrual system of accounting and thereby, it does not apply in a cash-based, single-entry accounting system.

How the accounting equation connects to financial statements

The accounting equation forms the foundation for key financial reports like the Balance Sheet and Income Statement.

Balance Sheet:

The Balance Sheet is essentially a snapshot of the equation.

It is pertinent to note that the term basic accounting equation is another name for the ‘Balance Sheet Equation’. The reason balance sheet always balances is because of the following equation:

Assets = Liabilities + Equity.

It shows what the business owns and owes at a specific point in time. The ingredients of this equation - Assets, Liabilities, and Owner's equities are the three major sections of the Balance sheet. By using the above equation, the bookkeepers and accountants ensure that the "balance" always holds i.e., both sides of the equation are always equal.

Income Statement:

The Income Statement links to equity by tracking revenues and expenses over time. The expanded equation looks like this:

Assets = Liabilities + (Capital + Revenue – Expenses).

As the business earns or spends money, equity is adjusted accordingly.

This connection helps you see how daily transactions feed into larger reports that guide decision-making and growth.

Types of accounting equation and formulae correlation

The entire financial accounting depends on the accounting equation which is also known as the ‘Balance Sheet Equation’. The following are the different types of basic accounting equation:

- Asset = Liability + Capital

- Liabilities= Assets - Capital

- Owners’ Equity (Capital) = Assets – Liabilities

Assets = Liabilities + Owner’s equity

This balance sheet equation tells you that all the assets owned by the business are either sponsored using the owners’ equity or the amount which company should owe others like suppliers or borrowings like Loans

Liabilities = Assets – Owner’s Equity

The difference of assets and owner’s investment into business is your liabilities which you owe others in the form of payables to suppliers, banks etc.

Owners’ Equity = Assets – Liabilities

This equation reveals the value of assets owned purely by owner equity.

While trying to do this correlation, we can note that incomes or gains will increase owner’s equity and expenses, or losses will reduce it.

Extended Version of The Accounting Equation

The extended accounting equation is the following:

Assets = Liabilities + Contributed Capital + Beginning Retained Earnings + Revenue - Expenses - Dividends

What are the limitations of the accounting equation?

Accounting equation comes with its own limitations. To begin with, it doesn’t provide an analysis of how the business is operating.

Furthermore, it doesn't totally keep accounting mistakes from being made. In any event, when the balance sheet report adjusts itself, there is still a chance of a mistake that doesn't include the accounting equation.

FAQs

What is the basic accounting equation formula?

The basic accounting equation formula is:

Asset = Liabilities + Equity

What are the three accounting equations?

The three components of the accounting equation are assets, liabilities, and equity.

Why does the accounting equation always need to balance?

The equation ensures that every transaction is recorded accurately. Assets must always equal the sum of liabilities and equity, which reflects the true financial position of a business.

What’s the difference between assets, liabilities, and equity?

-

Assets are resources the business owns (like cash, equipment).

-

Liabilities are obligations the business owes (like loans or unpaid bills).

-

Equity is the owner’s stake in the business after liabilities are subtracted from assets.

What is double-entry bookkeeping and how is it related?

Double-entry bookkeeping means that for every transaction, at least two accounts are affected—ensuring the accounting equation stays balanced.

What happens if the equation doesn’t balance?

It indicates an error in recording or calculation. This must be corrected to maintain accurate financial statements and ensure compliance.

Read More on Accounting

Accounting Software, Accounting Principle, Accounting Methods, Accounting Rate of Return, Cash Accounting, Accrual Basis of Accounting, Financial Accounting, Cost Accounting, Golden Rules of Accounting, Accounting Standard, Cash Accounting vs Accrual Accounting, Cost vs Management Accounting