Keeping track of financial activities is important for business owners and entrepreneurs to better balance their accounts. It also helps maintain precision, uniformity, and adherence to accounting standards. The one fundamentals of accounting that helps business owners achieve this with efficiency is the accounting cycle. It entails a series of procedures for documenting, categorizing, summarizing, and disclosing business transactions that take place within a specified accounting period.

The accounting cycle documents, summarizes, and reports financial transactions to provide business owners with meaningful financial information. Although the cycle may appear complicated, it produces realistic financial results that reveal your company's success. Understanding this cycle helps you use financial data for decision-making and accounting efficiency. Let's break down the phases to simplify the accounting cycle and maximize its commercial benefits.

Accounting cycle for financial management

The accounting cycle is the process of recording, summarizing, and reporting a company's financial transactions over a specific period. It systematically documents all business activities, converting raw data into meaningful financial statements. These statements provide critical insights into the company's performance, enabling informed decision-making.

Rather than just crunching numbers, the accounting cycle serves as a strategic tool for understanding a business's financial health. Business owners who grasp the accounting cycle can leverage their financial information to monitor progress, mitigate risks, identify opportunities, and drive sustainable growth. Mastering the accounting cycle empowers entrepreneurs to make data-driven choices, an invaluable asset for long-term success.

Benefits of an efficient accounting cycle

From budgeting to expense tracking, the accounting cycle helps business owners in different facets of their financial objectives. It also leads them to increased accuracy and efficiency. The primary benefits of efficient accounting cycle for business owners are:

- Accurate financial reporting: Generates error-free, audit-ready financial statements through rigorous adherence to accounting principles.

- Up-to-date visibility into business performance: Enables real-time monitoring of crucial metrics and trends by processing transactions as they occur.

- Data-driven strategic decision making: Provides validated financial data and analytics to inform pricing, budgeting, growth strategies, and more.

- Measuring past financial strategies' effectiveness: Allows comprehensive evaluation of previous tactics based on historical performance data.

- Compliance with accounting standards and regulations: Ensures adherence to accounting standards and legal obligations.

- Accurately reflecting business performance: Results in precise financial statements that thoroughly depict the company's operations.

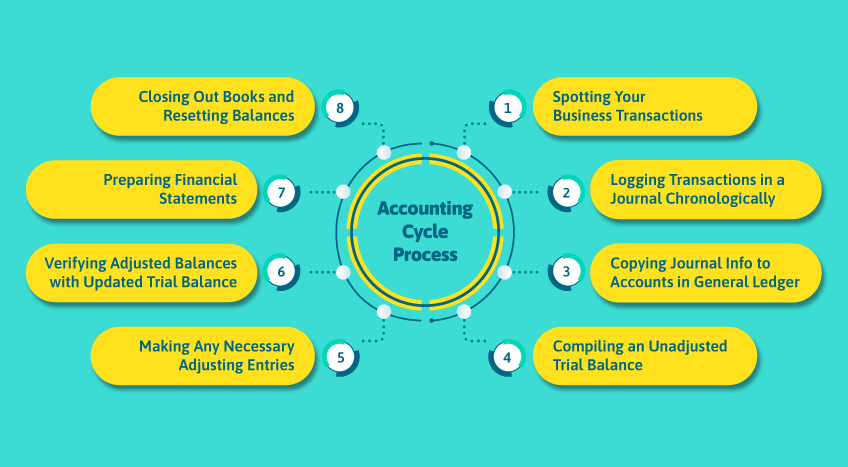

Steps in the accounting cycle process

The eight-step accounting cycle is critical for every accountant and business owner to understand. These divided tasks include the following steps:

Step 1: Spotting your business transactions

The accounting cycle commences with the identification of every financial transaction that your business undertook within the specified period. Such transactions as sales, purchases, payroll, income, and expenses can significantly affect your financial position. It is imperative to meticulously document each and every transaction, regardless of its magnitude; even a cup of coffee acquired for a client meeting ought to be chronicled. A meticulous identification and documentation of every transaction establishes the foundation for precise accounting.

Step 2: Logging transactions in a journal chronologically

Once all transactions have been discovered, they must be recorded in a diary by date. A chronological record of your financial activities produces a timeline. By using debit and credit notation, this procedure generates journal entries that identify which accounts each transaction affects. Tracking transactions in a journal provides an organized history so you can look back and reference details if needed.

Step 3: Copying journal info to accounts in general ledger

Subsequently, the journal entry data is transmitted or posted to amend the balances of the respective general ledger accounts. Throughout the entire period, the general ledger provides a comprehensive record of all financial transactions broken down by account. The grouping of transaction data by account facilitates the monitoring of statuses.

Step 4: Compiling an unadjusted trial balance

Before the preparation of financial statements, the balances of all general ledger accounts are detailed in an unadjusted trial balance. The trial balance serves as an initial verification process to detect and address any inconsistencies in the ledgers before moving forward with the subsequent procedures. Consider it a dress rehearsal before the major performance.

Step 5: Making Any necessary adjusting entries

Journal entries are adjusted as necessary to conform to accounting principles and ensure that revenues and expenses are balanced. Adjustments commonly made in accrual-based accounting consist of depreciation, allowance for poor debts, prepaid expenses, unearned revenue, and so forth. These modifications help in constructing a precise depiction.

Step 6: Verifying adjusted balances with updated trial balance

An adjusted trial balance is generated once all adjusting entries have been incorporated. This ensures that, after adjustments, debits and credits in your ledgers are equal. Fixing any discrepancies before the compilation of official financial statements is possible.

Step 7: Preparing financial statements

After adjusting the accounts and ensuring that the trial balance accurately reflects the balances, the time has come to generate the official financial statements. The income statement, balance sheet, cash flow statement, and statement of retained earnings are typical components of this.

Step 8: Closing out books and resetting balances

At the end of the accounting period, the accounts are closed to conclude the accounting cycle. In order to revert temporary account balances to zero, including revenues, expenses, and dividends, closing entries are generated. This effectively resets the balance sheet, thereby initiating a new accounting cycle.

Wrapping up

Mastering the accounting cycle provides vital visibility into your business's financial health and performance. By systematically recording, processing, and reporting transactions, you gain data-driven insights crucial for driving growth and success. While manual accounting can be tedious, leveraging solutions like Tally Solution can automate and streamline the cycle through real-time updates and seamless integration. Implementing an efficient accounting cycle, whether manually or through software, is essential for monitoring financial performance and positioning your business for long-term prosperity.