- What is cash management?

- Why is cash management important to any business?

- What is ACH?

- What does working capital include?

- What are some causes of problems with cash management?

- How to optimize cash flow management?

One of the most critical aspects of managing a business is cash management. It is also called treasury management. The people in a company who are usually connected to cash management are CFOs (Chief Financial Officers), business managers, and corporate treasurers. They outline the company’s cash management strategies and all cash-related decisions and responsibilities. Often the people who should be managing and optimizing the cash flow are not fully aware of the methods of doing so. When there is improper cash management within a business, it can result in many financial problems. Regular reporting and analysis of the company’s cash flow is essential for the company’s financial stability and good health.

What is cash management?

The process of collecting and managing the cash flow from the activities of a company, such as investing, financing, and operating, is called cash management. It is essential to manage cash well to maintain the organization’s stability. Cash management includes the management of financial instruments such as market funds, treasury bills, and certificates of deposit.

|

How Does Accounting Information Help in Decision Making? The Employer’s Guide |

Cash is the primary asset of a company or individual. It is essential for the daily operational expenses and to settle obligations and debt. Cash management services are offered by individuals and institutions. The Primary financial and cash management provider is usually a bank. Companies also offer financial management solutions to companies and individuals to help them best use their cash and get the maximum returns.

Cash is used for operating expenses such as paying taxes, salaries, inventory purchases, rent, etc. It is also used as capital for investments such as long-term deposits, property, plant, equipment (PPE), and non-current assets. The extra cash that remains after expenses usually goes towards the distribution of dividends. A company with multiple heads under which there is an inflow and an outflow of cash needs detailed management of cash to keep the company stable.

Cash Management Is Vital To A Business

Why is cash management important to any business?

The people who manage the company’s cash flows are usually the chief financial officers, business managers, and corporate treasurers. They perform functions such as cash management strategies, stability analysis, etc. It is common for many companies to outsource their cash management to outside service providers.

Company analyses the cash flow report to study the pattern of their cash flow management. This is a report that details the cash inflows and outflows. The cash flow report is inclusive of the cash flows of operating activities, investing activities, and financing activities. The bottom line of the cash flow statement reveals the amount of cash that is readily available for an organization. This statement has three parts; investments, financing, and operating activities. The operating section based on the net working capital is listed on the cash flow statement as the company’s current assets minus current liabilities. It is always the aim of a company to make the current assets exceed the current liabilities.

The cash outflows and inflows usually deal with the investing and financing activities of the company, such as real estate, new equipment, machinery, inventory, or paying out dividends. A company usually has controls to manage the efficiency of cash flows. The most important components of cash flow that are managed are the average length of account receivables, write-offs, collection processes, rates of return on investments, liquidity, and management of the credit line.

Cash management is the foundation of the financial stability of a company. TI is the primary asset that the company uses to pay for its expenses and obligations. It is essential to effectively manage the outgoing cash flow to maximize the earnings of the company. It is equally important to optimize the earnings from idle cash. Efficient cash management is essential for the growth of the business.

What is ACH?

An Automated Clearing House or ACH is an electronic funds transfer system run by the National Automated Clearing House Association (NACHA) that manages and allows for payments in the U.S. ACH usually clears most debit and credit transactions on the same day. The organizations creating these transactions are the ACH Originators. ACH transactions are electronic payments that authorize the ACH originators to debit or credit from the customer’s bank account. For example, a company that is directly depositing the person’s salary due into their bank accounts.

What does working capital include?

Generally, working capital includes the following:

Working capital usually includes the current asset and the current liabilities.

Current assets

- Cash

- Inventory stock

- Accounts receivable within one year

Current liabilities

- Accounts payable due within a year

- Short-term debt payments due within one year

Most companies record the change in working capital for each reporting period under the operating section of the cash flow statement. When this change is positive, it indicates that the current assets to cover the current liabilities have increased. When it is negative, it indicates that the current liabilities have increased, meaning there is an inability to pay the liabilities. This change directly affects the cash on the bottom line.

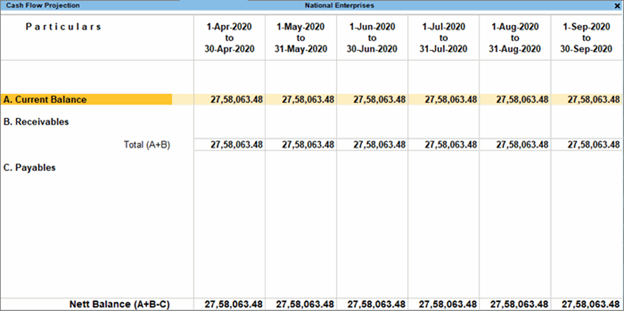

Cash Flow Projection Report From Tally

What are some causes of problems with cash management?

Despite cash management being so vital to the stability and growth of a company, it is often neglected. The most common causes of poor cash management are:

Lack of understanding of the cash flow cycle

An efficient business understands the proper timing of cash inflows and outflows. This is crucial to perfectly time activities such as inventory purchases and pays cash to accounts payable. Sometimes, when a company is faced with unexpected peaks in orders, they may need to purchase a huge amount of inventory yet have insufficient cash due from sales. This causes a cash crunch due to a lack of timing and foresight.

Profit vs cash

As described above, there may be a timing difference between purchasing the inventory needed for a production boom and receiving money for the sales. The sudden increase in demand may look favorable on the income statement and show a profit. But, unless the cash for sale is received, the company will still face a deficit of cash. This occurs because the administration does not understand the distinction between profit and cash flow. So, a company growing too fast may generate revenue but may lack cash flow.

Lack of cash management skills

Sometimes managers do not take the extra effort to educate themselves in the nuances of cash flow management. Every manager needs to be able to analyze and optimize the cash flow of the business. This requires having procedures, systems and a framework in place so that all receivables are collected in time and that payables are paid on time and not too much in advance.

Unwise capital investments

Sometimes a company may invest money in a project or product that does not perform as well as expected. This results in insufficient cash flows or returns on investment. The project or investment may become a drain on the company’s cash flow and impact the cash balance.

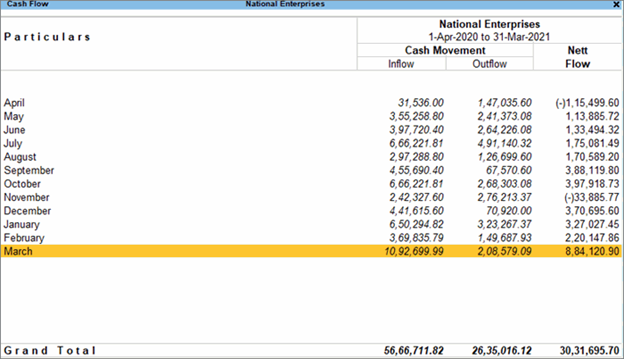

Monthly Cash Flow Report From Tally

How to optimize cash flow management?

When a company does not correctly report and analyze their cash flow statements, they have no way to visualize the overall cash flow. It is essential to use a complete business management solution such as TallyPrime to generate complete and accurate cash flow statements. Regular reporting of the cash flow enables management to make informed decisions. It also helps them to change their strategies when they see that the cash floor for a given period is not optimal. Cash flow management should be given the importance that it deserves and be an integral part of its strategies and goals. Convenient and easy-to-use cash management tools such as TallyPrime enable the proper and efficient management of the company’s cash flow. Good cash management fuels the growth of the company and directly impacts the bottom line of the company. The right tools such as TallyPrime aids the efficient reporting and management of the company’s cash flows.

Read More: