- Accounting information and decision making

- Lenders

- Investors and stakeholders

- Accountants

- How do business owners use account information?

- How is an accounting information system helpful in decision making?

Accounting is vital to managing and steering a business in the right direction. Without a proper accounting system, how would you know if a business is making a profit or loss? Investors, bankers, and other lenders would have no way of gauging the financial health and status of the business without business accounting. Financial accounting reports are vital to informed decision making.

Accounting information and decision making

Informed decisions are intelligent and safe. Instead of working on hunches or opinions, a business person would do well to base their decision-making on actual facts and figures. This is exactly what accounting reports are. Accounting reports give you an overview of the money flow within the business. You can also drill down to the details when required.

Accounting also drives the decision-making outside the company. If a potential investor needs to decide on whether to invest in the company, they assess the accounting reports of the company to determine how well the company is doing.

Lenders

Access to capital is vital to the start and continued growth of a business. It is rare that a business owner starts their business entirely with their own funds. Businesses most often raise money either through investors or lenders. People and entities who put their money into a business would only do so if they have the confidence that they are going to get good returns from it. Lenders would need to know if the company is capable of repaying the amount that is lent.

A business owner has to demonstrate the attractiveness and potential of investing in the business. For a new business, this can be achieved by showing financial projections. An established business will have to show lenders the accounting reports of the recent past to illustrate that you are indeed a business worth lending to. This is especially important when you borrow from institutions.

Lenders usually require you to submit audited copies of the following reports for credit analysis:

- Income statements

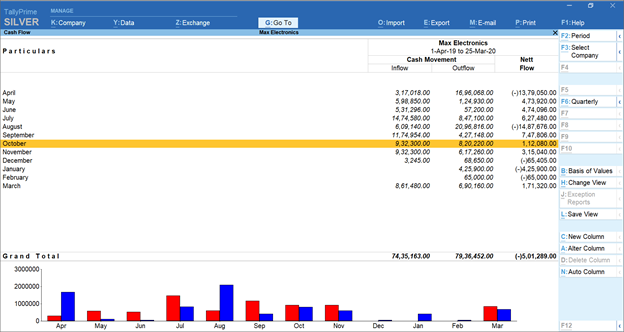

- Cash flow statements

- Business tax returns

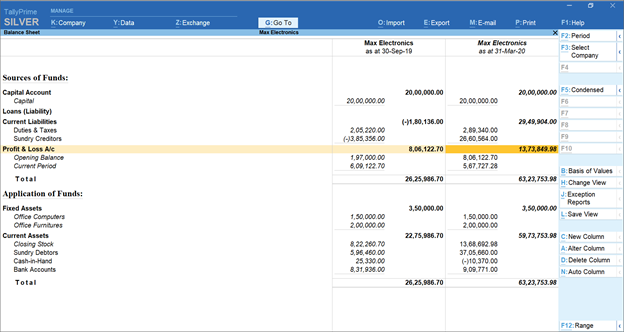

- Balance sheets

These reports may be the deciding factor in whether or not the institution is willing to extend credit to you and may also determine the quantum of the amount.

Cash Flow Statement Generated By Tally

Investors and stakeholders

Just as lenders do, investors and stakeholders also require precise and accurate financial information to base their decisions on. Startups need investors to put together enough capital to get their business off the ground. To attract investors, you need more than an idea. Investors appreciate a sound business plan and financial projections.

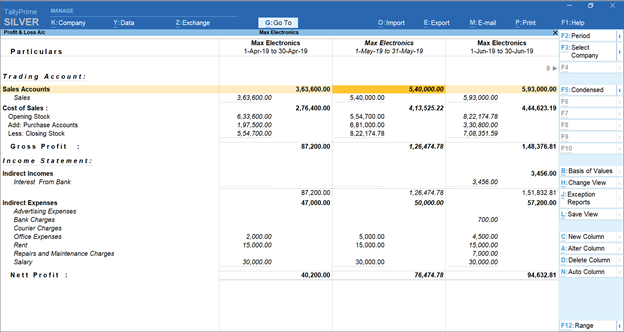

An existing company may need additional investments to expand and grow. Investors study the income and cash flow in the company to determine if it is financially healthy. Income statements are also useful to study if the business is generating an income consistently or if it is sporadic and unreliable. Accurate financial reporting is essential for investors to assess the risk and benefits of investing in the business.

Tally Generated Balance Sheet Gives An Overview Of Finances

Accountants

An accountant is often called upon when financial decisions such as buying more equipment or taking on more human resources are considered. An accountant can only give sound advice and make decisions based on the financial reports of the company. Reports tell the accountant the capability of the business to spend at that time. If not, the accountant would have to advise that the business take a loan in order to make the addition of equipment or people. Accounting tools for business decision making makes the accountant’s job so much easier.

How do business owners use account information?

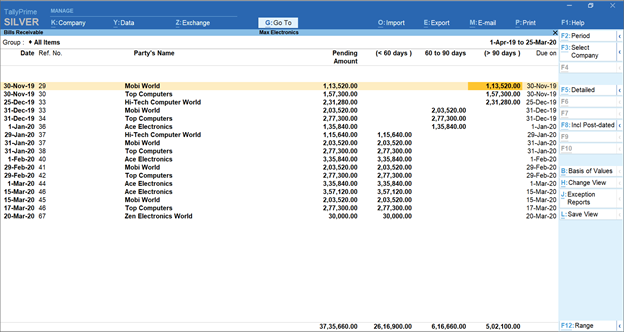

Business owners get a clear picture of how their business is faring through accounting reports. Important decisions such as how much to budget for the time period, whether to expand the business, acquire more equipment or manpower, or downsize should be made based on the actual financial status of the company. The balance sheet and the profit and loss account give a larger overview of the company’s finances. Accounts receivable and accounts payable are also of interest to the business owner. They indicate how much money is owed to the company and how much the company owes to others.

Bills ageing report generated by Tally

A business owner or manager cannot make well-informed decisions unless they have access to real-time accurate data about the finances of the company. Earlier, the accountant would be called upon to produce accounting reports. But, an accounting software makes accounting reports easily accessible to the business owner, management, accountants and other decision makers.

Accounting reports help the business owner see if the company made a profit or loss in the last year. They can also compare the profit or loss to the previous year’s figures. They can study how much they have spent on raw materials, manpower, and overheads. This can help streamline or negotiate the rates for expenses that are too high.

If a business is doing well and there is money available, a business owner can plan the budget to reinvest the money and improve or expand the business in the next year. If the financial status is healthy, employees can be given a raise and more essential human resources can be hired. Such decisions can have a huge impact on the amount of money that is budgeted and spent for the next accounting period. If these decisions are made carelessly or without studying the financial status of the company, the results can be disastrous.

How is an accounting information system helpful in decision making?

To recap, accounting information is essential at all levels of the business internally and externally for decision making. Every decision in the company whether it is getting a loan, hiring more staff, budgeting, pricing goods, investing, expanding, or downsizing needs sound financial information.

Financial information and reporting should be accessible at all levels of the company. The mid and lower levels of management also require good accounting information and reporting to perform well. For example, if the reports show that the high cost of raw materials is impacting the profit margin, the company will have to renegotiate prices with their suppliers, find cheaper suppliers or adjust the sale price of their goods. These decisions cannot be made arbitrarily and must be backed with the numbers to support the decision.

The profit and loss account gives business owner vital information

Maintaining accounts with manual pen and paper methods makes it very difficult to access quickly in real-time. By the time a report is manually prepared, the information may be outdated. In the current business world, companies have to be very nimble and quick in their decision-making. So, manual methods of accounting are a big stumbling block to quick and informed decision-making. Even in a small business, going through numerous files and receipts and then compiling them into a summarised report is a painstaking and slow process.

Some people use spreadsheets to capture and store their accounting information. This is a good method to produce graphs and reports based on specific data. However, to produce an accounting report you still have to extract and distill the data from your spreadsheets and compute the report manually. Using software accounting tools for business decision-making makes reporting real-time and instantaneous.

TallyPrime is a business accounting software that can be used at all levels and in all departments of a business. Accounting tools for business decision making ensure that your record keeping is accurate and reflects on the accounting ledgers accurately. TallyPrime gives you complete access and control over your business’ accounting for decision making. You store every transaction digitally and whenever required generate the reports that you require with a few clicks.

TallyPrime also has different levels of access so that different decision makers in the business can access only the reports that are relevant to them. By speeding up reporting it enables the decision makers to make quick and well informed decisions without having to call on an accountant. It makes your business nimble and quick to react to any changes in the market or the business.

Explore More Products