Your first tax season is like playing a frantic game without a rule book, and this teaches you what preparation is all about. It’s different out there, where you are expected to learn things such as forms, deadlines, and deductions. But Don’t Worry.

Focus on the subject. It isn’t as bad as it looks at first. This guide opens out new, unique strategies you can use to ensure your first tax season is fruitful. So take out your financial toolbox and fasten your seat belt - we’re off to the world of taxes as one unit.

Grasp the game: Taxes explained

Consider taxes to be one of the rules of a game. For you to deserve to win the tournament, ensure that you comprehend the procedures. The first step is defining what qualifies as income subject to taxation. It’s not just your salary; it could also include earnings from freelance gigs, profits from your business, or interest earned on savings accounts, as well as fixed deposits.

Now, let’s discuss about tax forms. For salaried employees it is essential to get acquainted with Form 16. It outlines their earnings and TDS (tax deducted at source). Similarly, business owners have their responsibilities, including filing GST returns, maintaining profit and loss (P&L) accounts, and more. The more familiar you are with these basics, the easier your tax season will be in the future.

The rookie mistakes: What not to do?

Mistakes are part of being new; however, in the case of taxes, they are far more costly in terms of time and finances. The most frequent fault is procrastination. Deadlines tend to fly under the radar, and missing the tax filing due date can lead to additional fines and interest charges. Setting reminders or alarms can come in handy to avoid straying from the schedule or forgetting important dates.

Another mistake rookies tend to commit is under-utilising taxation and its benefits. Deductions offer numerous opportunities to decrease taxable income. Participating in PPF, buying insurance, and claiming tax reductions for home loan interest or rent can dramatically help decrease your tax obligations.

One crucial step is the mandatory linkage of Aadhaar and PAN. The government has made this linkage a requirement, with the last date for compliance set as [Insert Last Date]. Failure to link Aadhaar and PAN can render your PAN inoperative, leading to issues with tax filings and other financial transactions. Ensure this is done promptly to avoid complications.

Finally, do not practice cutting corners when it comes to accuracy. Even a minute detail, such as misspelling your name or incorrectly typing in your PAN number, can earn you an embarrassing letter from the taxation office. Make it a rule to check important information more than once.

What to do if you receive a tax notice?

Receiving a tax notice can be unsettling, but panicking won't help. Here is a simple ABC guide to handle it:

Assess the Notice: Carefully read the notice to understand its purpose. It might be a discrepancy in your return, a mismatch in reported income, or a simple verification request.

Be Prepared with Documentation: Gather all necessary documents, such as your tax return, Form 16, investment proofs, and other relevant records. Ensure you have all the required paperwork to respond appropriately.

Consult a Professional: If the issue is complex or unclear, consult a tax expert or chartered accountant. They can help you draft a proper response and ensure compliance with the notice requirements.

Most importantly, respond within the stipulated timeline mentioned in the notice to avoid penalties. Addressing the issue promptly and accurately can resolve the matter smoothly.

Gather your tools: The requirements to file taxes

There are a few documents and relevant data that you must have on hand before you begin the actual filing. This means you have to organise your materials in a systematic way. These include:

Proof of salary

This can be in the form of pay slips, invoices as a freelancer, or profit-loss reports of any business activity.

Investment accounts

Investments can include deposits made to PPF, ELSS, and active insurance policies. Section 80C covers deductions for tuition fees, ELSS (Equity Linked Savings Scheme), PPF, and life insurance premiums. Section 80D allows deductions for medical insurance premiums for self and family, while Section 80G provides deductions for donations to eligible charities.

Loan details

This includes student loans, home loans, or business loans. Home loan interest can be deducted under Section 24(b), while principal repayment qualifies under Section 80C. For student loans, interest payments are deductible under Section 80E.

Expense records

Critical for business owners, these include rent receipts, utility bills, and operational expenses. Deductions under Section 37(1) apply to expenses incurred wholly for business purposes, such as rent, repairs, salaries, and travel. Additionally, depreciation on assets can be claimed under Section 32.

Keeping such documents ready facilitates the filing process and minimises the likelihood of errors.

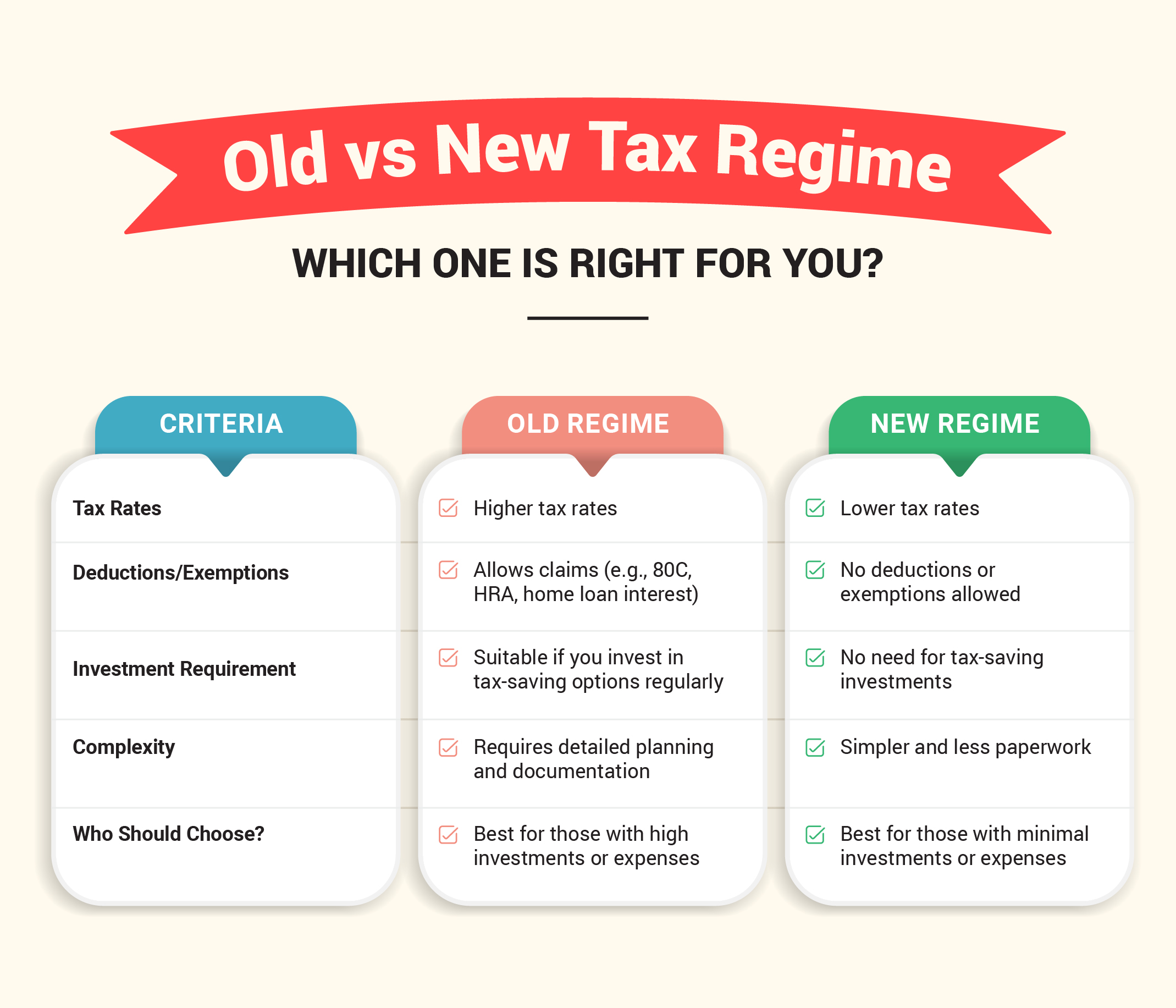

Know the rules: Old vs new tax regime

Starting 2024, the new tax regime is the default. All ITRs will be filed under the new regime unless the old regime is explicitly chosen.

India's taxation system offers two regimes: old and new. The old regime allows tax benefits through exemptions and deductions, ideal for those investing in tax-saving instruments or with specific expenses like rent.

The new regime has lower tax rates but fewer exemptions, suitable for those preferring simplicity without multiple deductions.

To choose, calculate your tax liability under both regimes using online tools like income tax calculators.

Planning for future tax seasons

Your first tax season is primarily a period for education. Use it as an opportunity to prepare for whatever challenges lie ahead. To begin with, make it a point to be disciplined and organised for the rest of the years. Capture all your earnings, expenditures, and investments on a near real-time basis, thus making it easy to file the next year’s returns.

Get accounting programs or even simple Excel sheets to manage your finances. Review your initial tax return to check for any errors or deductions you may have missed. This time around, make observations and do better the next time around.

Thus, ensure that you follow changes in the tax code. A new allowance or better tariff may yield benefits only if you know about them. Develop a habit of looking out for changes at the commencement of every fiscal year.

Conclusion

Unlike most rookies, you can go through your first tax season as an expert by being well-prepared and avoiding the pitfalls. With the right strategies and a clear understanding of your financial situation, tax filing can be made easy. Taxes are a year-round responsibility and always remember that every tax season is an opportunity for enhancement.