Financial Year 2024 marked a significant achievement for India’s lending industry. A total of 27.4 million MSME loans were sanctioned in FY 2024, indicating a large YoY growth in loan demand among MSMEs. The demand for small business loans is skyrocketing with the increasing number of MSME enterprises in the country.

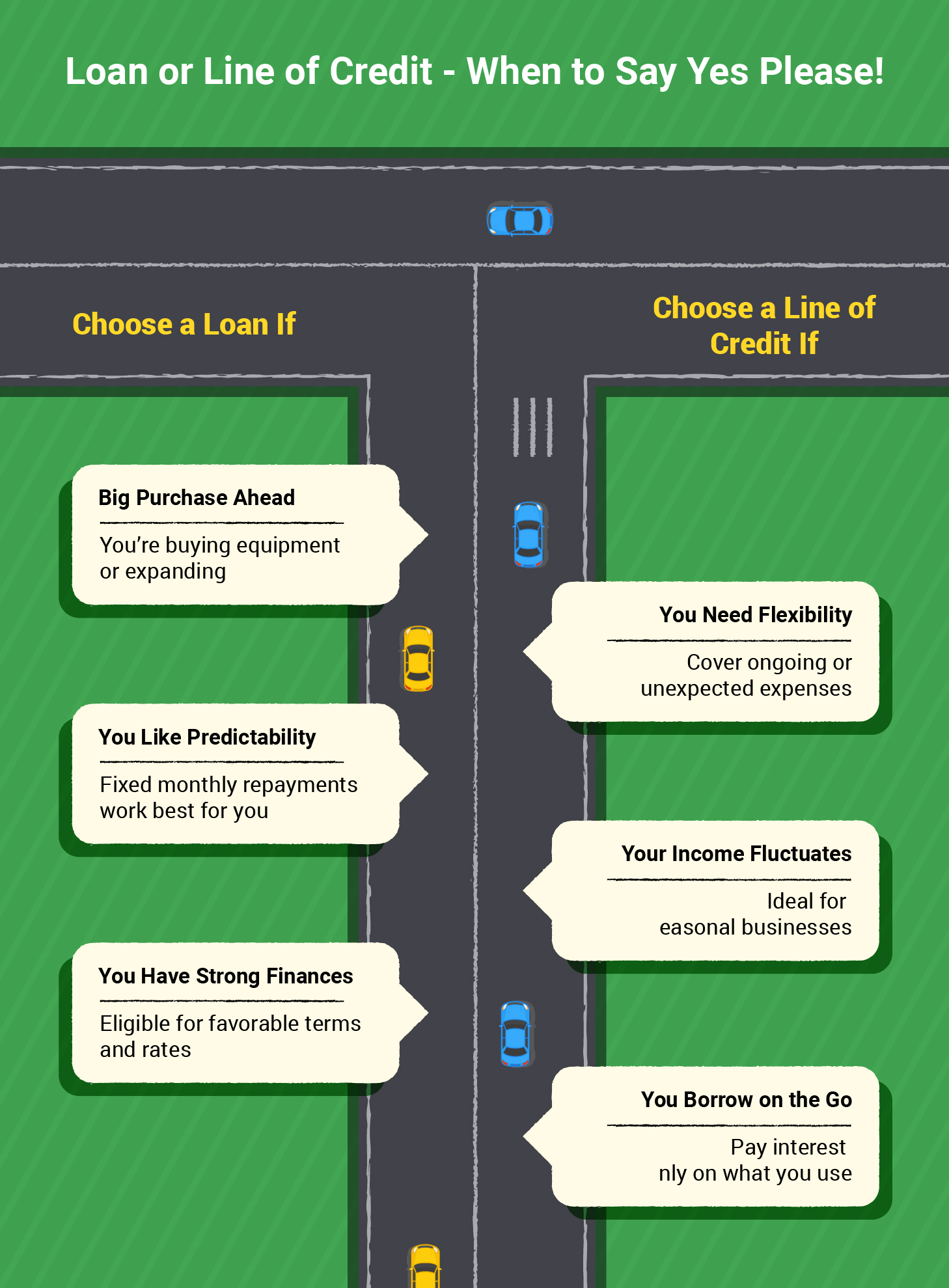

Business owners seek financing through small business loans or lines of credit to fund the company's needs. In this blog, we will dive into what small business loans and lines of credit are, how they differ from each other, the benefits and drawbacks of each, and how to decide which one to get.

What is a small business loan?

A small business loan is designed to provide funding to small enterprises for various purposes. Generally, this is used to meet one-time business expenses, such as buying equipment to expand operations or hiring new employees.

The repayment terms for small business loans are generally fixed, meaning you will know exactly how much to pay each month. The loan amount, interest rate, and repayment period depend on factors such as your business’s financial health, creditworthiness, and the lender’s policies.

Common types of small business loans

- Term loans: These are traditional loans with fixed interest rates and repayment schedules. They can be used for short-term and long-term financing needs.

- Equipment finance: It is used to purchase equipment and is secured by the equipment itself as collateral.

- Invoice financing: This is a financial solution where a business can borrow money using their unpaid invoices.

- Merchant cash advances: In this arrangement, the business receives a lump sum payment in exchange for a portion of future sales. The loan is typically repaid through a percentage of daily credit card transactions.

What is a line of credit?

In contrast to a traditional loan, a line of credit provides more flexibility in financing. It’s a revolving credit facility that allows business owners to borrow money up to a predetermined limit, repay it, and then borrow again as needed. This is akin to a credit card but specifically designed for business purposes.

A line of credit can be utilised to finance working capital, seasonal needs, or any emergency requirements. Interest is only charged on the amount borrowed, and once the debt is repaid, those funds become available again for borrowing.

There are two main types of business lines of credit:

Revolving line of credit: This is the most common type, where you can repeatedly borrow and repay funds within a credit limit.

Non-revolving line of credit: This doesn’t allow you to borrow again once you’ve paid off the borrowed amount.

Key differences between small business loans and lines of credit

Both small business loans and lines of credit are used to fund businesses, but they differ significantly in structure, usage restrictions, and repayment terms. Understanding these differences will help you determine which option best meets your business needs.

|

Feature |

Small business loan |

Business line of credit |

|

Loan amount |

Fixed amount and is given upfront. |

Access to funds is up to a limit. |

|

Repayment structure |

Fixed monthly payments. |

Flexible payments based on usage. |

|

Interest rates |

Fixed or variable interest rate. |

Interest is charged only on the borrowed amount. |

|

Best for |

One-time, large-scale investments. |

Ongoing, variable cash flow needs. |

|

Collateral |

Secured loans-require collateral Unsecured loan- no need for security |

Secured line of credit - requires collateral Unsecured line of credit- no need for security |

|

Approval process |

Can take time, often requiring extensive documentation. |

Faster approval process, with fewer documentation requirements |

Pros and cons of small business loans

Here are some of the advantages and disadvantages of small business loans:

Pros

Predictable payments: With fixed repayment terms and interest rates, business owners can plan their finances more accurately. The set repayment schedule allows for consistent budgeting and financial forecasting.

Large loan amounts: Small business loans generally provide access to larger sums of money, making them ideal for significant investments like purchasing equipment, business expansion, or acquiring property.

Long-term financing: Many small business loans come with longer repayment terms, providing flexibility in managing debt settlement and reducing short-term financial strain.

Cons

Strict qualification requirements: Traditional loans often require strong credit scores, a history of steady revenue, and a solid business plan. Businesses with limited financial histories or poor credit may struggle to qualify.

Lengthy approval process: The process of applying for and securing a small business loan, especially SBA loans, can be time-consuming. It may take weeks or even months before funds are disbursed.

Fixed repayments: The fixed nature of the payments means you must adhere to a set schedule, which could be challenging for businesses experiencing fluctuating income or cash flow.

Pros and cons of lines of credit

The advantages and disadvantages of lines of credit are detailed below.

Pros

Flexibility: A line of credit allows you to borrow only the amount you need. Once the borrowed amount is repaid, those funds become available again for borrowing.

Quick access to funds: In most cases, the approval process for lines of credit is faster than for other loans. This makes it an excellent option for businesses facing urgent, short-term financing needs.

Interest on borrowed amount: You’re only charged interest on the funds you borrow, making lines of credit a more cost-effective option for funding smaller, variable expenses.

Cons

Variable interest rates: Many lines of credit come with variable interest rates, meaning your repayment amounts could increase if rates rise.

Lower credit limits: Compared to other forms of small business financing, lines of credit typically offer smaller amounts. This makes them suitable for short-term financial needs but not ideal for long-term, large-scale projects.

Risk of over-borrowing: This credit facility is recurrent and may force businesses to borrow beyond their capacity due to debt-feed. However, there is a need to employ this financial tool appropriately.

Tips for securing financing

Follow these tips to secure the right financing:

- Check your credit: Do this to assess your financial health and understand your creditworthiness.

- Prepare financial documents: Have your balance sheets, tax returns, and cash flow statements up to date.

- Create a business plan: Allocate the funds towards a clear plan, specifying how the money will be used and outlining your business goals.

- Compare lenders: Check different moneylenders for the lowest interest rates, terms, and fees.

- Understand the terms: Know how much interest you will pay and the repayment schedule.

Choosing between a small business loan and a line of credit depends on your business’s financial needs. The former is ideal for large, one-time expenses, while the latter offers flexibility for managing cash flow and smaller ongoing costs. By understanding your needs, preparing carefully, and comparing your options, you can secure the right financing to help your business grow and succeed.