If you are reading this, you have done most of the hard work in your business. You have now set up your business and created and streamlined the processes. Well, congratulations on that part! Now comes the financial aspect.

When you sell your goods or services to your customers, how do you ensure they pay you the correct amount within the right time? Will you verbally communicate with them about your dues? Will you draft a contract and get it signed by them about what they need to pay you and when? These thoughts must have surely crossed your mind at some point. So, what is the solution, you may wonder?

As an entrepreneur, you are familiar with the world of invoicing. Just like your face is the index of your mind, an invoice is the index of your business. It bears the name, logo, and details of your business. So, what more do you need to represent your business to the outside world?

If your invoicing system is correct, almost nothing stops funds from flowing into your account. But if you are keen to master the art of invoicing, we will help you ace it. The comprehensive guide below will help you work out the nitty-gritty of invoicing and take your business to the heights you desire.

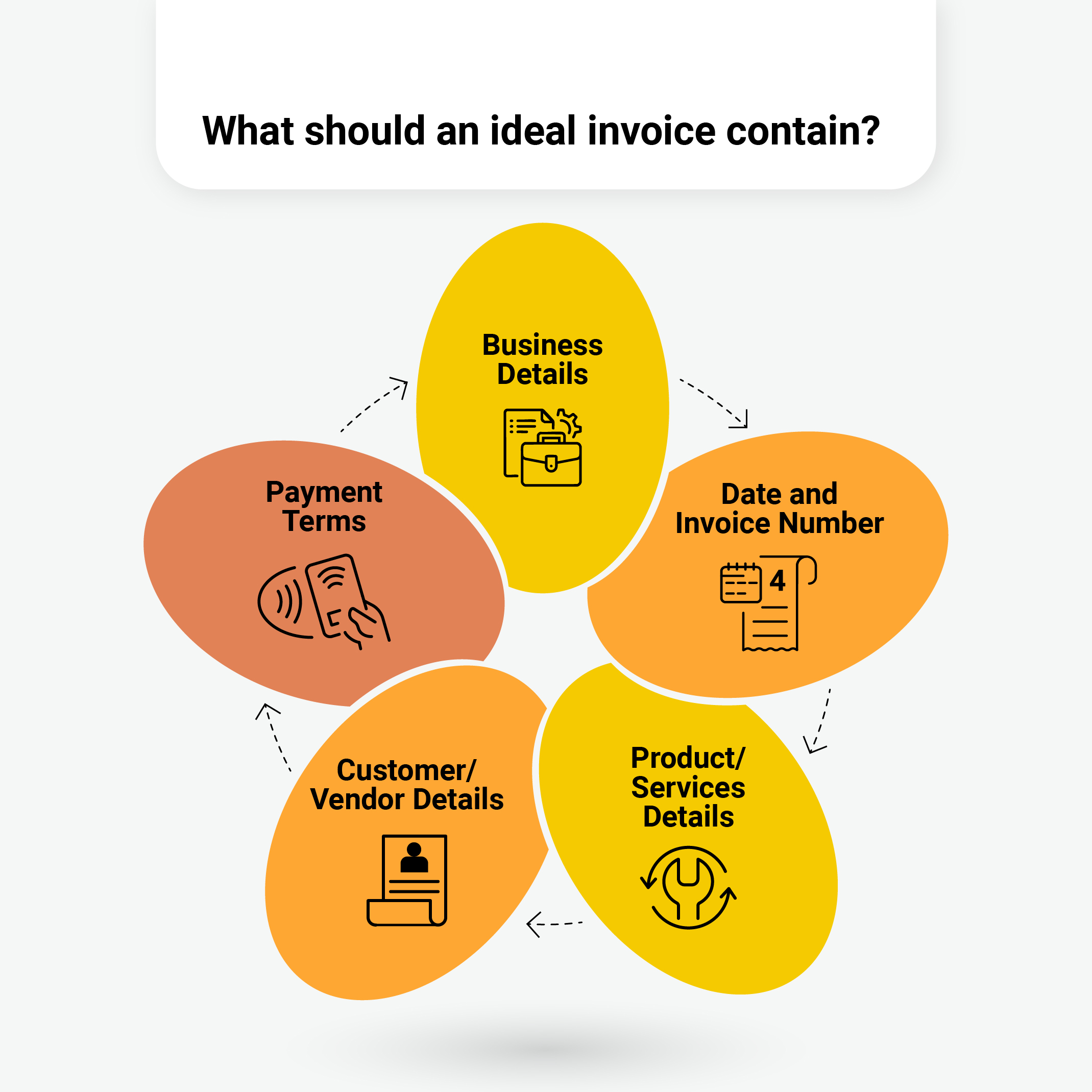

What’s inside matters!

A newspaper may look all glossy and attractive from the outside, but if it carries yesterday’s news, it is of no use to you. Similarly, your invoice may be colourful and well-designed on the face of it. However, if it doesn’t contain valid information, it is useless to your stakeholders.

- Details of your business: You can’t go wrong with this one! Your invoice should mandatorily contain the name, address, contact number, and email address of your business.

- Date: When are you raising the invoice, and when should you receive payment are crucial details. Without these, your invoice is as good as a blank canvas.

- Details of customers and vendors: If you want your invoices to show you real money, you must accurately fill in the complete details of your customers and suppliers/vendors to whom you intend to send these invoices.

- Products/Services details: Here comes the meaty part of your invoice! If your invoice fails to capture this part correctly, your accounting can go for a toss and impact your relationship with your stakeholders.

- This is the part where you accurately enter the type of product/service you offer, the number of items sold, the rate per item, and any other taxes/fees applicable to the items.

- You and your customers/vendors should be in sync with the items mentioned here to avoid problems like incorrect payment or delayed payment later.

- Terms of payment: You can shout all you want from the roof, “Show me the money” to your business establishment. However, unless you mention the payment terms clearly on the invoice, that money isn’t going to come, at least not when you want it to! What’s the total due? What mode of payment will your clients use? When should they pay you? What are the late payment charges, if any, if payment doesn’t happen within the due dates? The answers to these questions should be filled in this field.

Thorough audit: Check your invoices thoroughly before sending them to the recipients. You don’t want to cut a sorry face before your stakeholders, do you? Check the invoices thoroughly for silly mistakes, missed/inaccurate information, etc.

Choosing the right invoicing tool/software

Automation is key in today’s world. To ensure quick and accurate generation of invoices every single time, you need proper invoicing software or automated tools. If all you have before you are the devil and deep sea, your troubles end here. Here are a few tips to choose an invoicing software, that can prove to be the guardian angel for your business.

- Customised designs – This will help in increased visibility and timely payment of your invoices.

- Integration of multiple payment modes – Offer and integrate various payment modes like debit/credit cards, UPI, net banking, and more.

- Compatibility with many languages and currencies – This is essential when you deal with international clients.

- Compatibility with multiple devices — In today’s tech-savvy, dynamic business landscape, compatibility with various devices, such as mobiles, laptops, tablets, and smartwatches, is vital.

- Access to multiple reports – To make important decisions, you must have easy access to multiple reports, such as outstanding payments, refunds, and failed payments.

Follow-ups — The key to effective invoicing!

You do know that only the crying baby gets attention, don’t you? Well, your business is no different than this. We don’t mean you have to keep crying for your payments. However, you have to resort to a certain degree of follow-ups through reminders to let your customers know that it’s time for payments.

When you choose smart invoicing software, you don’t have to do the follow-up manually. The software will take care of it for you. When the due date is near, your customers/vendors/suppliers will receive a reminder. If they haven’t paid within the due dates, the software sends an email notifying them of late payment charges and urging them to pay immediately.

Tips to avoid common invoicing mistakes

Consider the following tips to avoid common invoicing pitfalls —

- Ensure on-time disbursal of invoices to clients

- Design professional-looking invoices with customised templates for added credibility

- Double-check every field thoroughly

- Be transparent about the charges (like extra fees, late payments, and taxes)

- Clearly state payment terms in simple-to-understand language

- Double-check the recipient’s name

- You must provide and maintain digital copies of invoices

- Consider using automated invoicing software; look for one that can be customised to meet your business’s exact needs

- Ensure regular follow-ups on your invoices

Wrapping up

Once you use customised software, you will realise that invoicing was never that scary and confusing in the first place! When you set right your invoicing process, you can be assured of timely payments. This will give you enough funds to keep your operations running smoothly, plan ahead, and stay in business for a long time.

Bonus – Free invoice generator

Now that you have understood the importance of invoicing, you will be thrilled to use our free invoice generator. All you need to do is fill it with the requisite information. This saves you time and effort to a great extent and lets you focus on other areas that crave your attention to take your entrepreneurial venture to newer heights.