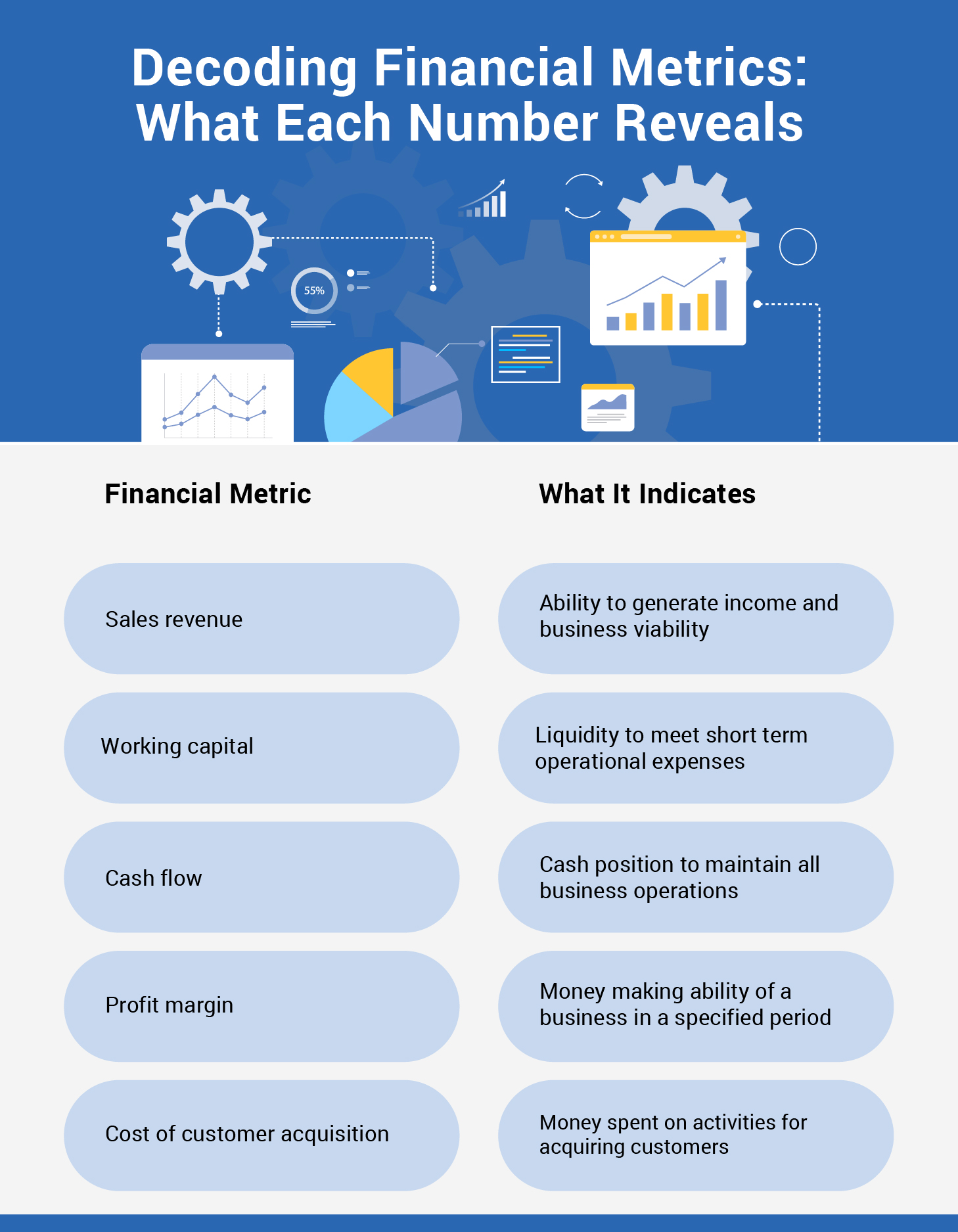

It takes a village to start a new business. But it takes a city of financial metrics to analyze the performance and health of your business. Metrics are the key to analysing of business performance. Financial metrics are considered as Key Performance Indicators that help measure a company’s progress towards a set goal.

As a new business it is important to track and analyze these metrics from the get go. It helps you find your key income generating activities, major clients, department-wise expenses, etc. An analysis of key metrics will help you determine the amount of money your business earns and burns.

A detailed analysis of these metrics can identify ways to improve your profits and cash flow. Metrics used by small businesses are usually categorized into profitability, efficiency, valuation and liquidity. But this varies as companies tend to choose those metrics that can accurately measure the profitability of their business operations.

Now that we have established the importance of keeping a close eye on financial metrics, let us move on to the key financial metrics that a new business should have a tight watch on from day one.

Key metrics for new businesses

1. Sales revenue

Imagine you sell three main categories of products; home appliances, gaming equipment and fitness equipment. Analysing the revenue figures, you find that of the three categories, the sales team closes deals for home appliances more often than the others.

On further analyses you have found that home appliances represent 50% of sales-driven revenue while the others represent 25% each. Based on this finding you decide to optimize sales efforts for gaming and fitness equipment so that revenue can be maximized across all product lines.

How to interpret sales revenue figures?

As a new business, your revenue comes from the total sales you have made. While looking at the total sales revenue for a day, month, quarter, etc., is important, it is also necessary to drill down and see how much money each sales transaction made.

Analysing your revenue figures can be done separately on individual branches, regions, products or customer segments. This will give you insights into who are your largest clients and repeat customers, which products are the best sellers and who are the top sales performers of your company.

2. Working capital

Let’s say you have two upcoming vendor payments for the purchases you made. Since both these vendors are MSMEs, you don’t want to delay their payments. So, you dip into your cash account and pay up the vendors. This cash in hand is called working capital.

Working capital means the liquidity of your company. It refers to the money available for businesses to cover the current and short-term expenses of the company.

How interpret working capital figures?

If the working capital is a positive number, your company has a healthy cash flow to manage its operations. But if this is a negative number it would mean that your company is struggling to finance its daily operations.

3. Cash flow

Money comes and goes out of business every day. Purchasing raw materials, selling goods, paying distributors, etc., are everyday activities that involve a monetary transaction. Even though this is a pain to keep track of, it is necessary as a business owner to have a tight grasp of monthly cash flow.

Say you have received two payments from sales made today. You have also paid up your raw material vendor and purchased a new machine on the same day. How will you know how much money was received and spent? You look at your cash flow statement.

How interpret cash flow?

A cash flow statement gives you all the details about your company’s cash flow – cash spent and generated by all business activities. This is called the operating cash flow. This determines whether your company is making a net profit from its core business operations, manufacturing and sales.

Positive cash flow indicates that a company has more money flowing into the business. A negative figure at the end of the cash flow statement indicates that more money is moving out of your company compared to money coming in.

Non-cash expenses are expenses that are not actually paid for with cash or credit in a given period. Examples are depreciation and amortization, deferred tax, unrealized gains or losses, etc.

4. Profit margin

Profit is the most critical of all the financial metrics. Anybody who asks you how your company is doing actually wants to know you how much profit you are shaking down from your money tree. After all, what is a successful business without enough profits right?!

Profit comparison is absolutely essential for any business owner. You should know how you are faring this year compared to last year or the last two years. This is important to measure the year-on-year growth of your business.

How interpret profit margin?

To monitor your business’s health, you should understand two types of profits: gross profit and net profit. Gross profit indicates how efficiently your company utlises labor and supplies for manufacturing goods or offering services. This helps you understand the costs needed to generate revenue.

Net profit is the amount of money that is shown in your book of accounts after you deduct all operational expenses from gross profit. This figure indicates whether your business makes more money than it spends.

5. Cost of customer acquisition

Consider that you are capturing about 20 new customers on average in a month. While this is excellent for your sales turnover, you should also think about how much money you burnt to gain each new customer.

The cost of customer acquisition includes all sales and marketing expenses including payroll for employees. Reducing this cost can directly lead to an increase in profit and gives better value per customer.

How to interpret customer acquisition cost?

A company uses several channels to attract new customers. For example, imagine you used social media advertisements and social events for capturing new customers. After analysis you found that social media ads gave you 5000 leads in just Rs 20000 while you spent Rs 50000 on social events and got only 1000 leads.

If you don’t check your metrics, then you might end up spending again on social events instead of the cost-effective option that leads to four times the leads. Analysing customer acquisition cost will help you identify the value per customer compared to the cost of acquisition. This will lead to choosing better sales and marketing alternatives that are cost effective.

How to use these key financial metrics?

These metrics must be used to make key business decisions. Take the cost of customer acquisition cost example, once you see which channels got you the most leads with the least money you will put more money into that channel.

Let’s say you were analysing your profit and loss statements for the past five years and you notice that the year-on-year growth has reduced by 2% from the last financial year. You should immediately go to the cash flow statement and check your cash flow to analyse net income generated vs net expenses. You will either see where you can cut down the expenses or decide to increase your sales revenue.

It is important to first set objectives like business valuation, efficiency percentage, profit margin, etc., and then choose the metrics for evaluation. The above-mentioned metrics are the most critical for small businesses for their initial stages of development.

Once metrics are chosen you can set benchmarks and goals that you must achieve to become a successful business. It is important to review your progress towards your goal achievement once a month.

If you are struggling with calculating cash flow and profit, explore our downloadable accounting templates. These are ready to use editable templates where you can fill in the data and easily calculate all the metrics mentioned. Also, have a look at other downloadable tools and templates essential for a small business.