Owning a business is like running a marathon. An effective business owner needs endurance, a solid plan to achieve their goals and, most importantly, patience. Now, imagine doing all of that while still staying on a budget. Sounds challenging, right?

Here’s the good news: The key to the financial health of your business and personal wealth lies in accurately monitoring your expenditures. Let’s pack our bags and embark on an adventure into the land of expense tracking, exploring a few tips and tricks.

Are you losing money without realising it?

Imagine this: It’s the end of the month, and your bank balance is far less impressive than you expected. You are left wondering why. Was it the office supplies or too many coffee meetings? Or that “special offer” subscription that renews automatically, and you never cancel it on time?

If this sounds familiar, you are not alone. Many business owners struggle to track where their money is going. But don’t worry – keeping track of expenses isn’t as daunting as one might think. With the right strategies, approaches, and tools, you can regain control of your business finances and steer them in the right direction.

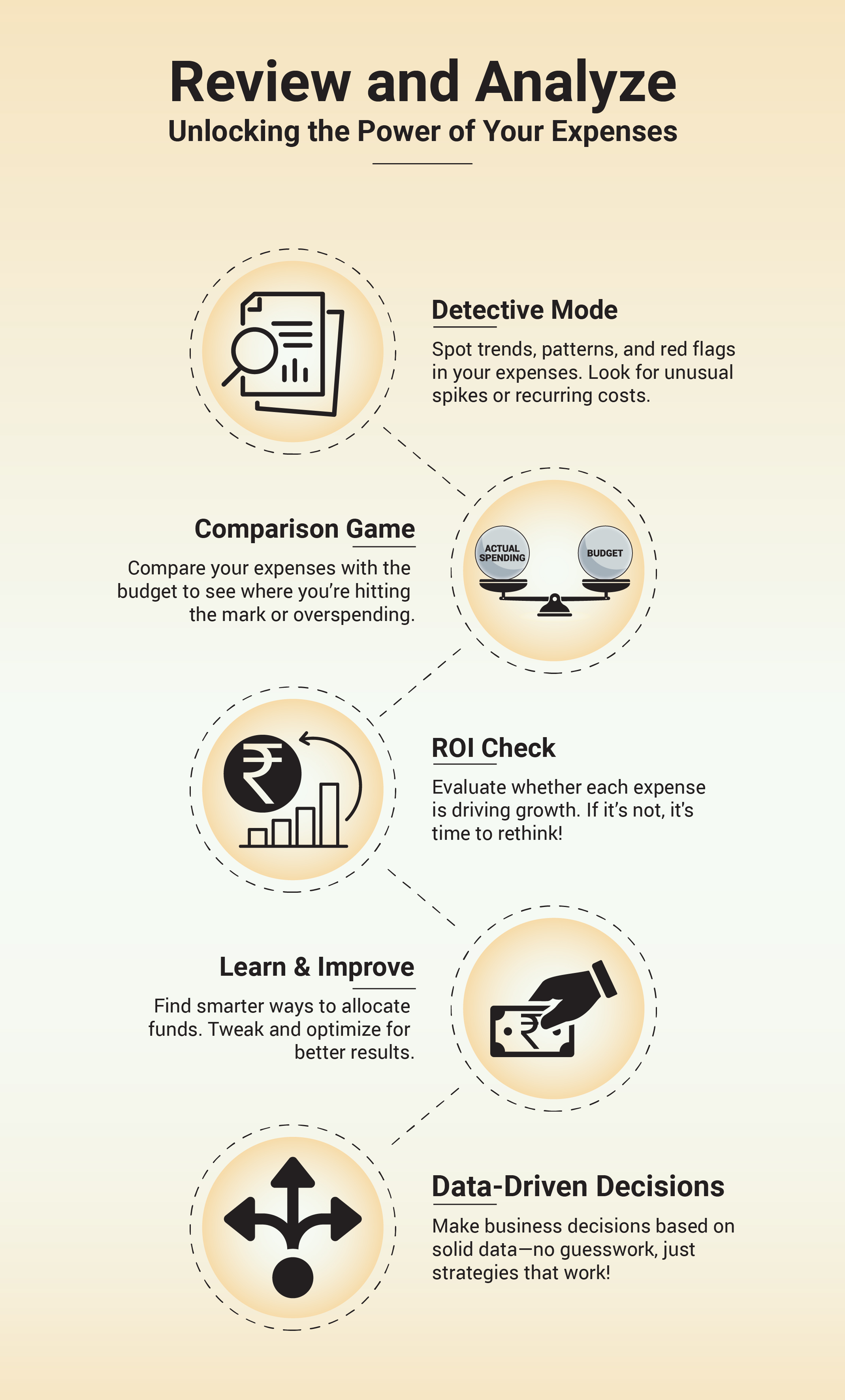

Why is tracking expenses your business’s secret weapon?

Expense tracking may be simple, but its impact is profound. It is the pillar that supports your business’s entire financial structure.

See the Money Trail: Tracking expenses shows exactly where your money is going—think of it as your business’s GPS to financial clarity.

Spot Sneaky Leaks: Find those small, unnecessary costs (like unused subscriptions or impulse buys) that quietly drain your profits.

Budget Like a Boss: When you know what you’re spending, you can plan smarter and allocate funds to things that actually grow your business.

Tax-Time Hero: Come tax season, your organized expense records will save you time, stress, and even help you claim deductions.

Make Confident Decisions: With clear numbers in front of you, you can confidently decide when to invest, cut back, or pivot.

How to organise and record expenses?

Keeping a record of expenses seems as exciting as sorting socks. However, with a few simple strategies, you can make it efficient and manageable. Here are the steps to follow:

- Use Simple Tools: Try an easy-to-use app or software like TallyPrime to track expenses—no complicated spreadsheets needed.

- Organize by Categories: Group expenses like rent, supplies, and marketing so it’s clear where your money goes.

- Snap and Save Receipts: Take quick photos of receipts and store them digitally—no more messy paper trails!

- Check Weekly: Spend a few minutes every week reviewing your spending. It’s quick and keeps things stress-free.

By keeping it simple, you’ll stay organized and stress-free while managing your expenses like a pro!

Cost-cutting hacks: Strategies to reduce business expenses

Go Paperless, Save More: Skip the printer—switch to digital invoicing and documents. It’s eco-friendly and budget-friendly!

Outsource Smarter: Hire freelancers for tasks like graphic design or content writing instead of full-time employees—pay only for what you need.

Ditch the Fancy Office: Co-working spaces or a home office setup can slash rent costs without cramping your style.

Bulk It Up: Buy supplies in bulk or team up with other small businesses for discounts—think Costco vibes for your business.

Review Subscriptions: Cancel unused software or services—yes, even that one you forgot you signed up for.

Energy-Saving Hacks: Use LED lights, smart thermostats, or just switch off unused electronics. Lower bills, brighter days!

Negotiate Everything: From vendor deals to office rent—don’t accept the sticker price without a little haggling.

Best practices for expense reporting

Expense reporting doesn’t have to be dreaded. With a few simple practices, you can make it more efficient and easier.

Keep It Real-Time: Log expenses as they happen—don’t wait till the end of the month when things get fuzzy. Think of it as your daily/weekly money journal!

Be Specific, Not Vague: Avoid “miscellaneous” as a category—label every expense clearly. A coffee meeting? Call it “Client Meeting - Refreshments.”

Go Digital, Ditch Paper: Use apps or software to report and organize expenses. It’s faster, easier, and saves you from drowning in receipts.

Set Clear Guidelines: Define what counts as a business expense—your team shouldn’t guess whether snacks or subscriptions are report-worthy.

Review Regularly: Schedule a quick monthly check-in to review reports. It’s like tidying up your financial closet!

Conclusion

Expense tracking may not be the most exciting activity in management, but it’s undoubtedly one of the most important. By adopting these tips, using intelligent tools, and implementing cost-saving strategies, you can enhance your business’s financial health.

So, what are you waiting for? Start tracking, start saving, and witness your business grow manifold. Bear in mind that each penny saved is a penny earned and small savings add up to significant success.