Congratulations on your entrepreneurial journey! Whether you're about to launch, just started, or are running an established business, you're navigating the unique challenges and rewards of building and growing your own enterprise. It’s a wild ride, and while you’re busy juggling a thousand tasks, there’s one area that can’t be ignored—accounting.

Now, we know what you're thinking. Accounting? Really? But among a million different creative things, strategies, and whatnot, do we have to talk about such a dull thing? Get ready with those ledger books because we will make the world of small business accounting super thrilling together. All right, are you prepared to solve the secret code of small business accounting? Let's do this with some practical advice and inspiration.

Why Understanding Accounting is Key for Business Success

Accounting might not sound exciting, but it’s the backbone of your business’s financial health.

Without it, your business would be a limp noodle, flailing everywhere. Proper accounting will help you measure your financial health, make critical business decisions, and keep you on the right side of the taxman. Going far beyond balancing the books: You will ensure that money is not wasted and that your business thrives. Accounting helps you:

-

Monitor your financial health

-

Make data-driven decisions

-

Stay tax compliant

-

Plan for growth and investments

In short, it’s not just about balancing books — it’s about building a profitable, sustainable business.

Setting up an accounting system – to manual or not to manual?

Now that we've got the lingo down, let’s talk about setting up an accounting system. There are two alternatives: manual accounting and accounting software solutions.

Manual accounting

Manual accounting is a system where transactions are written down manually into ledgers or using tools like Excel spreadsheets. It is similar to hand-written letters in this age of emails. It is charming but labor-intensive. If the tactile feel of paper or the straightforward nature of spreadsheets is something you can't do without, and you have a thing for nostalgia, this may be for you. However, be prepared for potential drawbacks.

Using physical ledgers means a lot of erasing, rewriting, and possible paper cuts. Even with Excel, you might face issues such as data entry errors, time-consuming updates, and the difficulty of maintaining large volumes of data efficiently. Additionally, manual methods lack the automated error-checking and integration features of modern accounting software, making it harder to ensure accuracy and streamline processes. As your business grows, these drawbacks can lead to inefficiencies and increased risk of mistakes.

Software solutions

It's better to use accounting software if you're a person who values efficiency over nostalgia. Software solutions streamline your accounting process, automate mundane tasks, and help you stay organized. It is just like having your accountant who never takes a break for a coffee. From invoicing to tracking your expenses and even generating your financial reports, good accounting software is all you need to give you the peace of mind to grow your business.

TallyPrime

Manual accounting is charming but inefficient for scaling businesses. That’s where TallyPrime comes in. Built for Indian businesses, it simplifies complex accounting tasks with features like:

- GST Compliance: Automatically manage GST calculations and returns

- Invoicing: Generate professional, GST-compliant invoices effortlessly

- Financial Reporting: Access real-time reports like balance sheets and profit & loss

- Inventory Management: Track stock levels and optimize purchases

TallyPrime ensures you stay financially organized while saving time — a win-win for any entrepreneur.

Understanding Basic Accounting Concepts

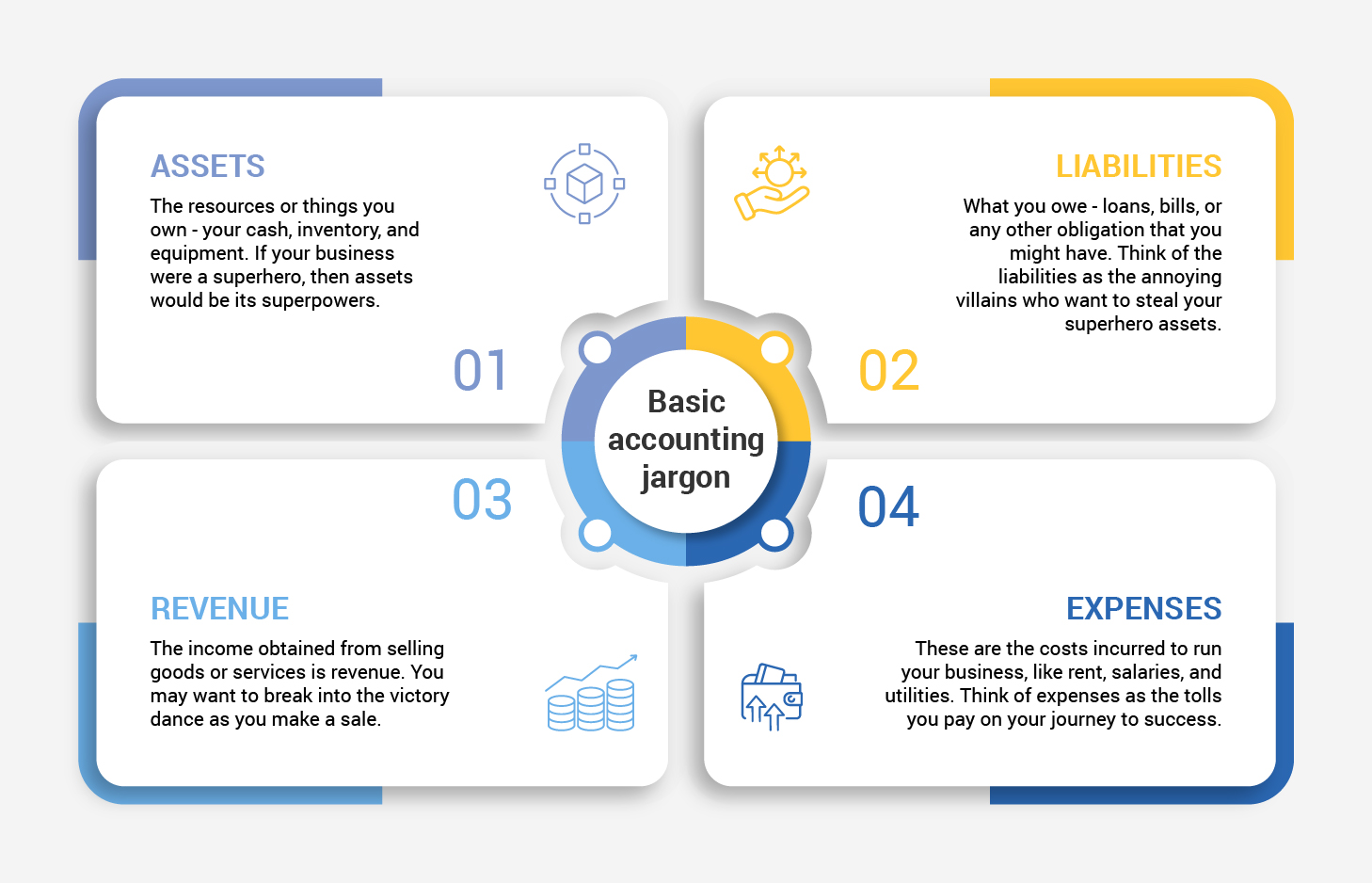

Before diving deeper, let’s decode some essential accounting terms every small business owner should know:

- Assets: What your business owns (e.g., cash, equipment, property).

- Liabilities: What your business owes (e.g., loans, credit).

- Equity: Your ownership value in the business.

- Revenue: Income from sales or services.

- Expenses: Costs incurred to run the business.

These are tied together by the Accounting Equation:

Assets = Liabilities + Equity

Understanding this equation ensures your books stay balanced — a crucial skill in bookkeeping for beginners.

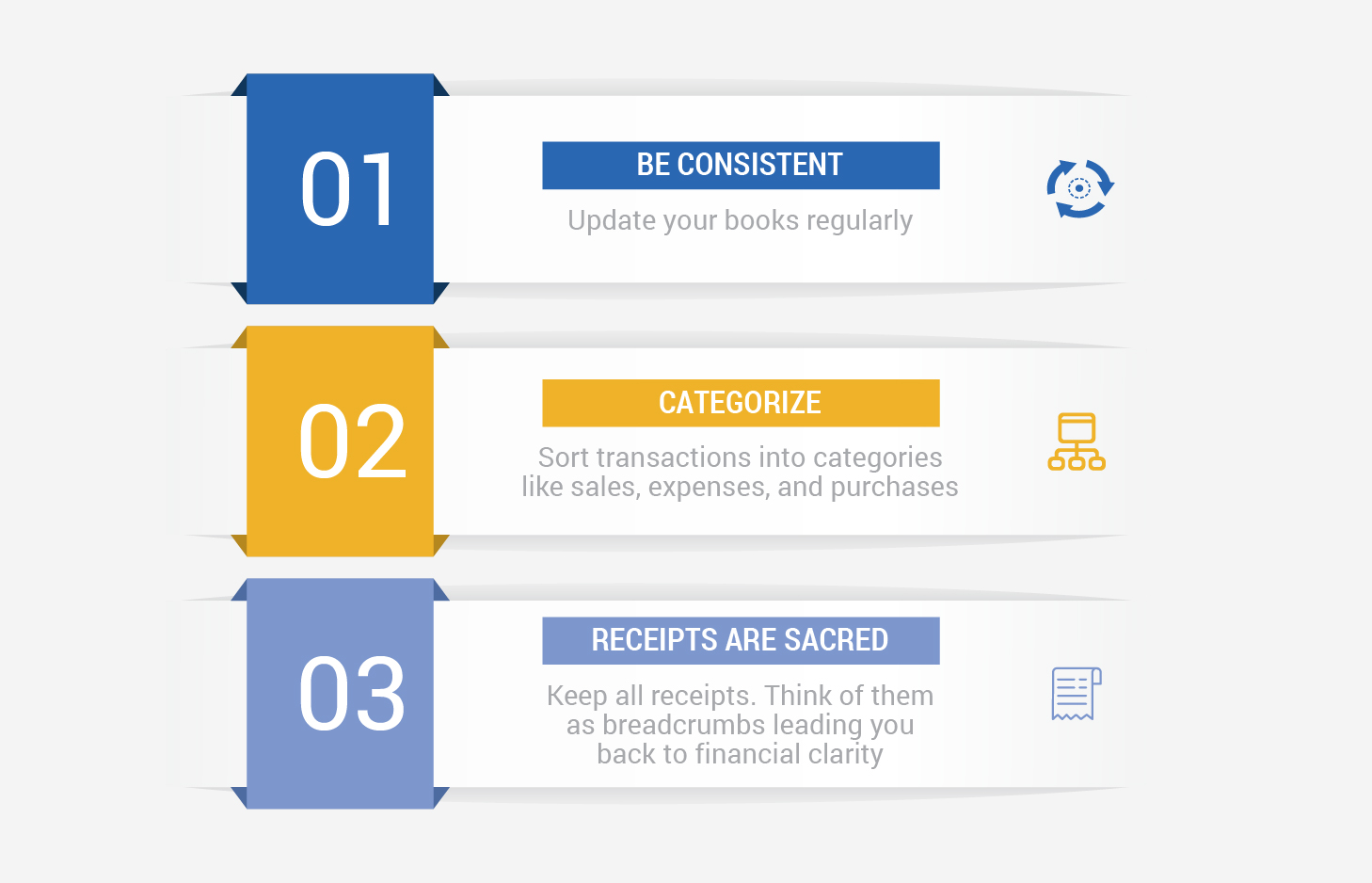

Keeping accurate records – the art of not losing your marbles

Keeping records is very important. Imagine trying to bake a cake by not measuring the ingredients. Chaos, right? That's what your financials turn into without an accurate record. Here are a few tips for keeping your records shipshape:

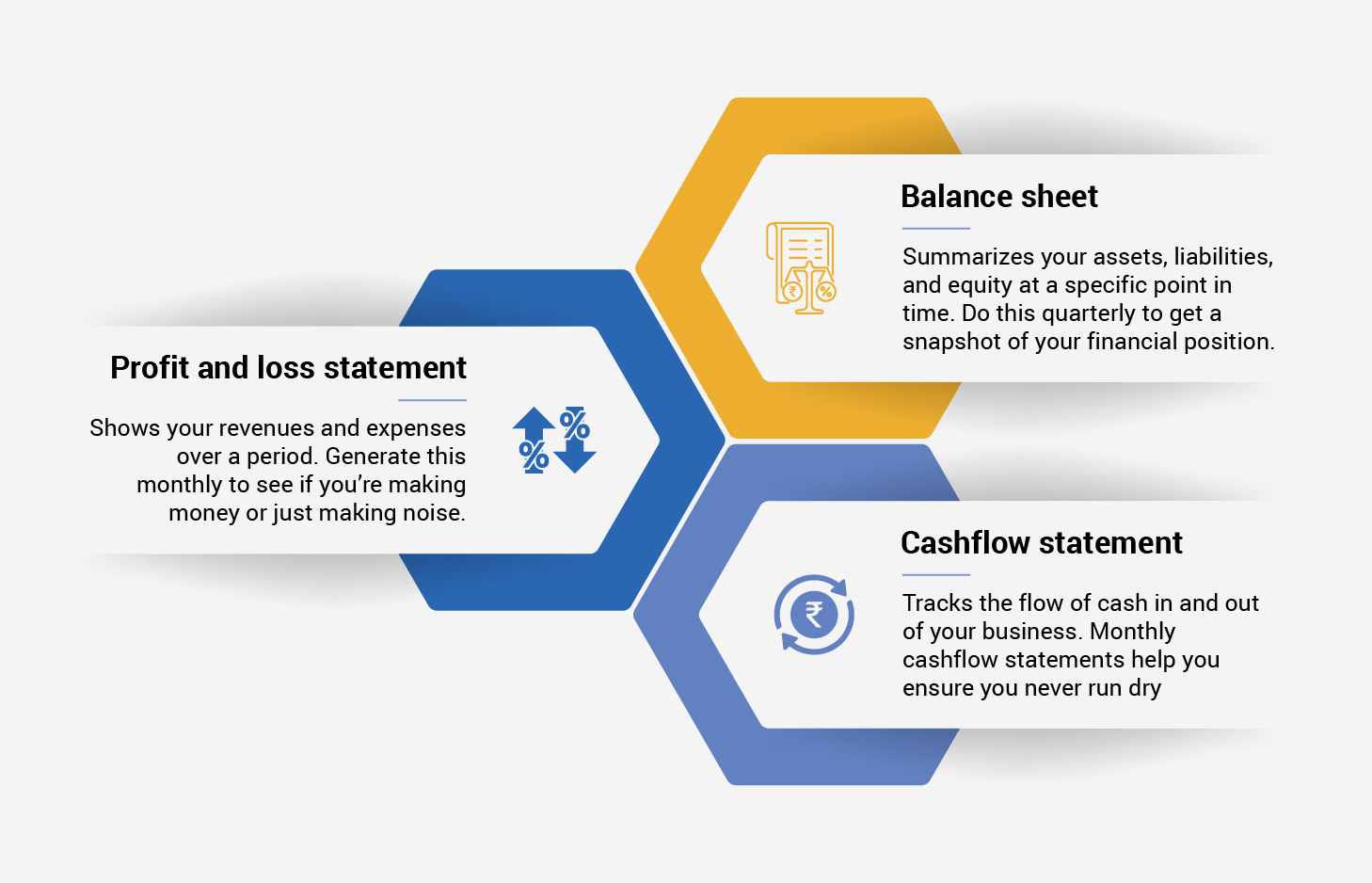

Regular financial reporting – your business’s report card

Financial reports are like report cards for your business, indicating how well, or not, you are doing. Regular reporting helps you spot trends, track progress, and make informed decisions. The key reports and when they need to be prepared are:

Tax compliance and preparation – dance with the taxman

Ah, taxes – the necessary evil. But with some savvy tips, you can waltz through tax season without breaking a sweat.

- Understand your tax obligations: Know the taxes applicable to your business, like GST, income tax, and TDS. Knowledge is power, and in this case, it keeps the taxman happy.

- Keep timely records: Accurate and up-to-date records make tax preparation a breeze. Remember those sacred receipts? They’re your best friends here.

- Invest in a good accountant: If taxes feel like a foreign language, hire a professional. They’ll ensure you’re compliant and might even save you some money.

- Use software: Again, software like TallyPrime can simplify GST filings and other tax-related tasks, making compliance less of a headache.

Common Accounting Challenges for Small Businesses

Running a business isn’t just about great ideas — it’s also about navigating financial hurdles. Here are common accounting challenges and how to overcome them:

1. Cash Flow Management

Challenge: Struggling to maintain a healthy cash flow can threaten daily operations.

Tip: Track income and expenses regularly, and forecast future cash needs.

2. Tax Compliance

Challenge: Staying on top of tax rules like GST, TDS, and income tax.

Tip: Use accounting software like TallyPrime to simplify tax filings and avoid penalties.

3. Record-Keeping

Challenge: Messy or incomplete records lead to errors and missed deductions.

Tip: Adopt structured methods and tools to keep financial data organized.

The Importance of Accurate Record-Keeping

Accurate record-keeping is not just an accounting chore — it’s your financial GPS. It helps you:

- Understand your profitability

- Prepare for audits and tax filings

- Secure funding from investors or banks

Tools for Better Record-Keeping:

- Spreadsheets for startups with minimal transactions

- Accounting software like TallyPrime for growing businesses needing automation, accuracy, and compliance

Wrapping up

And there you have it – a comprehensive guide to small business accounting. Embrace the journey, for accounting isn’t just a chore; it's the key to unlocking your business’s potential. Keep your records in order, put in all the hard work, and remember, each rupee that you account for today takes you closer to your dreams tomorrow. Happy accounting, and may your business grow to phenomenal heights!

Bonus: Free accounting template!

We know that getting started with accounting can be a bit daunting, so here’s a little gift to make your journey smoother—a free downloadable accounting template! This template is designed to help you keep track of your income, expenses, and generate basic financial reports with ease. It’s very user-friendly which makes it the perfect tool to kickstart your accounting journey. Click here to download and start simplifying your financial management today!