The VAT treatment on services received in the Designated Zones is different compared to that on goods purchased in the Designated Zone in UAE. In case of goods, purchases within the Designated Zone and outside the State are considered to be outside the scope of the VAT. Similar benefits are not extended for the supply of services to the Designated Zone.

In this article, we will understand the VAT treatment of services received by Designated Zone under following scenarios:

- Services received from Designated Zone

- Services received from Mainland

- Services received from outside the UAE State

To know more about Designated Zones, please read VAT on Designated Zone and VAT on Free Zones in UAE .

Services received from Designated Zone

Supply of services between Designated Zones in UAE is taxable at 5%. This is because, the place of supply for services supplied within the Designated Zone is considered to be within the State.

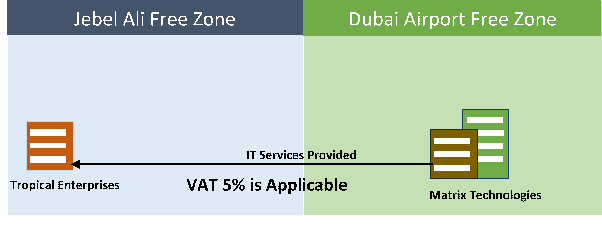

For example, Tropical Enterprises, located in Jebel Ali Free Zone, received IT Services from Matrix Technologies, located in Dubai Airport Free Zone.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free zone are Designated Zones. The supply of services from Matrix Technologies to Tropical Enterprises will attract VAT at 5%.

Services received from Mainland in UAE

The supply of services to Designated Zone from the mainland (inside the State) are taxable and VAT at 5% should be charged on the supply of services.

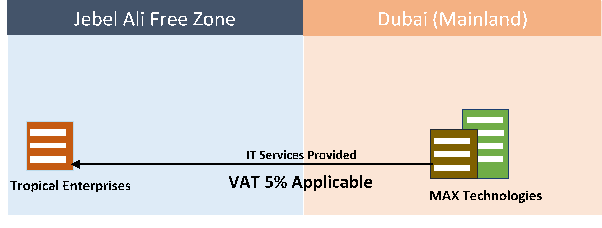

For example, Tropical Enterprises, located in the Jebel Ali free zone, received IT Services from MAX Technologies, located in the Dubai mainland.

In the above illustration, IT Services are received in Jebel Ali Free Zone (Designated Zone) from Dubai (mainland). The supply of IT Services from MAX Technologies to Tropical Enterprises will be taxable and VAT at 5% needs to be charged for such IT services.

Services received from outside the UAE State

Services received in Designated Zone from outside the UAE State will be taxable on a reverse charge basis. The recipient of such services needs to account for VAT under reverse charge basis and accordingly pay VAT while filing the VAT Returns.

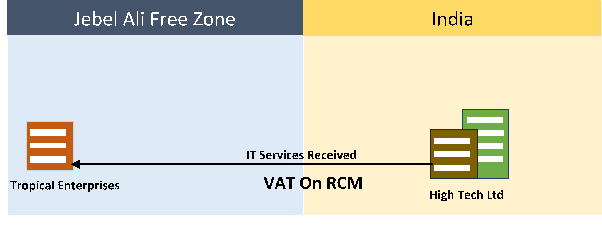

For example, Tropical Enterprises located in the Jebel Ali Free Zone received services from High Tech Ltd, located in India.

In the above illustration, services are supplied from India to Jebel Ali Free Zone (Designated Zone). The supply of services from High Tech Ltd to Tropical Enterprises will be taxable at 5%. The Tropical Enterprises need to account for VAT and pay VAT on such services on a reverse charge basis.

Conclusion

The businesses located in the Designated Zone need to remember that the receiving services are taxable irrespective of whether it is received from the Designated Zone or from inside the State(Mainland). Also, they need to make a note that the services received from outside the state are liable to VAT on a reverse charge basis. This implies that the recipient of such services need to account for VAT and pay the VAT liabilities while filing the VAT returns in UAE.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Zone

VAT on Designated Zone in UAE, VAT Treatment on Purchase of Goods into Designated Zone in UAE, VAT Computation in Case of Services Supplied from Designated Zone in UAE, VAT Computation on Goods Supplied from Designated Zone in UAE, New VAT Free Zones in UAE VAT

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs