The import of goods which is declared through UAE customs, needs to be declared in box no. 6 ‘Goods Imported into the UAE’ under the ‘Sales and All other Outputs’ section of the VAT form 201.

As shown in the image above, the box no. 6 will include the net value and the output VAT due on the goods which have been imported to UAE. The value and output VAT will be auto-populated, based on imports, which you have declared under your customs registration number, which is linked to your TRN. The value subject to VAT will include customs value as defined in the Customs legislation including value of insurance, freight, customs fees (if any) and applicable Excise Tax on the import of the goods into the UAE. As a result, VAT will be calculated on the net value, which is inclusive of all the above taxes and charges.

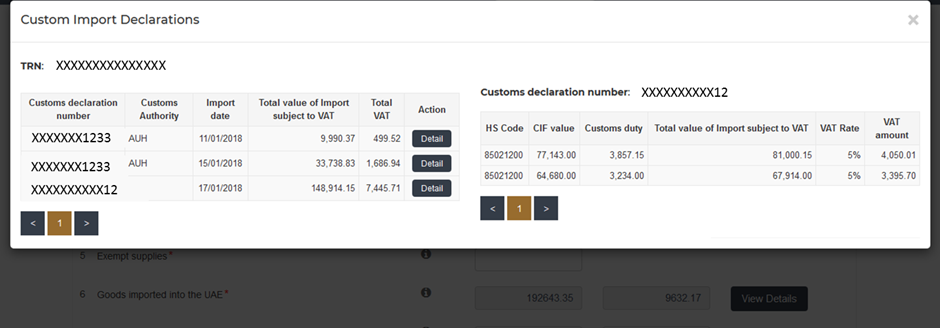

The box no. 6 is also provisioned with an option ‘View Details’. On clicking the same, it shows the list of customs import declaration made during the tax period.

As shown in the image above, it shows the list of customs declaration along with the customs declaration number, Customs Authority, Import Date, Total value subject to VAT and Total VAT due on the goods imported. On clicking ‘Detail’ under Action, it further details HSN code, CIF value, customer duty, value subject to VAT, applicable VAT rate and the VAT amount.

As the details are auto-populated in box no. 6, you should check the values which have been included in this box and match the values you expected to declare, based on the import declarations you have submitted during the tax period. If there is any difference, it should be reported in box no. 7 of the VAT form 201 during Tax Return filing.

This box will also include the details of imports made by an agent on behalf of non-registered persons. If you are an agent who imports goods into the UAE on behalf of non-registered persons, it is the responsibility of the agent to pay the tax in respect of import of goods. Therefore, such imports will also appear in this box.

Adjustments to goods imported into UAE

If the values populated in box no. 6 regarding goods imported into the UAE, is incomplete or incorrect - like few imports are excluded or appear to be incorrect, then such adjustments need to be reported in box no. 7 ‘Adjustments to goods imported into UAE’.

Depending on the difference in box no. 6, either value or output VAT can be adjusted. The amount of adjustment to be reported in this box could be positive or negative, and the taxpayer should be able to justify the adjustments when asked by the FTA.

For example, if you have imported goods worth 1 million AED plus VAT, and this import does not appear to be included within box no. 6, you can manually include this within box no. 7 (i.e. 1 million) and the respective VAT amount.

Also, if you have imported any goods which are not subject to the standard rate of VAT of 5% (for example goods subject to the 0% VAT rate), please use box no. 7 to adjust the VAT amount accordingly, as by default all of your imports will be assumed to be subject to the 5% VAT rate.

Please note, that it is the taxpayer’s responsibility to identify such adjustments and accordingly adjust them in box no. 7 of the VAT Form 201 during Tax Reutrn Filing. Similar adjustment needs to be done in case of the agent importing goods on behalf of the non-resident.

Key Points for filing import of goods details in VAT Return Form 201

- Only those imports of goods into the UAE through UAE customs needs to be captured in box no. 6.

- Imports of goods from agents on behalf of an unregistered person should be reported.

- In order to identify and report the adjustments, use the ‘View Details’ option available in box no 6. Check the total imports under “Amount (AED)” and the respective output tax under “VAT Amount (AED)” in box no. 6 and compare them with the import declarations submitted during the tax period.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, VAT Exempt Supplies in UAE, VAT Return Form 201, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Calculator

VAT Calculator, How to calculate VAT under Profit Margin Scheme

Place of Supply

Place of supply in case of export of goods, Place of supply of goods under VAT in UAE, Place of supply of real estate under UAE VAT, Place of Supply of Services, Place of supply of specific goods

VAT on Supply

VAT on Supply of Charitable Buildings, VAT on supply of commercial property, VAT on supply of mixed use developments, VAT on supply of bare land

Time of Supply

What is Time of Supply Rule under VAT in UAE, How to Determine Time of Supply for Services, How to Determine Time of Supply of Goods, Time of Supply in case of Assembly or installation of goods under VAT in UAE