All the businesses who are liable or eligible for VAT registration in Saudi Arabia should register using the General Authority of Zakat and Tax (GAZT) websites portal. On the basis of the annual value of taxable supplies, the registration deadlines are published by GAZT. Certain types of businesses were mandated to register by 20th December, 2017 and others were allowed to register until 20th December, 2018. In this article, we will understand, 'How to apply for VAT Registration in KSA'.

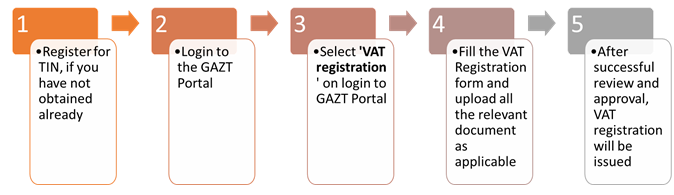

The VAT Registration in KSA is a 5 step process as illustrated below:

Let us understand the steps to apply for VAT registration in KSA in detail:

1. Register for Tax Identification Number (TIN)

The first step toward VAT Registration is to obtain the Tax Identification Number. This needs to be obtained prior to the VAT Registration from the GAZT website.To register for VAT TIN number, you need to follow the following steps:

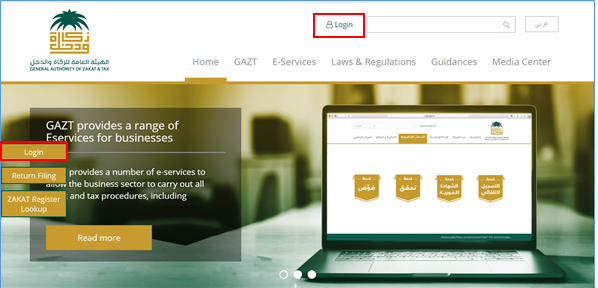

Click 'Login' from GAZT's website

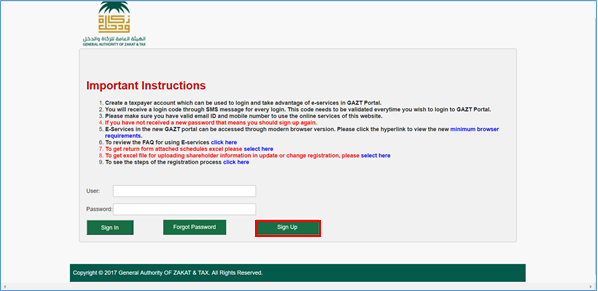

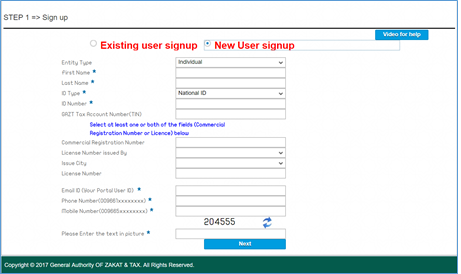

- Click on 'Sign Up' as shown below:

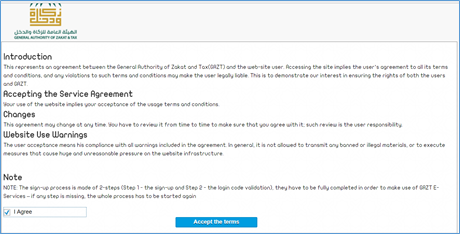

- Read the terms and conditions and tick 'I Agree' to proceed

- Sign up form will be available as shown below:

As shown above, select 'New User Login' and fill the all the details as required. After successful submission of all the details, TIN will be available for you to complete the VAT registration process.

2. Login to GAZT Portal

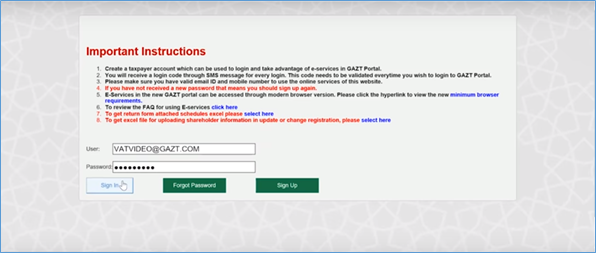

After receiving the TIN, you need to login again to GAZT website to start the registration process. As shown below, you need to mention the username and password which you had mentioned while obtaining the TIN number.

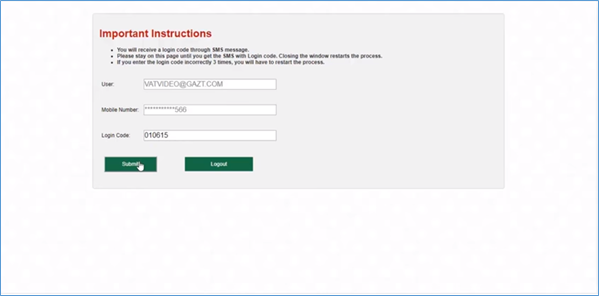

Next, you need to authenticate the login using the login code sent to the registered mobile number as shown below:

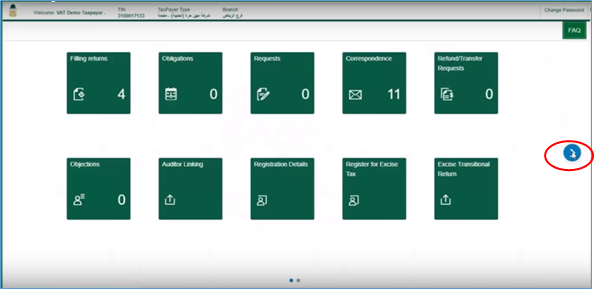

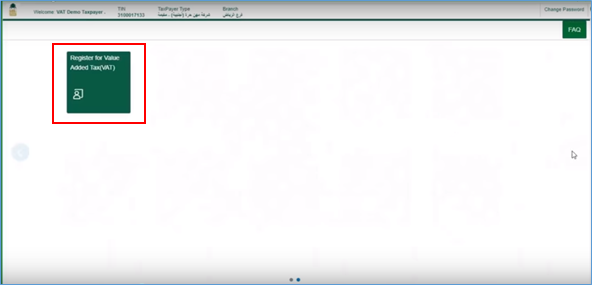

3. Select VAT registration from the Dashboard

After login into the GAZT’s portal, you will be able see the Dashboard as shown below. To navigate to the Registration page, you need to slide into the next page as shown below:

On sliding to the next page, click 'Register for Value Added Tax (VAT) as shown below:

4. Furnishing the details and documents for completing VAT Registration

This is an important step in VAT Registration process. Here, you need to furnish details of your business and upload relevant supporting documents as required. The registration form will require you to specify 3 key details mentioned below:

- Taxpayers Details

- Financial Details

- Financial Representative

Let us discuss the steps for completing the registration details.

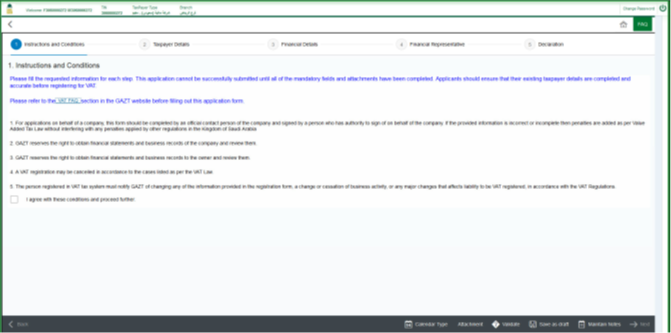

After clicking on click 'Register for Value Added Tax (VAT), the registration form as shown below will open:

It broadly contains the following sections:

- Instructions and conditions

The first page will instruct taxpayers regarding how to proceed through the registration. After reading, you need to tick ‘I Agree with these conditions and Proceed further’ in order to complete the registration process.

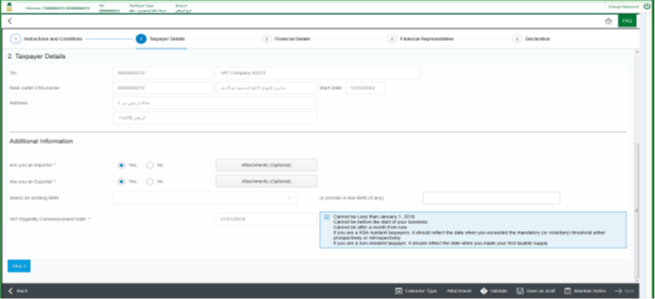

- Taxpayers Details

In the taxpayer’s section, the details such as TIN, Company Registration (CR), and address will be auto-filled based on pre-existing records for each business in GAZT.

In the additional information section, you need to provide the following information:

- Whether or not the business imports or exports goods or services

- An IBAN number to be associated with the business’s VAT account

- The date the business became eligible for VAT (e.g. if the business only recently surpassed one of the revenue thresholds)

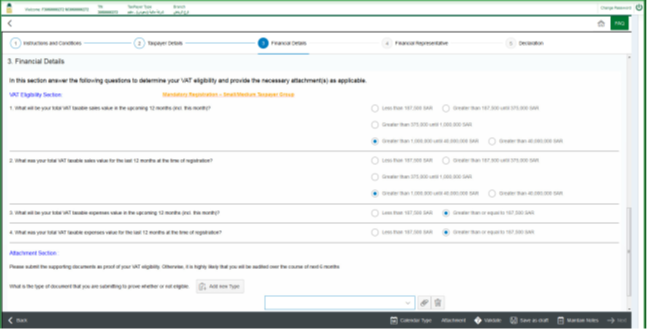

- Financial Details

In this section, you need to furnish the financial details of the business. This will be used to assess the VAT registration eligibility of the business. The following details need to be declared under financial details:

- Projected taxable sales for the next year

- Actual taxable sales for the last year

- Projected taxable expenses for the next year

- Actual taxable expenses for the last year

After declaring the details shown above, you need to attach the documents such as income statements, customs report etc. as proof. Though attaching documents is not mandated but it is recommended that supporting documents are attached. In the absence of proof of documents, audit may be initiated to verify the details declared.

Natural persons who conduct economic activities and do not have a CR are eligible to register for VAT. To do that, a TIN is required which is obtained by registering on GAZT's website on the following link.

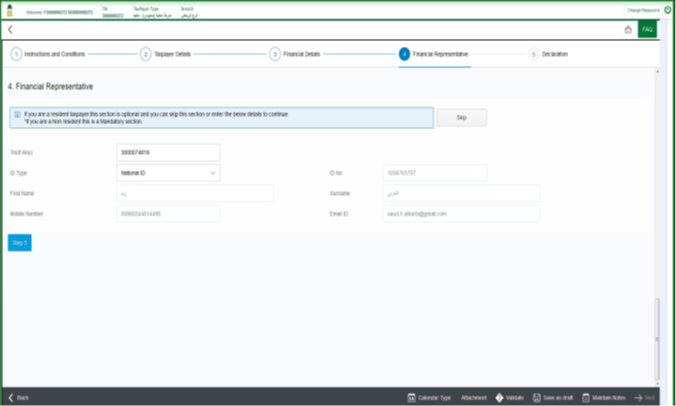

- Financial representative (only for non-KSA registrants)

This section is applicable only for Non-residents. For Residents, this is optional and they may choose to skip this section. The non-resident need to provide the information about their designated tax representative in Saudi Arabia. Each non-KSA business will need to provide the following details of tax representatives:

- TIN (if they have one)

- ID number (such as a Saudi, Iqama, or GCC ID)

- Mobile number

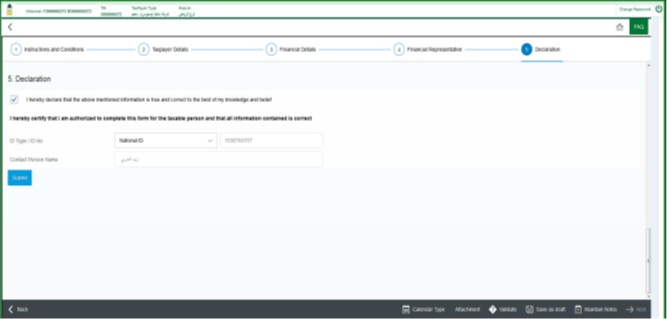

- Declaration:

Lastly, the taxpayer has to certify that all the submitted information is accurate. Along with that certification, the taxpayer will have to provide his name, ID number, and its title within the business.

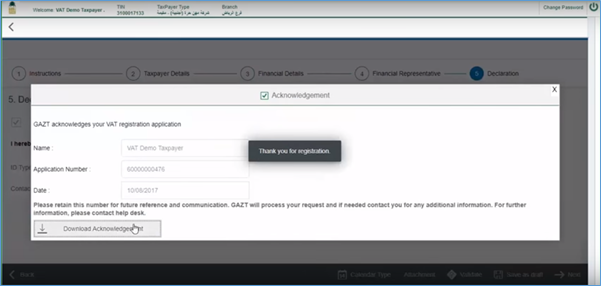

On clicking 'Submit', an application number will be available along with the acknowledgment which can be downloaded.

The downloaded acknowledgment is shown below:

Explore more Products