In our previous article 'VAT invoice in Saudi Arabia', we have learnt about Tax Invoice, the essential document to be issued for all taxable supplies of goods or services. We have also learnt the scenarios in which a tax invoice should be issued and the details that are required to be mentioned in a tax invoice. The Saudi VAT Law allows for the issue of a simplified version of a Tax Invoice, in certain cases. Let us understand more about simplified tax invoices under VAT in Saudi Arabia.

What is a simplified tax invoice?

A simplified tax invoice is a simplified version of a tax invoice, in which fewer details are required to be mentioned, as compared to a tax invoice.

When can a simplified tax invoice be issued?

A simplified tax invoice can be issued by a registered person for supplies of goods or services for value less than SAR 1,000. However, a simplified tax invoice cannot be issued in the following cases:

- Internal supplies, i.e. supply of goods or services to other GCC Countries

- Export of goods or services

In the above 2 cases, even if the value of the supply is less than SAR 1,000, the registered supplier has to issue a tax invoice.

What are the details required to be mentioned in a simplified tax invoice?

A simplified tax invoice should mandatorily show the following details:

- Date of invoice

- The full name, address and Tax Identification Number of the supplier

- Description of goods or services supplied d. Total payable for goods or services supplied e. Tax payable or an indication that the total payable amount includes VAT

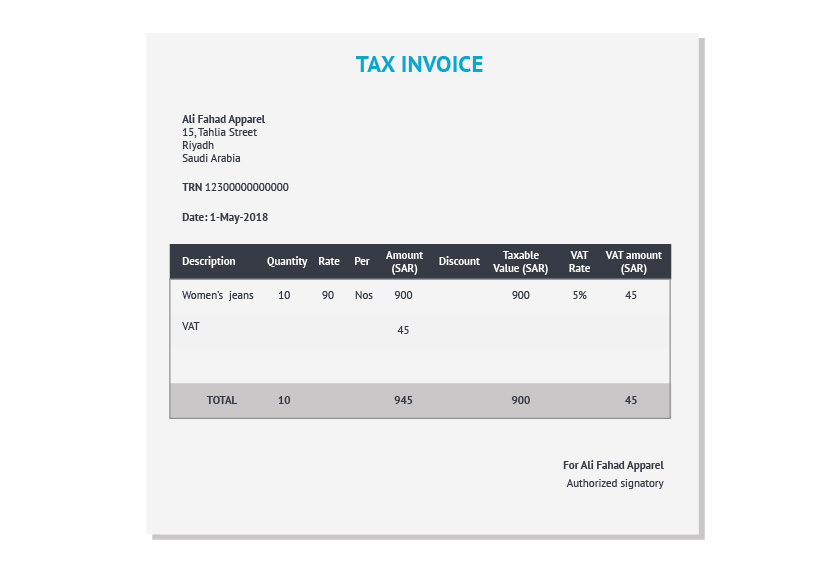

Let us see a sample format of a simplified tax invoice under VAT in Saudi Arabia.

Simplified Tax Invoice Format for KSA

Ali Fahad Apparel, a registered dealer in KSA, supplies 10 women’s jeans to an unregistered customer, Jabar Clothes, in KSA. The value of the jeans supplied does not exceed SAR 1,000. Hence, Ali Fahad Apparel issues a simplified tax invoice to Jabar Clothes, as shown below:

A simplified tax invoice, as you can observe, requires fewer details to be mentioned, as compared to a tax invoice. A tax invoice requires certain additional details of the supply to be mentioned, as detailed in our article 'VAT invoice in Saudi Arabia'. A notable difference between a tax invoice and a simplified tax invoice is that the recipient’s name, address or Tax Identification Number are not required to be mentioned.

A simplified tax invoice is largely useful for persons who supply to consumers or unregistered customers, who are not eligible for input tax recovery. Since a simplified tax invoice does not mention the recipient’s details, it cannot be used by a registered recipient to recover input tax on a supply. Hence, registered persons purchasing goods or services from registered suppliers should insist on receiving a tax invoice for the supply, as the tax invoice serves as the valid document on the basis of which input tax can be recovered.

In conclusion, a simplified tax invoice makes the task of invoicing easy for businesses whose value of supplies do not exceed SAR 1,000.

Explore more Products